Statistical Mechanics of Money

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

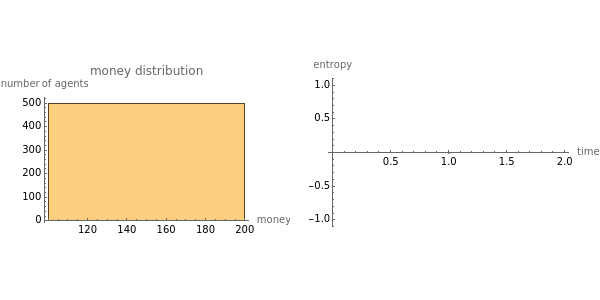

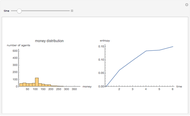

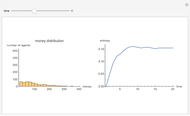

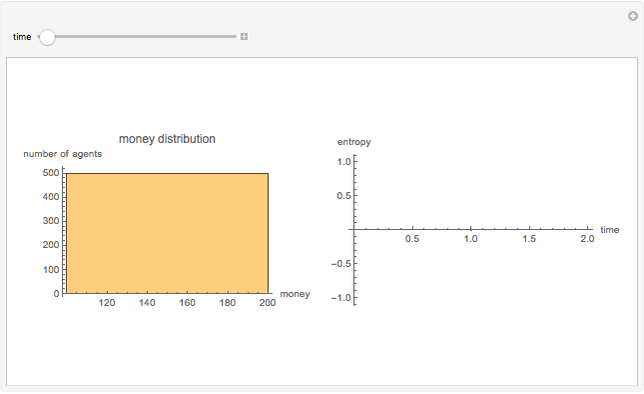

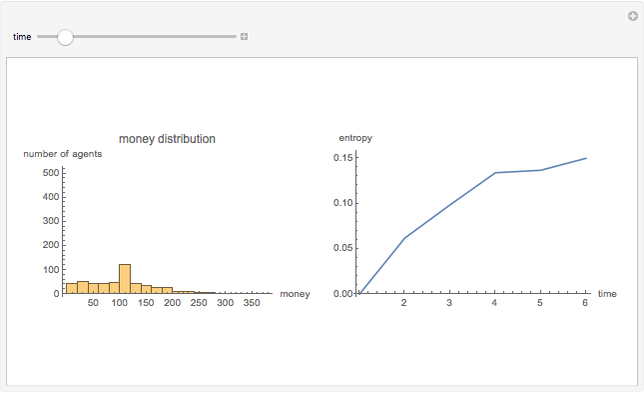

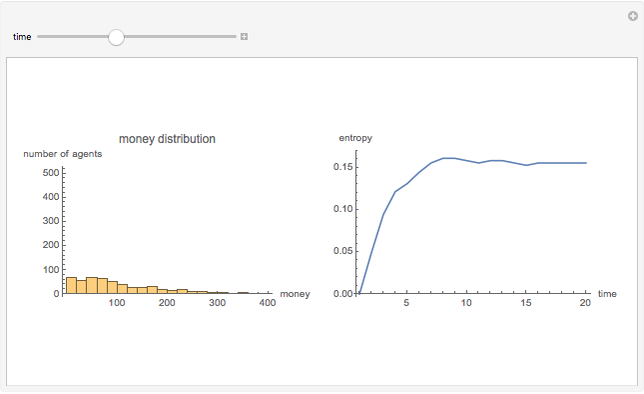

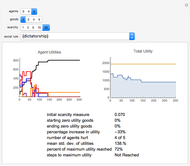

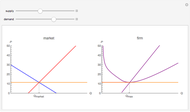

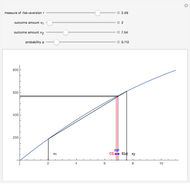

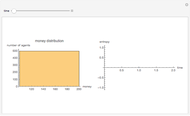

The empirical distribution of the majority of people's wealth is consistent with an exponential (Boltzmann-Gibbs) distribution. This outcome can be replicated by an abstract agent-based simulation that models the exchange of money for goods in market economies. In this simulation, (i) total money is conserved and (ii) a random amount of money is transferred from one randomly selected agent to another ad infinitum. The first plot tracks the instantaneous money distribution (a simple proxy for wealth). The money distribution is initially equitable but rapidly converges to the highly unequal exponential distribution, at which point the economy enters statistical equilibrium. The second plot tracks the entropy of the money distribution, which increases to a maximum. The exponential distribution is the maximum entropy distribution under the constraint of money conservation. So market exchange between large numbers of independent agents is a mechanism that produces the "most disorderly" distribution of wealth subject to a simple conservation constraint.

Contributed by: Ian Wright (March 2011)

After work by: A. A. Dragulescu, V. M. Yakovenko, and Justin Chen

Open content licensed under CC BY-NC-SA

Snapshots

Details

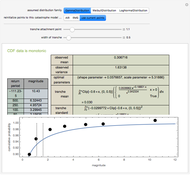

In this simulation, a random amount of money in the range [0,  ] is transferred from one randomly selected agent to another; if the agent has insufficient funds, the exchange does not take place. To produce smoother results, independent economies are simulated in parallel. The graphs summarize the income distribution and entropy of economies, each with 25 agents. This model of money distribution was first described in a classic paper of the econophysics movement [1].

] is transferred from one randomly selected agent to another; if the agent has insufficient funds, the exchange does not take place. To produce smoother results, independent economies are simulated in parallel. The graphs summarize the income distribution and entropy of economies, each with 25 agents. This model of money distribution was first described in a classic paper of the econophysics movement [1].

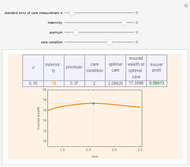

The complete wealth distribution is characterized by an exponential body (approximately 80% of the population) coupled to a power-law tail (a Pareto distribution, accounting for the wealthiest 20% of the population). A similar agent-based approach, described in [2], replicates the complete wealth distribution, in addition to other empirical regularities of capitalist economies, such as the power-law of firm sizes, the Laplace distribution of firm and GDP growth, etc. These results, and others, suggest that capitalist economies approximate a state of statistical equilibrium.

[1] A. Dragulescu and V. M. Yakovenko, "Statistical Mechanics of Money," The European Physical Journal B, 17(4), 2000 pp. 723–729.

[2] I. Wright, "The Social Architecture of Capitalism," Physica A: Statistical Mechanics and its Applications, 346(3-4), 2005 pp. 589–620.

Permanent Citation