European Option Greeks

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

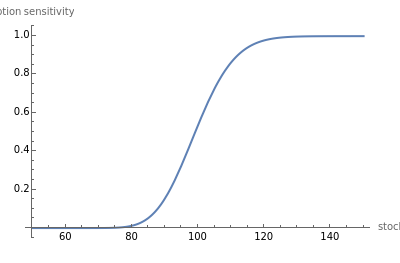

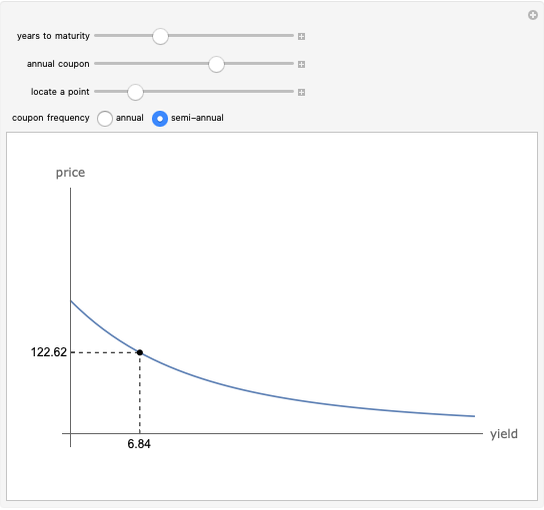

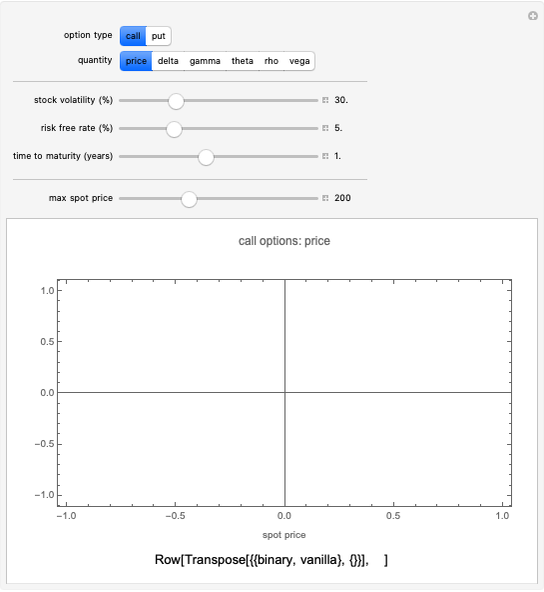

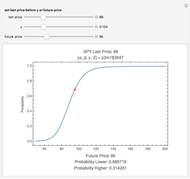

There are two main types of financial options that occur in the market: Call and Put options. There are two general classes of options: European, which are discussed here and American. European Call and Put options give respectively the buyer the right to purchase or sell a security at a later date, called the maturity date, for a fixed price called the strike price. American options only differ in that the date in on which the option is exercised can be any time before the maturity date. There are no explicit formulae for general American options. The most popular model for the evaluation of European options is called the Black-Scholes model after its creators. Such a model has a large number of input parameters, which include: current stock price, the strike price, interest rate, dividend yield of the stock, volatility or annualized standard deviation and time remaining to maturity measured in years. Options are most often purchased as part of a portfolio strategy in addition to some of the underlying stock and some bonds. The purchaser will need to modify his portfolio depending upon how the option changes for each of the parameters. This 2D plot demonstrates how the mathematical derivatives of European call and put option prices change for different values of their input parameters. These are their parameter sensitivities or as they are commonly known in the marketplace, their greeks. These greeks include the sensitivity of the option price to the stock (Delta), to the interest rate (Rho), to the volatility (Vega), to the elapsed time since entering into the option (Theta) and the second order partial derivative of the option price with respect to the stock price (Gamma). There are 5 greeks for each of the call and put option types. The first image shown here displays the behavior of the call option Delta for a typical range of input values.

Contributed by: Michael Kelly (Stuart GSB, Illinois Institute of Technology) (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

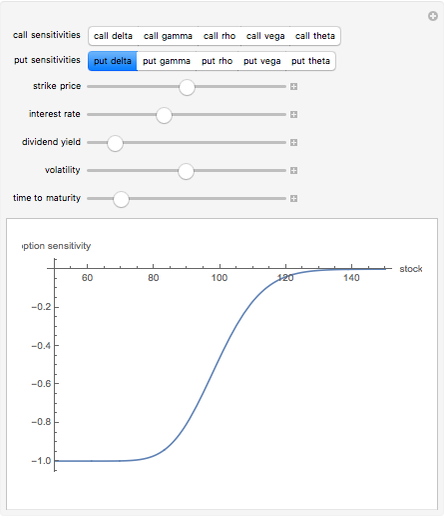

Snapshot 1: The next image is the put option Delta for a similar range of parameter values, but notice that while it has the same S like structure as the call Delta, the values are now negative.

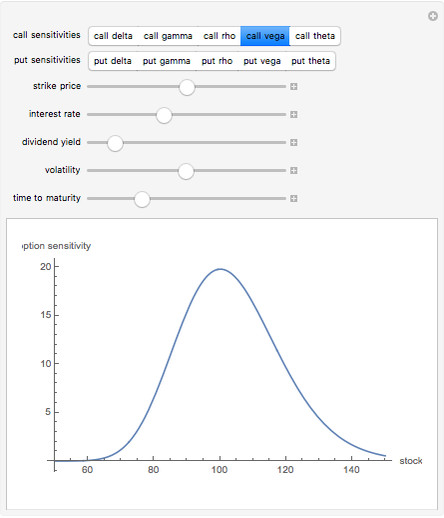

Snapshot 2: The volatility of a stock is one of the most important variables influencing the behavior of an option and its corresponding sensitivity Vega informs the trader how rapidly the option fluctuates for changes in volatility over the life of the option.

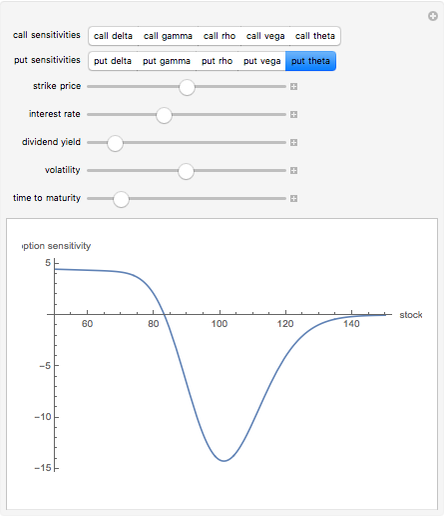

Snapshot 3: Theta informs the trader how the option alters as it approaches the maturity date, measured in years. Notice the large fluctuation around the strike close to maturity.

Snapshot 4: Financial option prices are determined by stochastic processes and these are significantly different from deterministic processes with the result that second order option changes remain important determinators of option prices. For this reason the Gamma greek is used to allow for second order effects in hedging a portfolio.

Snapshot 5: The Rho greek defined as the partial derivative with respect to the interest rate measures the sensitivity of the option price to small changes in interest rates given as percentages.

Permanent Citation

"European Option Greeks"

http://demonstrations.wolfram.com/EuropeanOptionGreeks/

Wolfram Demonstrations Project

Published: March 7 2011