Fund Drawdown Simulation

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

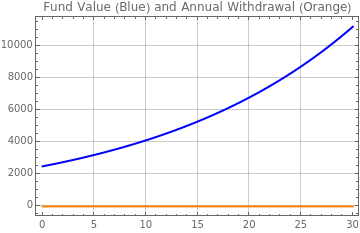

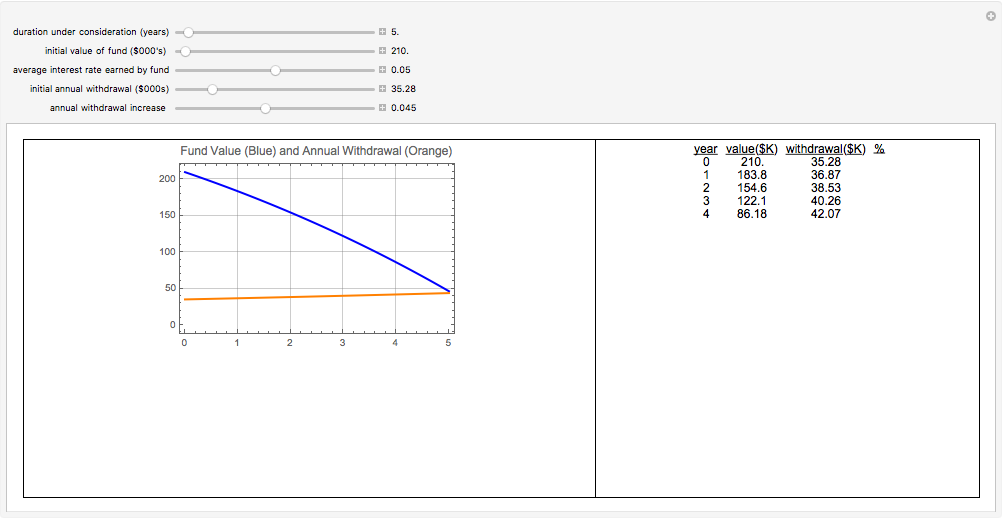

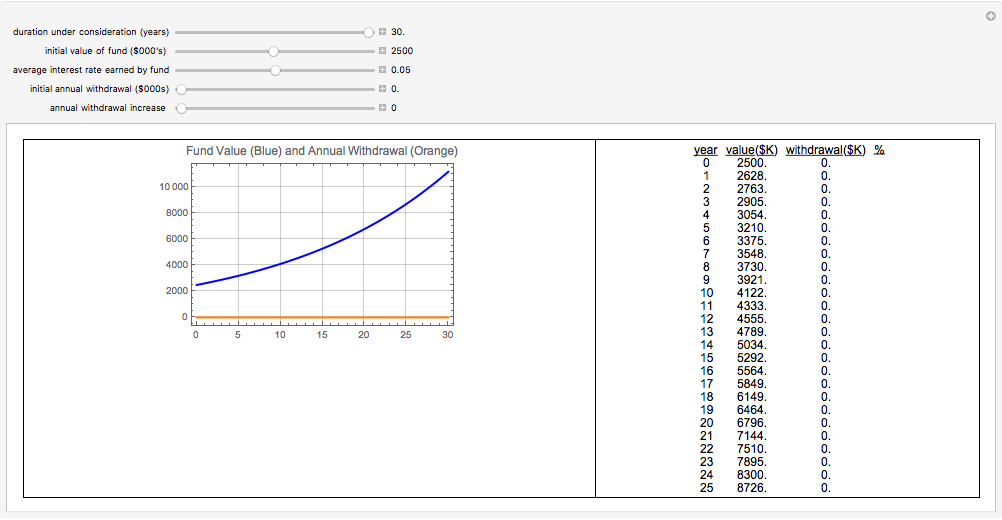

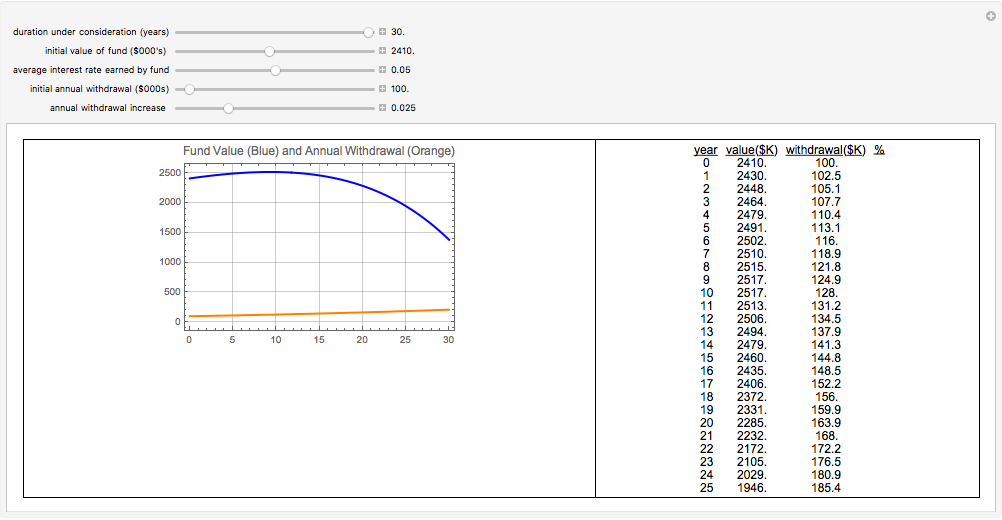

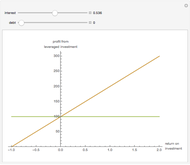

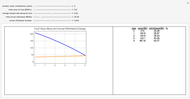

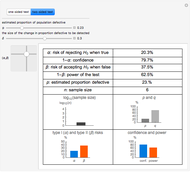

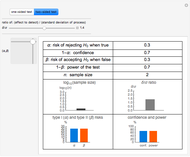

This Demonstration lets you estimate the value of a pool of money (the fund) that increases in value due to an investment return on the fund (at rates between 0 and 10% per year) and decreases in value due to an annual withdrawal. An example would be to estimate how the value of a college fund changes over the four years that tuition and living expenses are withdrawn, while the balance of the fund continues to earn interest. Similarly, the value of a retirement nest egg can be estimated under a situation where the retiree makes annual withdrawals.

Contributed by: Joe O'Hara (March 2008)

Open content licensed under CC BY-NC-SA

Snapshots

Details

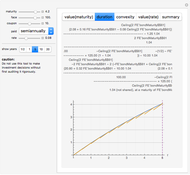

A change in the "annual withdrawal increase" applies the selected fractional increase to the value set by the "initial annual withdrawal ($000s)". For example, if the initial annual withdrawal is set at $1000 and the annual withdrawal increase is set at 0.05 (to counter the effects of inflation, say), then the annual withdrawal for the second year will be $1000 x 1.05 = $1050. The annual withdrawal for the third year will be $1050 x 1.05 = $1102.50 and so on.

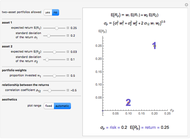

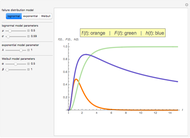

Here is an equation:

,

,

where  is the annual return as a fractional value,

is the annual return as a fractional value,  is the annual fractional increase in the withdrawal, and

is the annual fractional increase in the withdrawal, and  is the chosen initial annual withdrawal rate.

is the chosen initial annual withdrawal rate.

This Demonstration solves the above differential equation over a settable range of years, up to 30 years. When the constant annual withdrawal exceeds the investment return, the value of the fund declines over time. In this situation, the "value ($K)" column of the table may turn negative. In this case, the fund has been exhausted and the additional rows and columns of the table are not meaningful.

Permanent Citation