Returns to Scale in One-Factor Production Functions

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

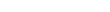

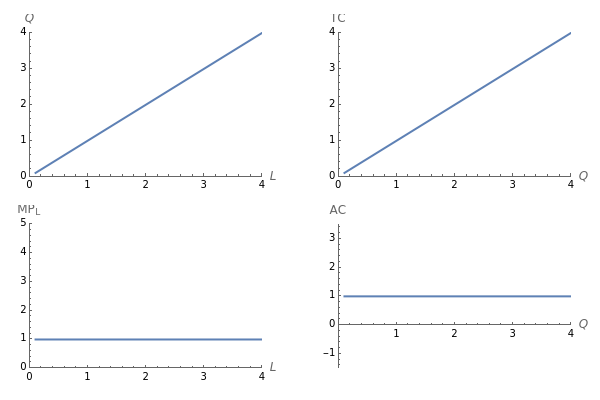

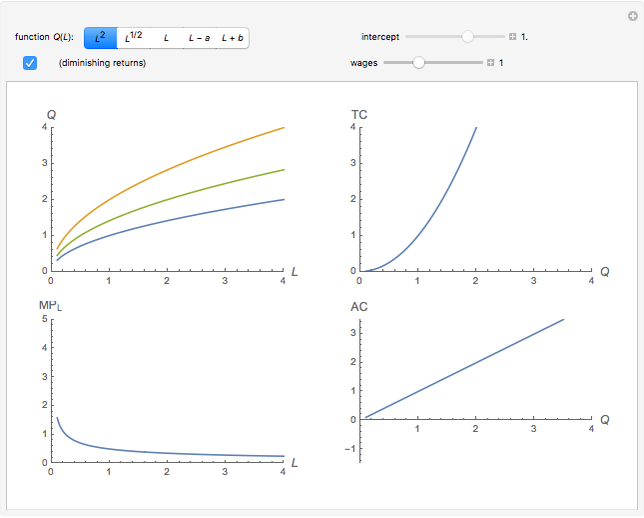

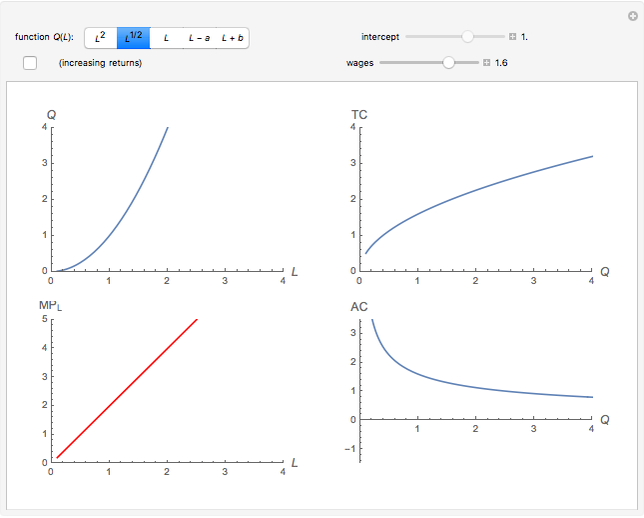

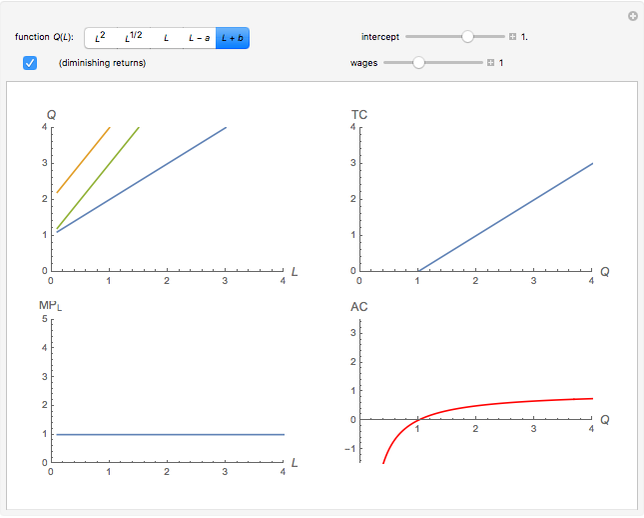

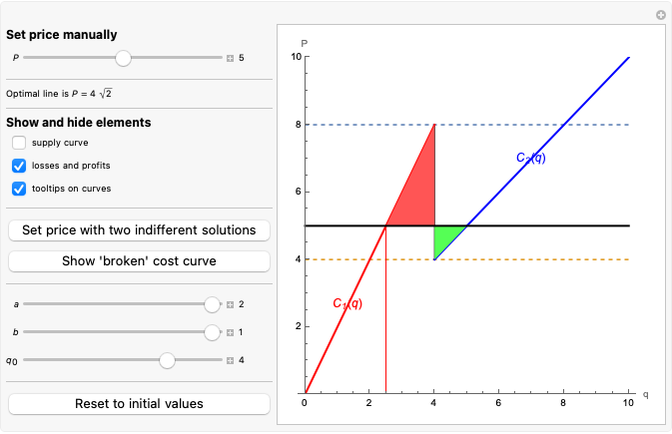

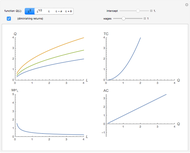

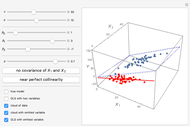

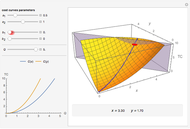

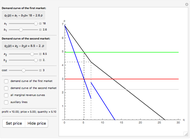

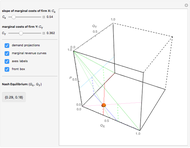

This Demonstration helps in visualizing relationships between such concepts as returns to scale, economies of scale and marginal factor productivity in the extremely simple setting of only one factor. Five easy tractable archetypical functions are considered, and it is shown why only two of them are often used, that is, a function of the type  is used in the context of monopolistic markets (including monopolistic competition or natural monopoly) and a function of the type

is used in the context of monopolistic markets (including monopolistic competition or natural monopoly) and a function of the type  is used in the context of classical monopoly and (or) classical competition. The "intercept" parameter can only be adjusted for the "

is used in the context of classical monopoly and (or) classical competition. The "intercept" parameter can only be adjusted for the " " and "

" and " " cases of the function

" cases of the function  . There are five cases for

. There are five cases for  . The first and fifth cases correspond to diminishing returns, the second and fourth correspond to increasing returns and the third corresponds to constant returns.

. The first and fifth cases correspond to diminishing returns, the second and fourth correspond to increasing returns and the third corresponds to constant returns.

Contributed by: Timur Gareev (May 2018)

Open content licensed under CC BY-NC-SA

Snapshots

Details

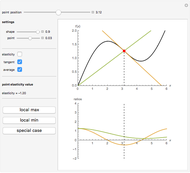

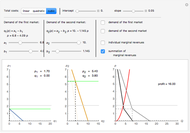

Five forms of one-factor production functions  are considered to study the returns-to-scale concept. Returns to scale are described as follows (for

are considered to study the returns-to-scale concept. Returns to scale are described as follows (for  ):

):

increasing returns:  ;

;

constant returns:  ;

;

diminishing returns:  .

.

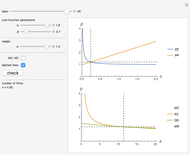

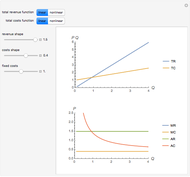

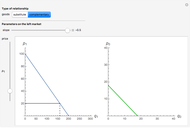

Returns to scale are defined in natural terms. When it comes to nominal terms, the term "economies of scale" is used. When factor markets are competitive (meaning that wages,  —the payment for a production factor—are given), there is a direct relationship between returns to scale and economies of scale. Increasing returns correspond to the downward part of the curve

—the payment for a production factor—are given), there is a direct relationship between returns to scale and economies of scale. Increasing returns correspond to the downward part of the curve  while diminishing returns correspond to diseconomies of scale described by the upward parts of the curve

while diminishing returns correspond to diseconomies of scale described by the upward parts of the curve  .

.  , so we need

, so we need  . In this simple world, total cost is just

. In this simple world, total cost is just  , where

, where  can be expressed from

can be expressed from  .

.

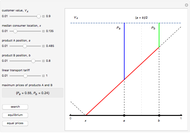

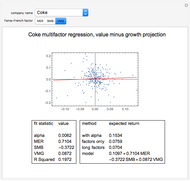

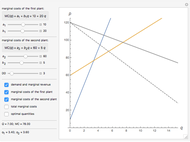

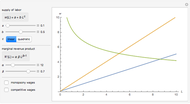

For example, in [1], Krugman's famous model of increasing returns in monopolistic competition uses the function  [1, p. 471], which is just an inverse production function

[1, p. 471], which is just an inverse production function  . Can a function of the type

. Can a function of the type  be used instead (formally it also models increasing returns)? The problem is that it has increasing marginal product of labor

be used instead (formally it also models increasing returns)? The problem is that it has increasing marginal product of labor  , which is an unrealistic assumption (the law of diminishing marginal productivity is violated). The plot that alerts the issue is colored red.

, which is an unrealistic assumption (the law of diminishing marginal productivity is violated). The plot that alerts the issue is colored red.

On the other hand, we cannot use increasing returns production functions in the context of perfect competition. To see why that is so, consider the  curve of economies of scale that always lie above marginal costs (

curve of economies of scale that always lie above marginal costs ( approaches the horizontal

approaches the horizontal  from above). Given that the competitive price is always

from above). Given that the competitive price is always  , all but one of the producers are forced to quit the market, leaving room for an imperfect market. Diminishing returns of the form

, all but one of the producers are forced to quit the market, leaving room for an imperfect market. Diminishing returns of the form  have to be used, which is a typical price-taking setting; for example, it leads to the individual producer's profit maximization problem

have to be used, which is a typical price-taking setting; for example, it leads to the individual producer's profit maximization problem  , where

, where  . At the same time, the linear diminishing returns function

. At the same time, the linear diminishing returns function  results in an infeasible partly negative

results in an infeasible partly negative  curve (which is also colored red).

curve (which is also colored red).

Reference

[1] P. R. Krugman, "Increasing Returns, Monopolistic Competition, and International Trade," Journal of International Economics, 9(4), 1979 pp. 469–479. doi:10.1016/0022-1996(79)90017-5.

Permanent Citation