Barrier Option Pricing within the Black-Scholes Model

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

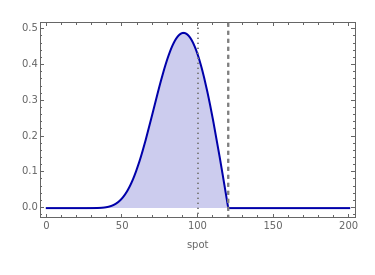

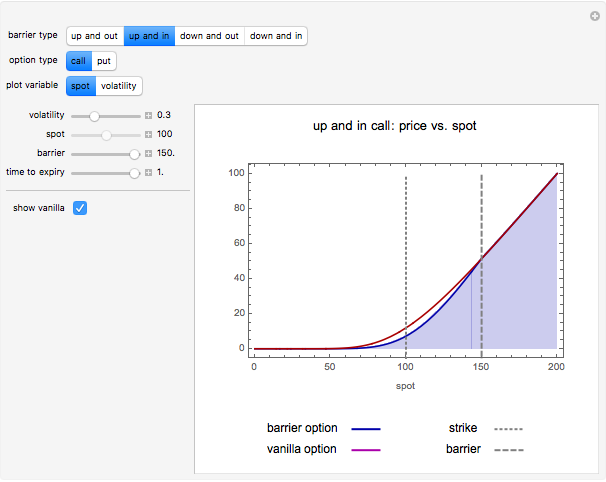

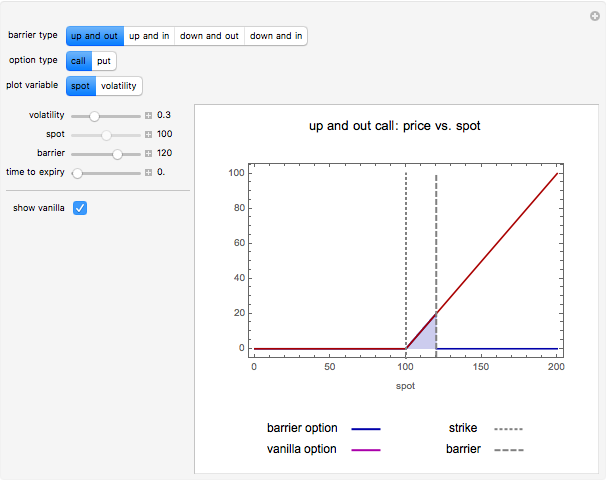

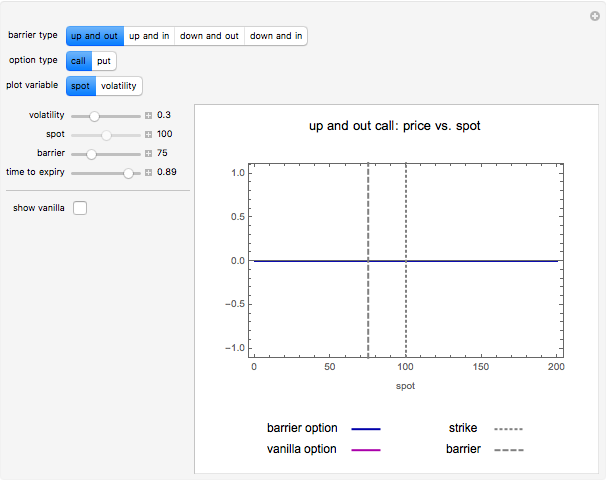

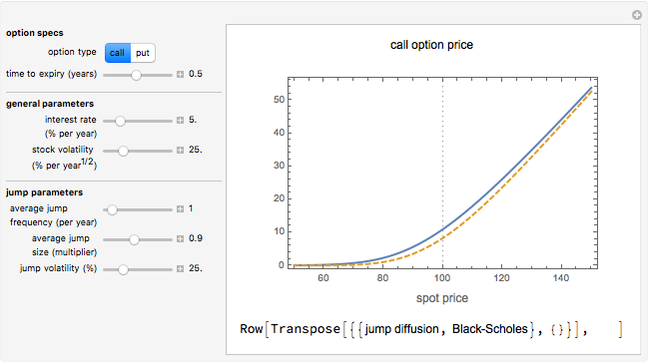

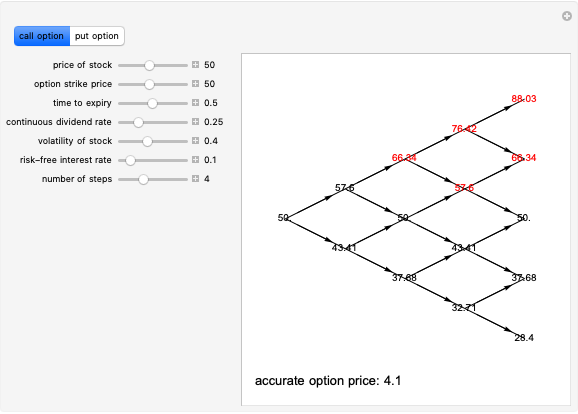

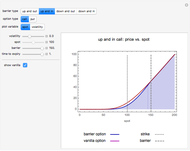

Barrier options are a particular type of exotic option in which a certain "barrier" level is specified, and then the option either "knocks in" (becomes exercisable) or "knocks out" (becomes worthless) if the underlying asset price crosses this level from above (for "down" types) or below (for "up" types). There are four types of barriers, varying according to how the barrier affects the price: "up and in", "up and out", "down and in", and "down and out". Additionally, as with regular vanilla options, barrier options come in "call" and "put" form. This Demonstration illustrates the pricing formulas for these options within the Black–Scholes framework.

Contributed by: Peter Falloon (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

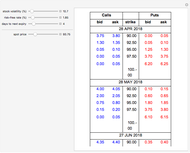

The closed-form pricing formulas for barrier options used in this Demonstration can be found in, e.g., P. Wilmott, Paul Wilmott on Quantitative Finance, New York: Wiley, 2006. In the Demonstration we assume zero dividend yield, an interest rate of 5%, and a strike price of 100.

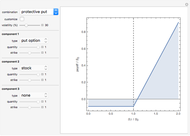

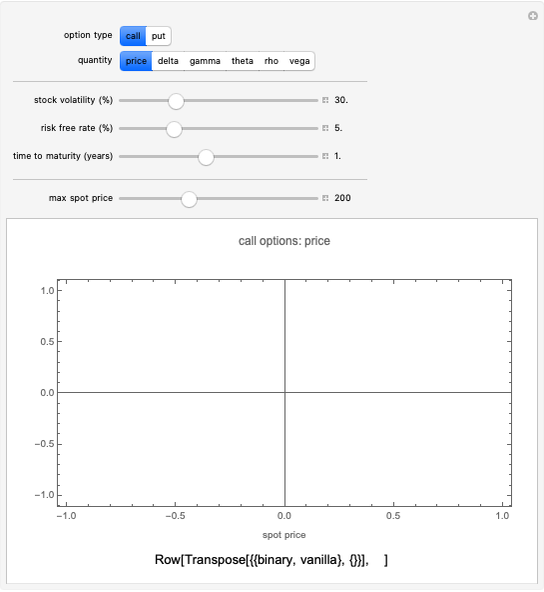

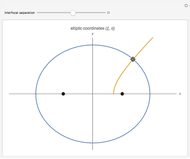

Snapshot 1: ticking the "show vanilla" box causes the price of the corresponding vanilla option to be shown in the plot; for cases like the "up and in" call this option makes it easier to see how the barrier option differs from the vanilla one

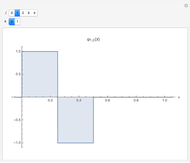

Snapshot 2: when the time to expiry is zero, the price curves reduce to the final payoff, which is a piecewise function

Snapshot 3: for certain combinations of strike price and barrier level, the option can be worthless; in this case, an "up and out" call with strike > barrier could never be exercised because it would "knock out" if the spot price ever went above the barrier (which would be necessary since it would only make sense to exercise if spot > strike)

Permanent Citation

"Barrier Option Pricing within the Black-Scholes Model"

http://demonstrations.wolfram.com/BarrierOptionPricingWithinTheBlackScholesModel/

Wolfram Demonstrations Project

Published: March 7 2011