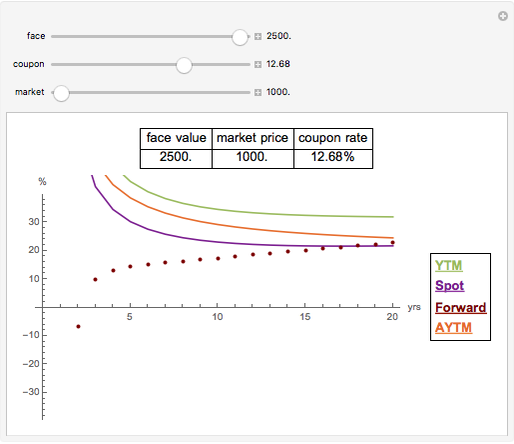

Yield, Spot, and Forward Curves

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

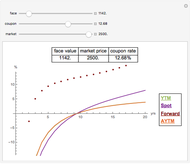

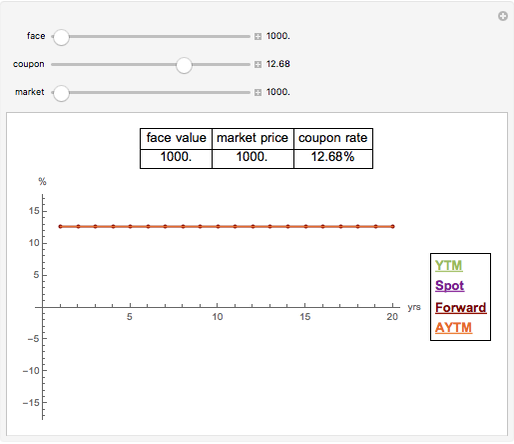

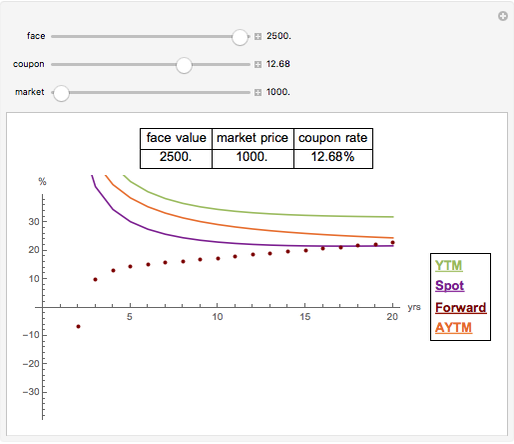

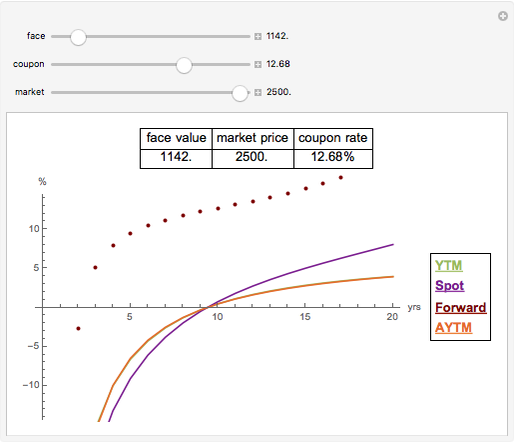

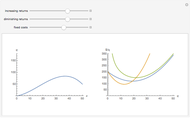

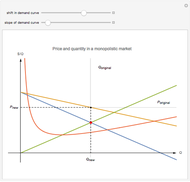

This Demonstration shows the yield, spot, and forward curves for a coupon bond with yearly coupons, purchased for the market price with no other costs and with the face value repaid at the end of the maturity. In addition, it shows the approximate yield to maturity curve, which is also known as Hawawini–Vora yield to maturity.

Contributed by: Gergely Nagy (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

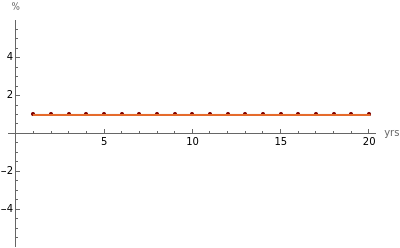

Snapshot 1: for the bond priced at par, the yield equals the coupon rate

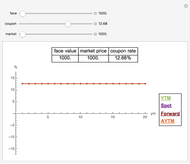

Snapshot 2: for the bond with higher face value than price, the yield curve is decreasing

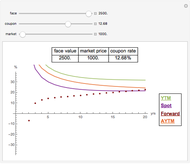

Snapshot 3: the opposite situation implies an increasing yield curve,

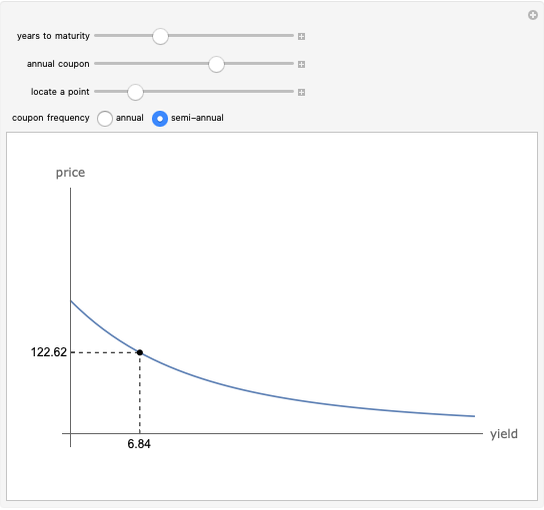

the Hawawini–Vora approximation:

Permanent Citation

"Yield, Spot, and Forward Curves"

http://demonstrations.wolfram.com/YieldSpotAndForwardCurves/

Wolfram Demonstrations Project

Published: March 7 2011