Monetary Policy in Krugman's Model of a Liquidity Trap

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

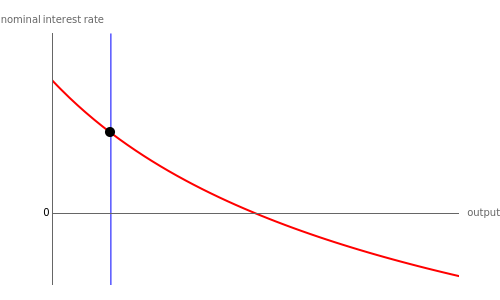

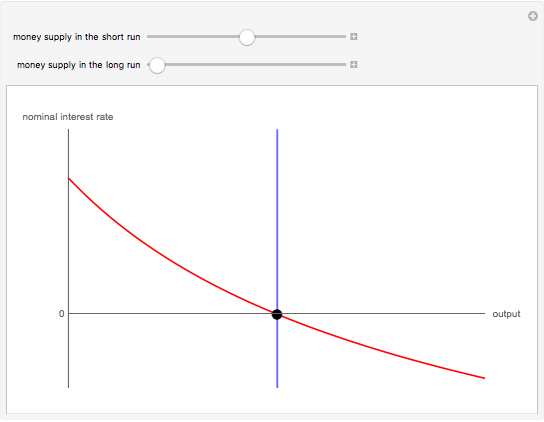

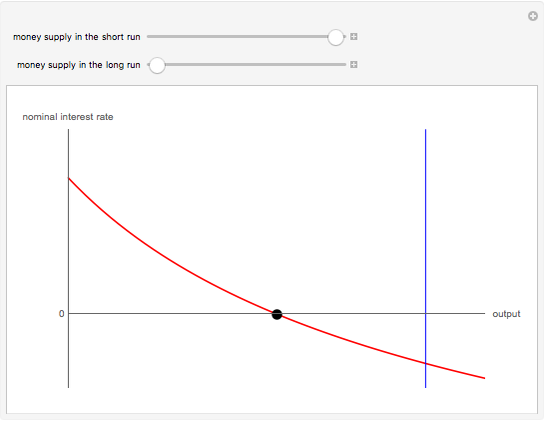

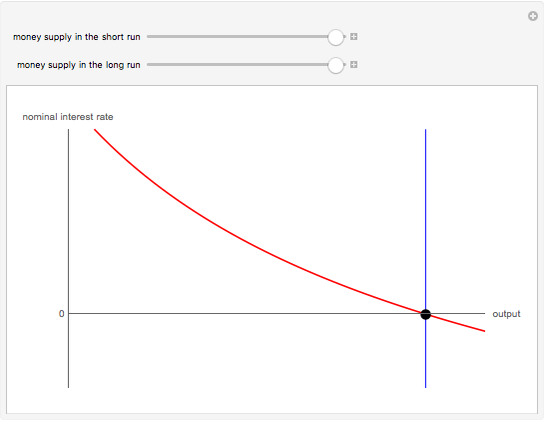

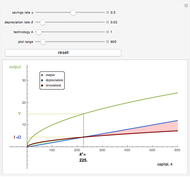

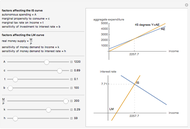

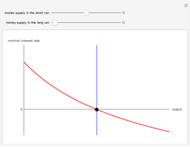

In his 1998 article on the liquidity trap, Paul Krugman presents a simple model. This Demonstration shows how monetary policy affects the level of output and the nominal rate of interest in that model. We see that temporarily increasing the money supply (increasing the money supply in the short run, while holding the money supply constant in the long run) increases output. Once the nominal interest rate falls to its zero lower bound, temporarily increasing the money supply does not increase output. Krugman calls this situation a "liquidity trap". In order to increase output in a liquidity trap, the money supply must be increased in both the short run and the long run.

Contributed by: Kevin W. Capehart (July 2011)

After work by: Paul Krugman

Open content licensed under CC BY-NC-SA

Snapshots

Details

This Demonstration follows Krugman [1] by illustrating his model in terms of a CC schedule, an MM schedule, and an equilibrium point.

The CC schedule shows the combinations of the level of output and the nominal interest rate at which a representative consumer is indifferent between, on the one hand, spending a dollar of money on consumption in the short run and, on the other hand, saving the dollar for consumption in the long run. The schedule is downward sloping because saving a dollar is less attractive when the nominal interest rate is lower. The schedule shifts to the right when the long-run money supply increases because an increase in the long-run money supply increases the long-run price level (by assumption), so saving a dollar is less attractive when the long-run price level is higher. The equilibrium level of output and nominal rate of interest will always lie on the CC schedule.

The MM schedule shows the level of output that could be purchased by the money supply in the short run. The schedule is vertical because it is independent of the nominal interest rate. The schedule shifts to the right when the short-run money supply increases because the short-run price level is fixed (by assumption), so more output could be purchased. If the nominal interest rate is positive, then the equilibrium level of output will lie on the MM schedule because the representative consumer will not hold money in excess of what is needed to purchase output. But if the nominal interest rate is zero, then the equilibrium level of output will not lie on the MM schedule because some money in excess of what is needed to purchase output will be held as a store of value.

For more details, see [1].

Reference

[1] P. Krugman, "It's Baaack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity, 2, 1998 pp. 137–187.

Permanent Citation

"Monetary Policy in Krugman's Model of a Liquidity Trap"

http://demonstrations.wolfram.com/MonetaryPolicyInKrugmansModelOfALiquidityTrap/

Wolfram Demonstrations Project

Published: July 20 2011