Determinants of the Weighted Average Cost of Capital (WACC)

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

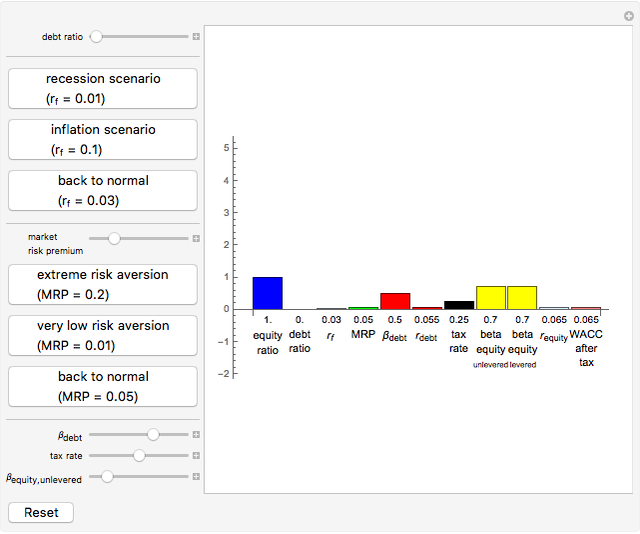

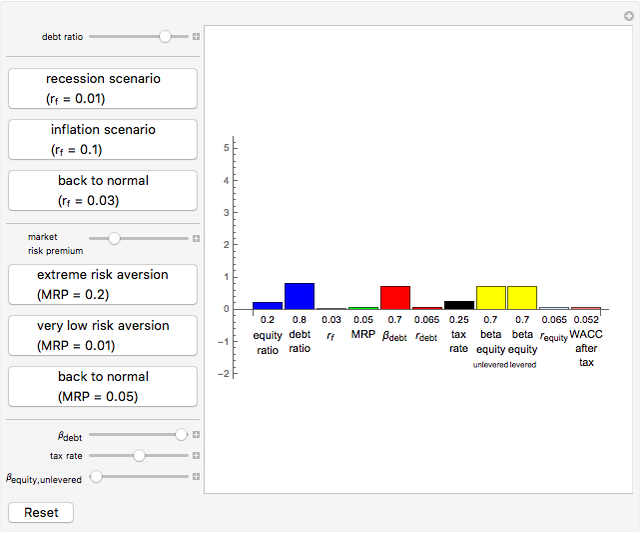

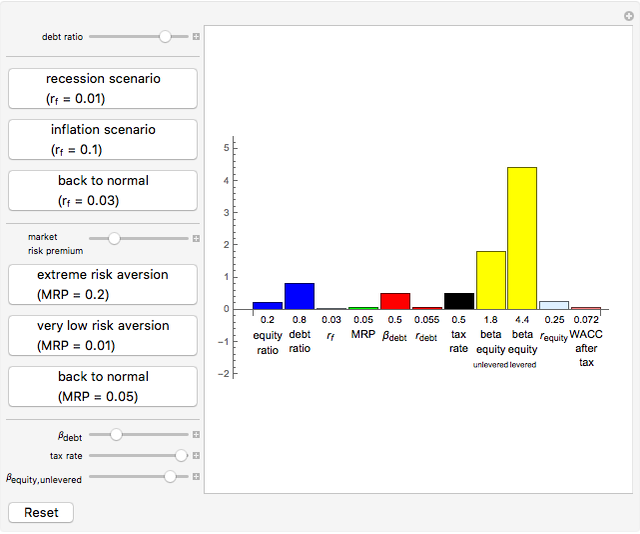

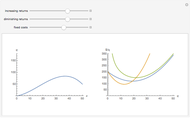

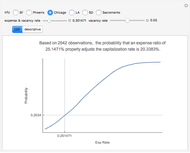

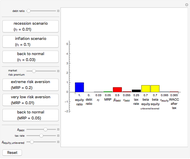

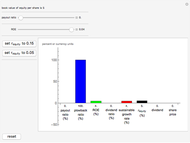

The (after-tax) weighted average cost of capital (WACC) of a company is the most important measure of cost of capital used in practice. In this Demonstration, you can enter all determinants of the WACC and the WACC is calculated. Additionally, you can investigate the dependency of the WACC on the respective input parameters.

Contributed by: Thomas Lindner (January 2012)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The cost of debt and cost of equity are calculated with  with the respective betas.

with the respective betas.

The levered equity beta is calculated from the unlevered beta via  .

.

The WACC (after tax) is computed with the fully simplified expression from all input parameters  . This is straightforwardly derived from the WACC and expressions given above.

. This is straightforwardly derived from the WACC and expressions given above.

Permanent Citation