Stock Market Crossover

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

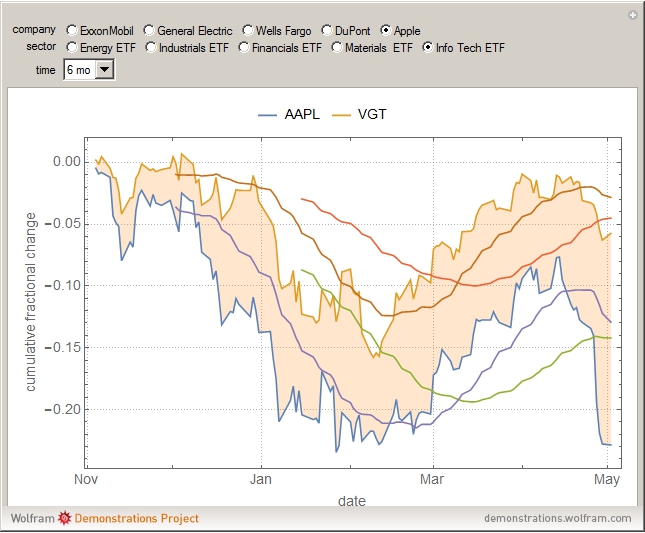

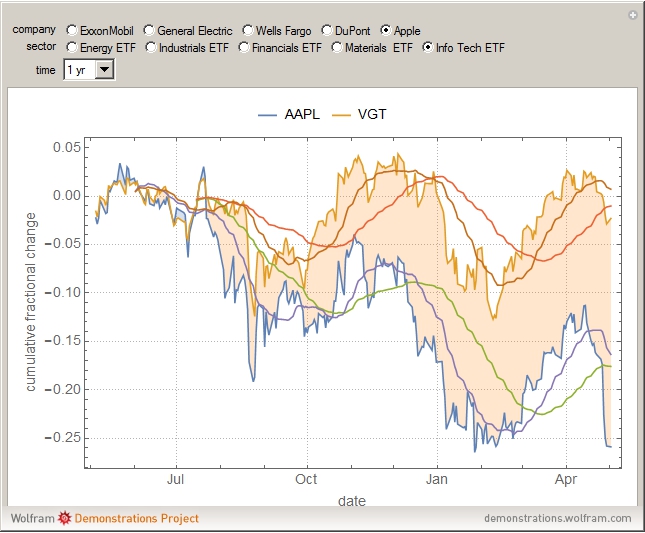

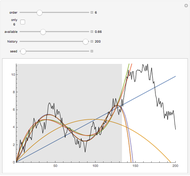

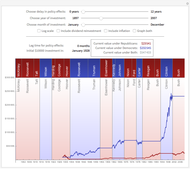

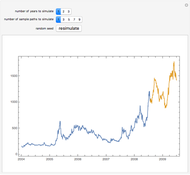

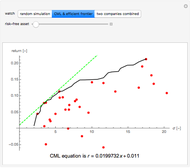

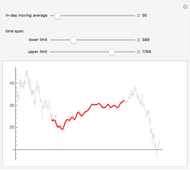

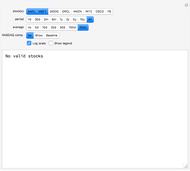

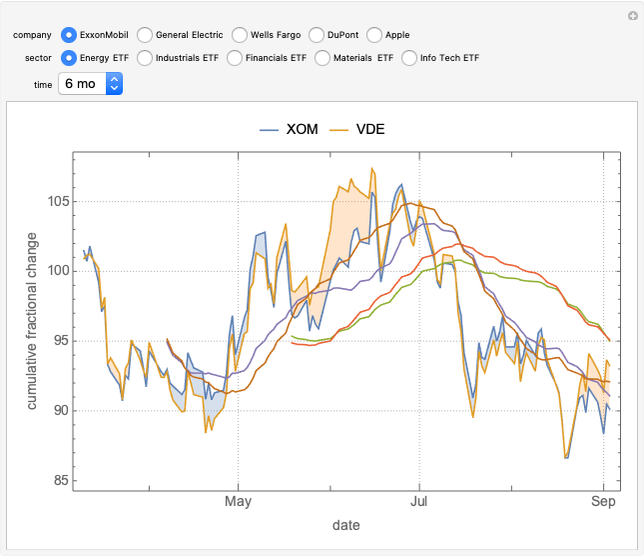

An ETF, or exchange traded fund, is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. By owning an ETF, investors get the diversification of an index fund as well as the ability to trade it like a stock on an exchange. This Demonstration plots the cumulative fractional change of a security and its respective Vanguard sector ETF for comparison. 50- and 20-day moving averages are included to show crossovers and short- or long-term market trends.

Contributed by: Andrew Tao and Michael Kelly (May 2016)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Crossovers occur when the value of a security intersects with a stock indicator, such as a 20- or 50-day moving average (MA). Crossovers often indicate a reversal or start of a bullish or bearish trend. A security-indicator crossover may indicate a short-term fluctuation such as when the security crosses above the MA, triggering a buy signal, or when it crosses below the MA, triggering a sell signal. Similarly, an indicator-indicator crossover may indicate a long-term trend, so that the 20-day MA crossing above the 50-day MA may indicate a possible upward trend and a buy signal, while the 20-day MA crossing below the 50-day MA may indicate a possible downward trend and a sell signal.

Permanent Citation

"Stock Market Crossover"

http://demonstrations.wolfram.com/StockMarketCrossover/

Wolfram Demonstrations Project

Published: May 4 2016