Principal Becomes an Agent

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

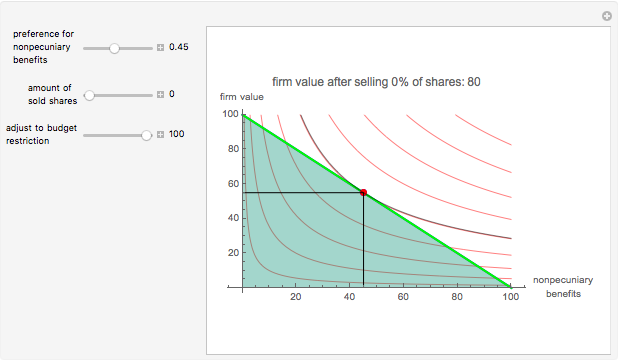

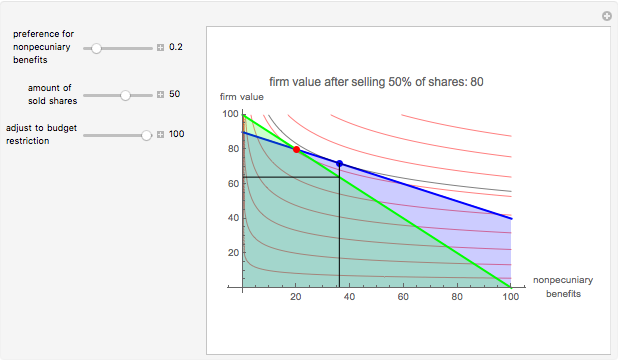

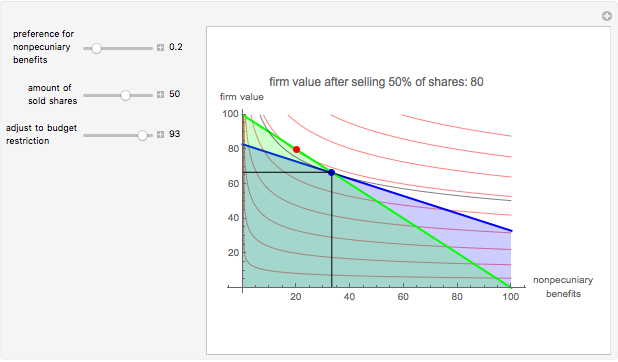

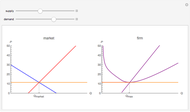

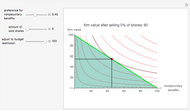

This Demonstration shows the effects of the selling of shares to outside shareholders through an owner-manager (principal and agent at the same time, e.g. an entrepreneur) on firm value, according to agency theory (simplified from [1]). Firm value (vertical axis) is at maximum (100%) if the agent does not consume any nonpecuniary benefits (e.g. a company jet for his personal use), which reduces firm value along the green line (45°, budget restriction). The agent's preference of firm value versus nonpecuniary benefits is represented with the red curved lines (indifference curves, which you can change with the "preference" slider). The agent chooses the point of tangency between indifference curve and budget restriction (red point) for his/her level of consumption and firm value. The loss of firm value shown here is part of so-called "agency costs", which appear whenever ownership and control (management) of a firm is separated.

Contributed by: Johannes M. Lehner (June 2014)

(Johannes Kepler University Linz, Austria)

Based on a program by: Loreto Llorente

Open content licensed under CC BY-NC-SA

Snapshots

Details

1. The red curves represent indifference curves between firm value and the consumption of nonpecuniary benefits through the agent. If the agent is 100% owner of the firm (thus at the same time principal) the agent will choose between firm-value and nonpecuniary benefits at the tangency of the indifference curve and the budget restriction (45° line), represented by the red dot.

2. Selling a percentage  of shares to outside owners ( the "amount of sold shares" slider) flattens the agent's restrictions to the degree

of shares to outside owners ( the "amount of sold shares" slider) flattens the agent's restrictions to the degree  (blue line appears). The tangency point moves to the right (the blue dot). If, for example, the agent sells 50% of the shares (and keeps the preferences slider at 0.2) the agent's consumption of nonpecuniary benefits would increase to 36 units, thereby diminishing firm value to the same extent.

(blue line appears). The tangency point moves to the right (the blue dot). If, for example, the agent sells 50% of the shares (and keeps the preferences slider at 0.2) the agent's consumption of nonpecuniary benefits would increase to 36 units, thereby diminishing firm value to the same extent.

3. Outside buyers of the shares will anticipate the increased consumption of nonpecuniary benefits and will not be willing to pay the original price of shares according to the previous firm value.

4. [1] proves that the firm value at which outsiders are willing to buy and the previous owner/agent is willing to sell will be at the point where budget restriction, consumption line, and indifference curve intersect. You can find this point by moving the "adjust to budget restriction" slider that puts the blue dot on the 45° line.

Reference

[1] M. C. Jensen and W. H. Mecklin, "Theory of the Firm: Managerial Behavior and Ownership Structure," Journal of Financial Economics, 3, 1976 pp. 305–360, especially Figure 1.

Permanent Citation

"Principal Becomes an Agent"

http://demonstrations.wolfram.com/PrincipalBecomesAnAgent/

Wolfram Demonstrations Project

Published: June 19 2014