Trader Dynamics in Minimal Models of Financial Complexity

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

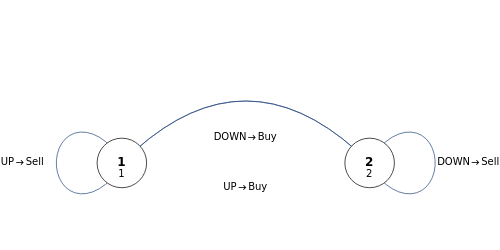

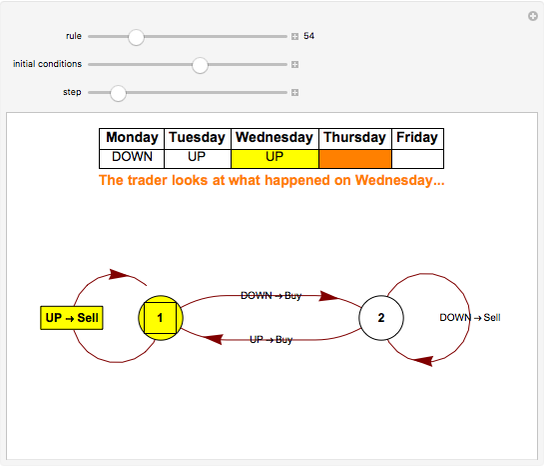

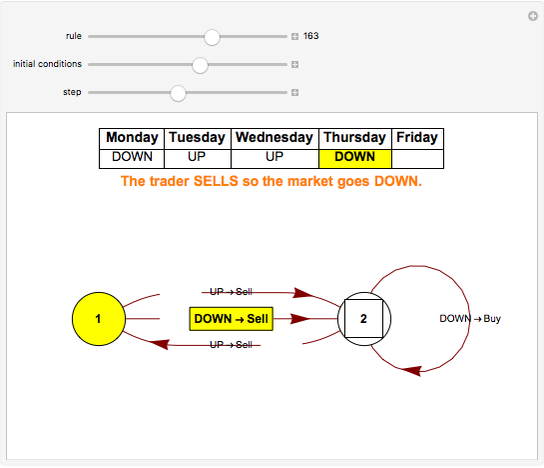

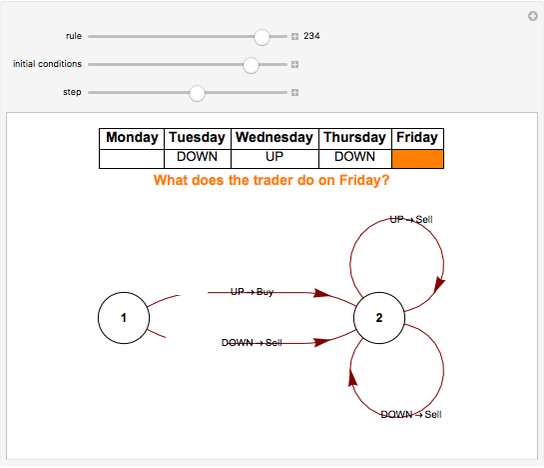

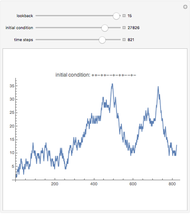

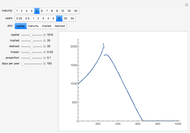

Move the step slider to watch your trader think. Pick the rule he follows and the initial conditions for the first three days of the week. The trader looks back over the past three days in considering what to do. The big circles are states, like the emotions of the trader. He always starts in state 1 and then follows the arrows that correspond to the market movement (UP or DOWN) of the day under consideration. The yellow state is the one he was in when he started thinking about the day in question, and the one with the square in it is the one he will move to, based on the yellow arrow that he follows. His "current thinking" is shown on the yellow arrow, too (BUY or SELL), but he only makes his final decision when he has reached the last day that he considers.

Contributed by: Philip Maymin (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

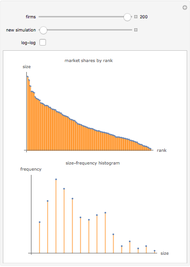

These trading rules are the minimal models of the complexity of financial securities. Other models either rely on multiple traders interacting with each other or explicitly force randomness into the model. Here, the rule is simple, deterministic, reasonable, and minimal.

In fact, only rule 54 (and rule 201, which is the same as rule 54 but with renumbered states) generates complex security prices. See the demonstration "The Minimal Model of the Complexity of Security Prices" to examine the behavior of rule 54.

The single trader can be thought of as the representative investor and the security he is trading can be thought of as the market. That is why the price goes up when the trader decides to buy: because there is no one else for him to transact with, the price goes up to reflect his "indifference price," even though there is no actual traded volume. In other words, at the old price, the trader wants to buy, so the price goes up, and now he is indifferent.

After he has made his decision for Thursday and the market has moved to reflect his decision, you can see what he will do on Friday by continuing to move the step counter. Notice he no longer looks at Monday at all! This is because he has a lookback of three days. And he treats Thursday's price changes, for which he was solely responsible, the same as he treats Tuesday and Wednesday. In other words, the trader is not "aware" of the rule he is following. (Are you aware of what makes you predictable?)

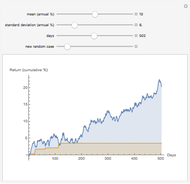

In general, a rule 54 trader can have a lookback of more than three days, and lookbacks of three days are not very interesting. Why? Because the trader is deterministic, based on the values of the past three days, and there are only eight distinct such values. Therefore, the price series must cycle within eight days. But it doesn't take a very long lookback to make a very long and complex cycle: with lookbacks of 15 business days, it would take about 130 years for the price series of rule 54 to cycle.

For more information, please consult this overview.

Permanent Citation

"Trader Dynamics in Minimal Models of Financial Complexity"

http://demonstrations.wolfram.com/TraderDynamicsInMinimalModelsOfFinancialComplexity/

Wolfram Demonstrations Project

Published: March 7 2011