Spotting a Liquidity Trap

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

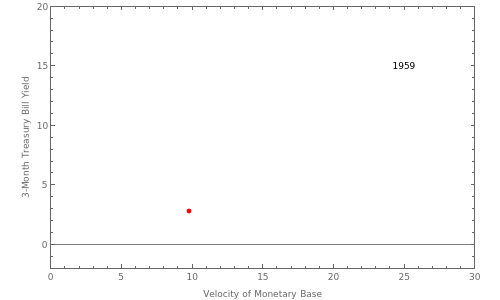

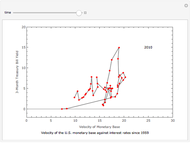

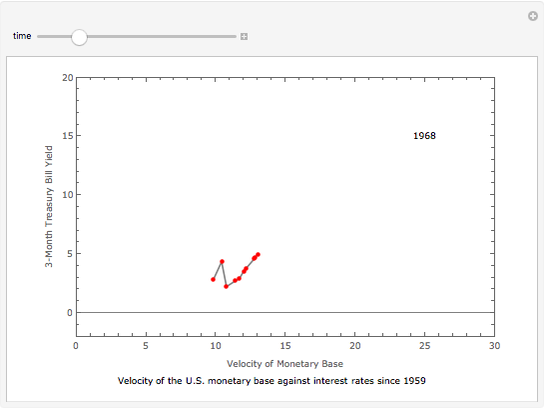

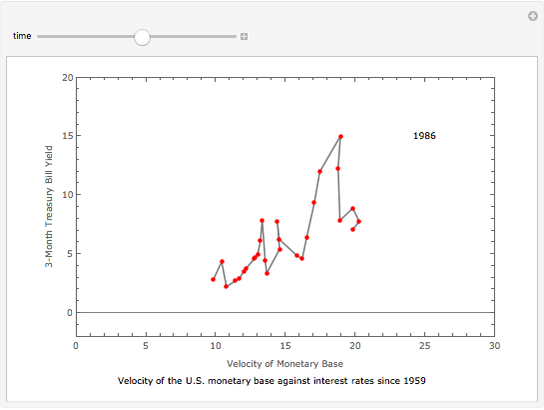

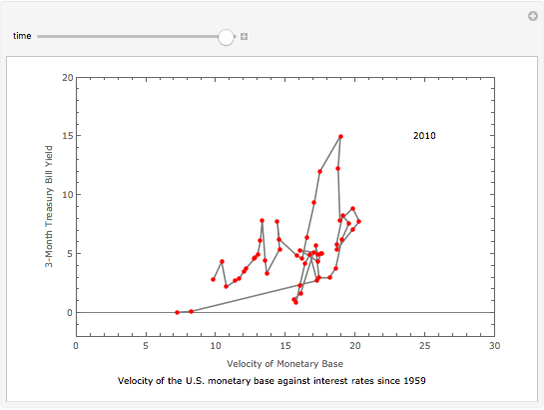

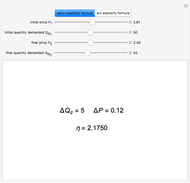

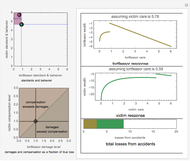

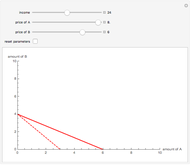

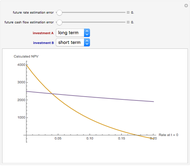

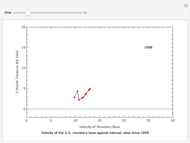

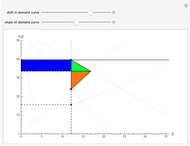

In a liquidity trap, monetary policy is unable to stimulate an economy. The liquidity trap turns out to be one of the many controversies surrounding Keynesian economic theory. In introductory economics classes, they are described as occurring when interest rates decline toward zero but additional cash balances are kept idle. This is usually shown by drawing a perfectly elastic liquidity preference curve. In this Demonstration, we investigate the occurrence of a liquidity trap in the United States. We use the 3-month treasury bill yield to represent interest rates. If the cash balance is indeed kept idle given a low interest rate, one will observe low velocity of money. A liquidity trap can be spotted when a low velocity of money is found given a low interest rate. You can find such cases in the most recent past.

Contributed by: Samuel G. Chen (April 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

This Demonstration was inspired by weekly market comments from Hussman Funds.

Permanent Citation

"Spotting a Liquidity Trap"

http://demonstrations.wolfram.com/SpottingALiquidityTrap/

Wolfram Demonstrations Project

Published: April 19 2011