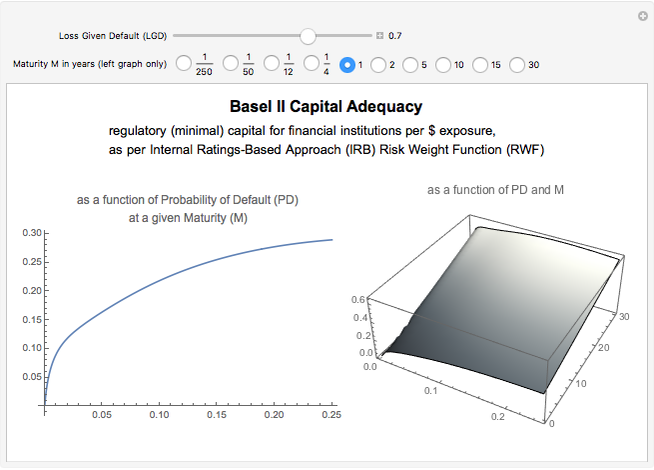

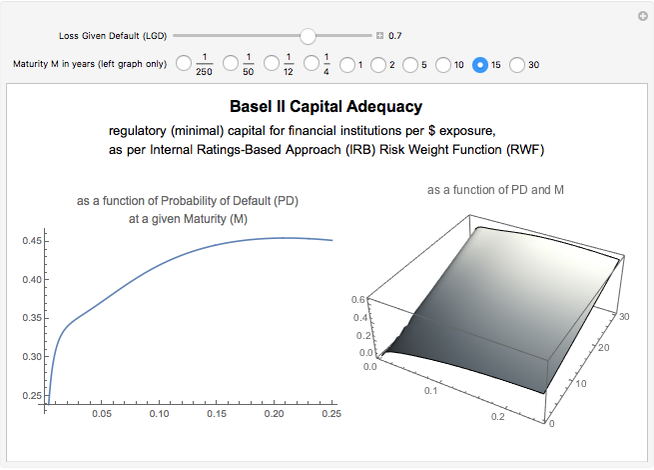

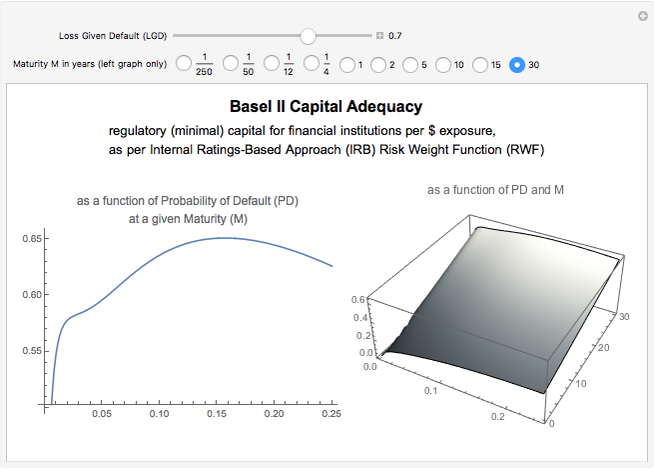

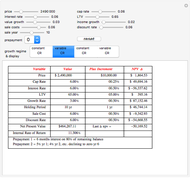

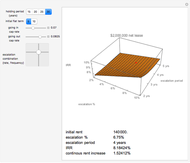

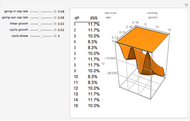

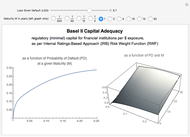

Basel II Capital Adequacy: Internal Ratings-Based (IRB) Approach

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

The key cornerstone of prudential regulation of banks (and financial institutions in general) is to ensure that each bank holds sufficient equity capital to absorb unexpected losses, that is, the materialization of financial risks, principally market (price), liquidity, credit, and operational risks.

[more]

Contributed by: Poomjai Nacaskul (March 2011)

Quantitative Models & Financial Engineering, Bank of Thailand & MBA Program, Mahanakorn University of Technology

Open content licensed under CC BY-NC-SA

Snapshots

Details

Observe that the function is strictly concave and increasing as the probability of default (PD) is close to zero.

References

[1] Basel Committee on Banking Supervision. "International Convergence of Capital Measurement and Capital Standards." (June 2006) http://www.bis.org/publ/bcbs128.pdf.

[2] Basel Committee on Banking Supervision. "An Explanatory Note on the Basel II IRB Risk Weight Functions." (June 2005) http://www.bis.org/bcbs/irbriskweight.pdf.

[3] M. B. Gordy, "A Risk-Factor Model Foundation for Ratings-Based Bank Capital Rules," Journal of Financial Intermediation, 12(3), 2003 pp. 199–232.

[4] O. A. Vasicek, "The Loan Loss Distribution," Technical Report, KMV Corporation, 1997.