Tax Incidence

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

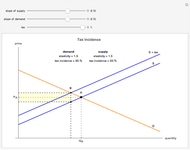

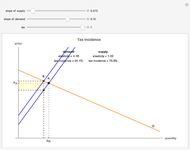

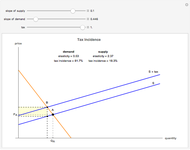

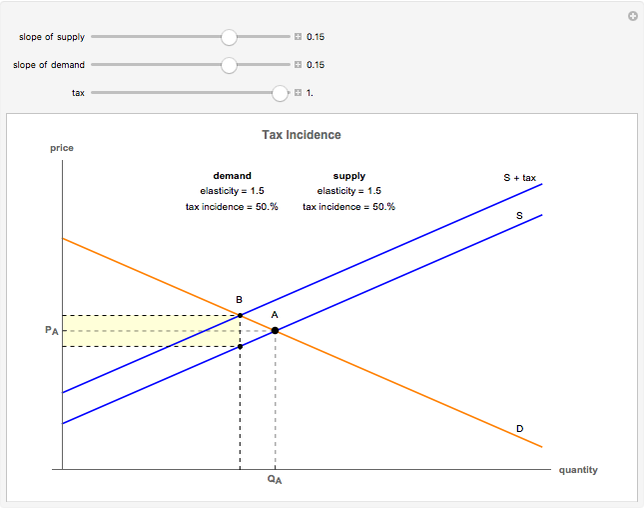

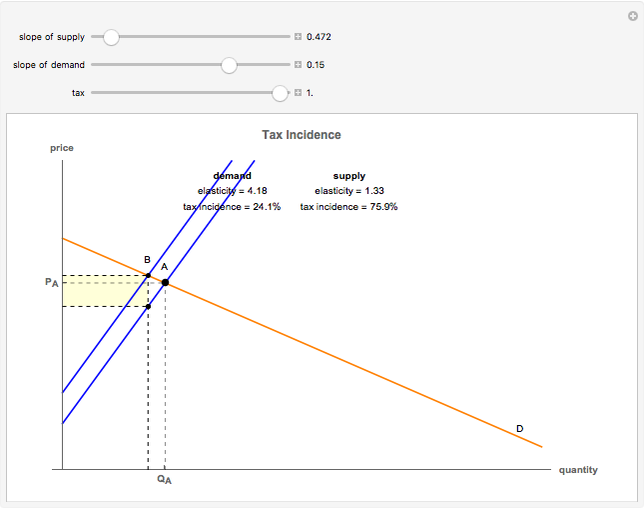

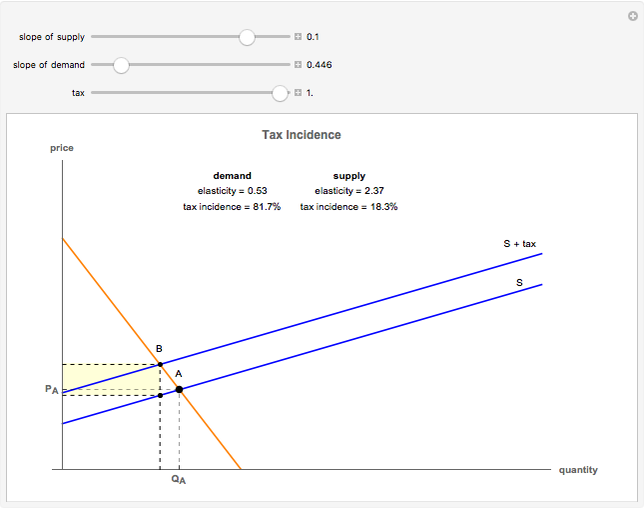

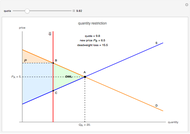

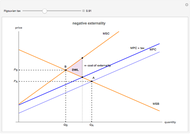

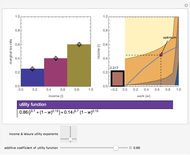

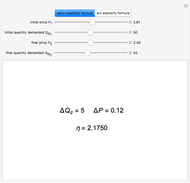

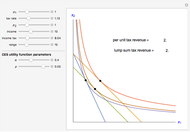

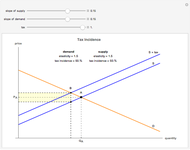

When the government imposes taxes on a market, the incidence of the tax refers to who (producers or consumers) pays the tax burden. Tax incidence depends on price elasticities of supply and demand. This model shows what percentage of a tax is paid by consumers and producers, and you will see that the group with the smaller elasticity bears the more significant burden of the tax. When the elasticities are equal, both groups contribute equally to the tax burden.

Contributed by: Nicholas Palmer (October 2014)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Elasticity refers to responsiveness to price changes; a high-price elasticity of demand indicates that consumers consume much less after a price increase or much more after a price decrease. Price elasticity of supply works the opposite way with production by suppliers, such that highly elastic supply leads to sharply increased production after a price increase and a significant decrease in production when prices fall. It makes sense that the group (consumers or producers) that has a smaller, more inelastic curve bears the burden of the tax because they will not respond very much to the price change relative to their elastic counterpart. Snapshot 1 demonstrates how both producers and consumers share the burden of the tax when their elasticities are equal. Snapshot 2 illustrates a scenario where demand is more elastic than supply, so suppliers bear the more significant burden. Snapshot 3 shows how consumers bear the more significant tax burden when supply is more inelastic than demand.

Permanent Citation

"Tax Incidence"

http://demonstrations.wolfram.com/TaxIncidence/

Wolfram Demonstrations Project

Published: October 23 2014