Random Simulation of a Financial Portfolio

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

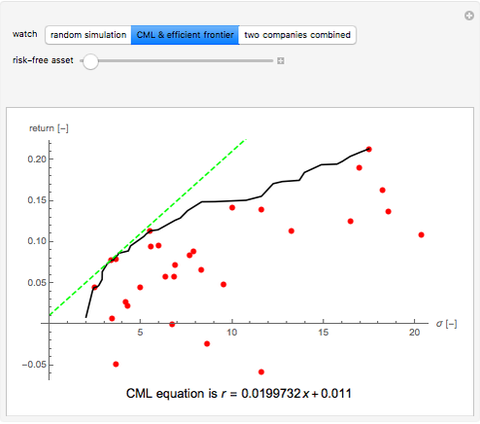

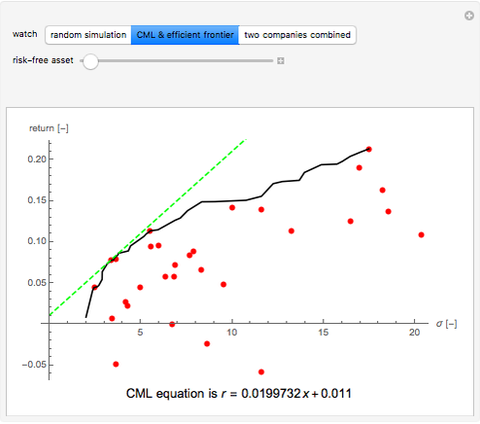

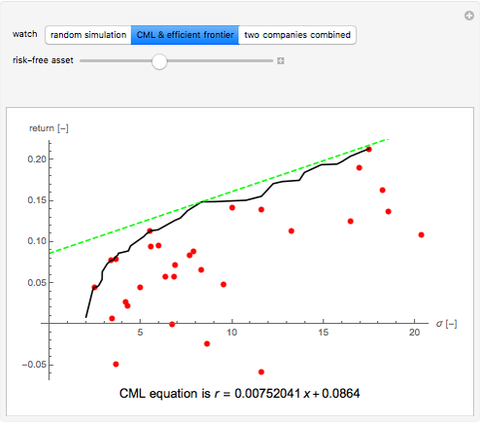

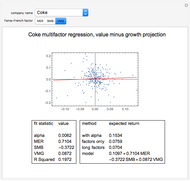

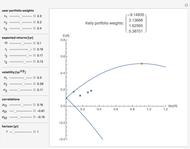

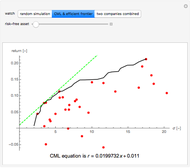

This Demonstration uses random number generation to create a portfolio with up to 30 elements (represented by red points) taken from the Dow Jones Industrial Average using data from 2003 to 2010. The yellow point shows a portfolio with weight 1/30 for each asset. The program finds the efficient frontier according to modern portfolio theory and shows the capital market line (CML) from the 1500 generated points. The CML consists of the risk-free asset's return and market portfolio lying on the efficient frontier. The combination of the two companies shows possible trajectories of the portfolio according to the correlation.

Contributed by: Alois Neumann (September 2011)

(Czech Technical University)

Open content licensed under CC BY-NC-SA

Snapshots

Details

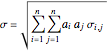

A random simulation is faster than an analytical solution, which also takes too much memory. Every blue point is defined by the equations  and

and  , where

, where  are the contributions of asset

are the contributions of asset  ,

,  ,

,  to a portfolio,

to a portfolio,  is the covariance of assets

is the covariance of assets  and

and  ,

,  is the expected return of asset

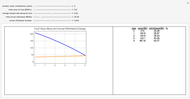

is the expected return of asset  . The second control, "CML & efficient frontier", finds the efficient frontier, which consists of all the points that give the best return at the same level of volatility and the curve is nondecreasing. The more points we use for the simulation, the smoother the efficient frontier. The efficient frontier is necessary for finding the CML. A CML is defined by equation

. The second control, "CML & efficient frontier", finds the efficient frontier, which consists of all the points that give the best return at the same level of volatility and the curve is nondecreasing. The more points we use for the simulation, the smoother the efficient frontier. The efficient frontier is necessary for finding the CML. A CML is defined by equation  . Here

. Here  is the expected return,

is the expected return,  is the risk-free return,

is the risk-free return,  is the slope of the line, and

is the slope of the line, and  is the volatility. The only unknown element is

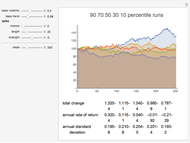

is the volatility. The only unknown element is  , but we know that CML is tangent to the efficient frontier; the highest possible slope of the line is defined by two points: a risk-free return and a point on the efficient frontier. The third control "two companies combined" shows a trajectory of a portfolio that is composed of two companies. Every point of the trajectory is defined by equations

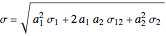

, but we know that CML is tangent to the efficient frontier; the highest possible slope of the line is defined by two points: a risk-free return and a point on the efficient frontier. The third control "two companies combined" shows a trajectory of a portfolio that is composed of two companies. Every point of the trajectory is defined by equations  and

and  , where

, where  is the contribution of asset 1 to a portfolio,

is the contribution of asset 1 to a portfolio,  is the contribution of asset 2 to a portfolio,

is the contribution of asset 2 to a portfolio,  is the expected return of asset 1,

is the expected return of asset 1,  is the expected return of asset 2,

is the expected return of asset 2,  is the volatility of the portfolio,

is the volatility of the portfolio,  is the variation of asset 1,

is the variation of asset 1,  is a variation of asset 2, and

is a variation of asset 2, and  is the covariance of assets 1 and 2. Here

is the covariance of assets 1 and 2. Here  ,

,  , with the restriction

, with the restriction  .

.

Permanent Citation

"Random Simulation of a Financial Portfolio"

http://demonstrations.wolfram.com/RandomSimulationOfAFinancialPortfolio/

Wolfram Demonstrations Project

Published: September 16 2011