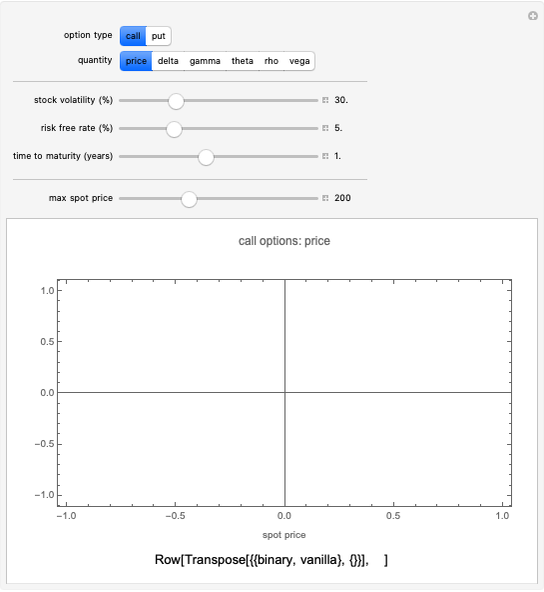

Option Prices in Merton's Jump Diffusion Model

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

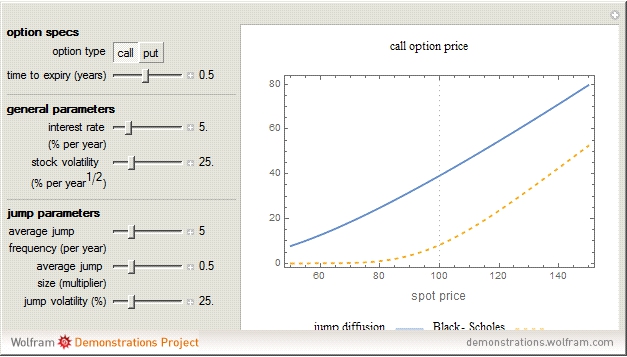

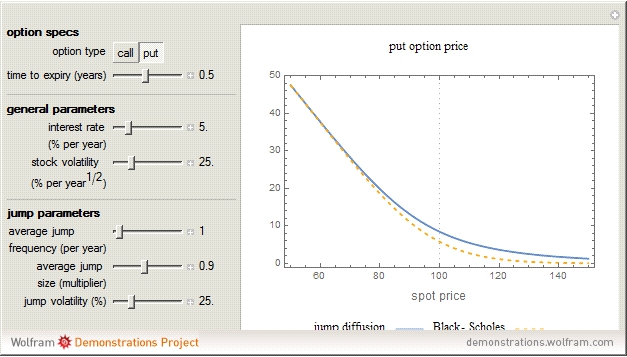

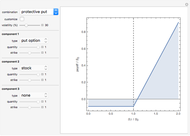

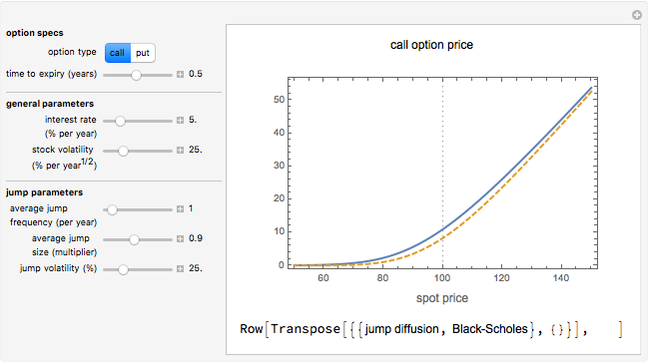

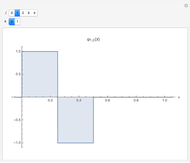

The jump diffusion model, introduced in 1976 by Robert Merton, is a model for stock price behavior that incorporates small day-to-day "diffusive" movements together with larger, randomly occurring "jumps". The inclusion of jumps allows for more realistic "crash" scenarios and means that the standard dynamic replication hedging approach of the standard Black-Scholes model no longer works. This causes option prices to increase compared to the Black-Scholes model and to depend on the risk aversion of investors. This Demonstration explores how the price of European call and put options varies with the jump diffusion model parameters.

Contributed by: Peter Falloon (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

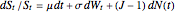

In the jump diffusion model, the stock price  follows the random process

follows the random process  . The first two terms are familiar from the Black-Scholes model: drift rate

. The first two terms are familiar from the Black-Scholes model: drift rate  , volatility

, volatility  , and random walk (Wiener process)

, and random walk (Wiener process)  . The last term represents the jumps:

. The last term represents the jumps:  is the jump size as a multiple of stock price while

is the jump size as a multiple of stock price while  is the number of jump events that have occurred up to time

is the number of jump events that have occurred up to time  .

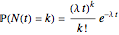

.  is assumed to follow the Poisson process

is assumed to follow the Poisson process  , where

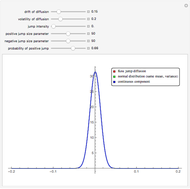

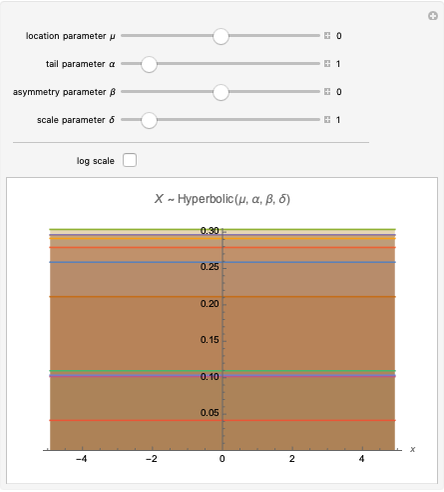

, where  is the average number of jumps per unit time. The jump size may follow any distribution, but a common choice is a log-normal distribution

is the average number of jumps per unit time. The jump size may follow any distribution, but a common choice is a log-normal distribution  , where

, where  is the standard normal distribution,

is the standard normal distribution,  is the average jump size, and

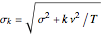

is the average jump size, and  is the volatility of jump size. The three parameters

is the volatility of jump size. The three parameters  characterize the jump diffusion model.

characterize the jump diffusion model.

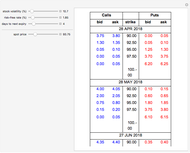

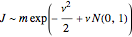

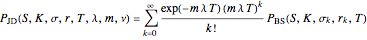

For European call and put options, closed-form solutions for the price can be found within the jump diffusion model in terms of Black-Scholes prices. If we write  as the Black-Scholes price of a call or put option with spot

as the Black-Scholes price of a call or put option with spot  , strike

, strike  , volatility

, volatility  , interest rate

, interest rate  (assumed constant for simplicity), and time to expiry

(assumed constant for simplicity), and time to expiry  , then the corresponding price within the jump diffusion model can be written as:

, then the corresponding price within the jump diffusion model can be written as:

,

,

where  and

and  . The

. The  term in this series corresponds to the scenario where

term in this series corresponds to the scenario where  jumps occur during the life of the option.

jumps occur during the life of the option.

It can be shown that for all derivatives with convex (Wolfram MathWorld) payoff (which includes regular call and put options) the price always increases when jumps are present (i.e., when  )—regardless of the average jump direction. Thus, holding other parameters constant, the option price is a minimum for

)—regardless of the average jump direction. Thus, holding other parameters constant, the option price is a minimum for  (i.e., the Black-Scholes case) and increases both for

(i.e., the Black-Scholes case) and increases both for  and

and  . This increase in price can be interpreted as compensation for the extra risk taken by the option writer due to the presence of jumps, since this risk cannot be eliminated by delta hedging (see Joshi 2003, Section 15.5).

. This increase in price can be interpreted as compensation for the extra risk taken by the option writer due to the presence of jumps, since this risk cannot be eliminated by delta hedging (see Joshi 2003, Section 15.5).

R. Merton, Continuous‐Time Finance, Oxford: Blackwell, 1998.

M. Joshi, The Concepts and Practice of Mathematical Finance, Cambridge: Cambridge University Press, 2003.

Permanent Citation