Two-Period Consumer Model with Different Interest Rates

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

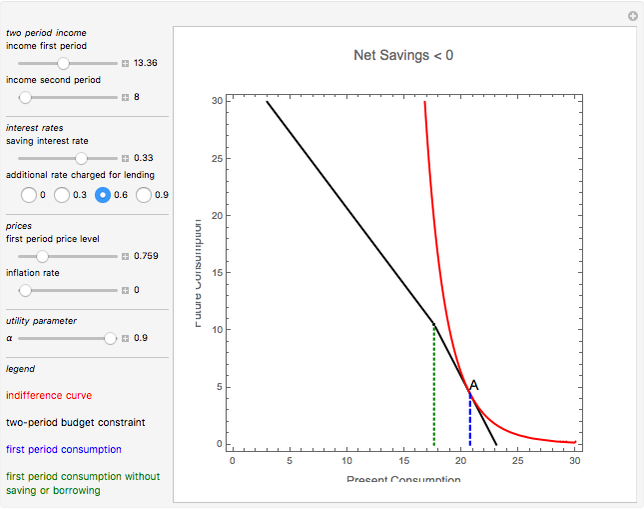

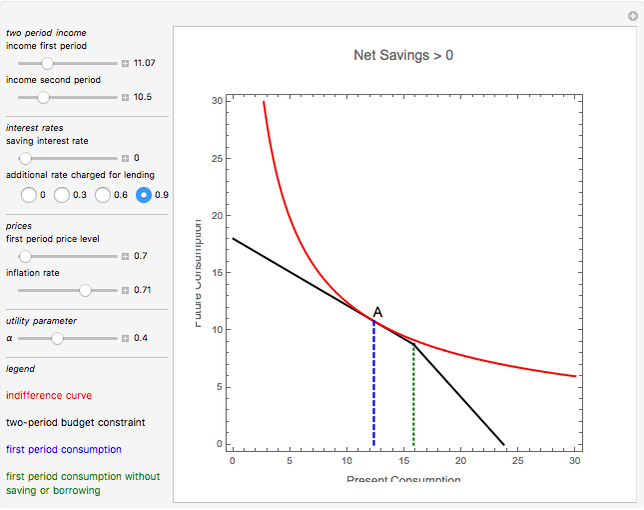

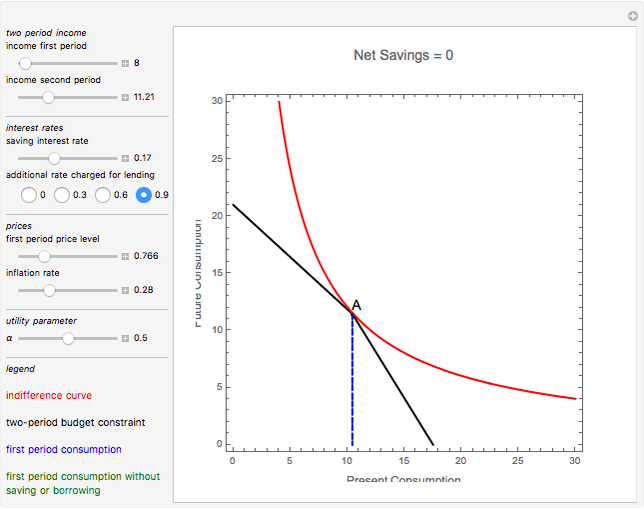

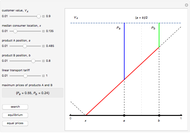

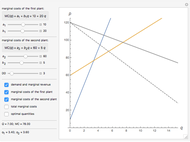

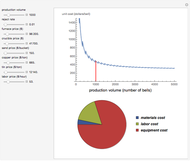

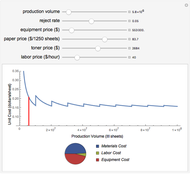

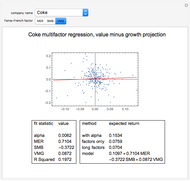

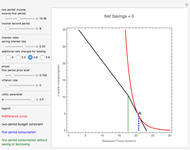

This Demonstration shows how the variation of different parameters of the two-period model changes the utility maximizing solution  for a consumer deciding what to consume in the first period (

for a consumer deciding what to consume in the first period ( axis) and in the second period (

axis) and in the second period ( axis), constrained to a piecewise, two-period budget. The maximizing process is performed with a standard Cobb–Douglas utility function and decides whether the consumer is a saver or a borrower (given by the distance between the blue dashed line and the green dotted line).

axis), constrained to a piecewise, two-period budget. The maximizing process is performed with a standard Cobb–Douglas utility function and decides whether the consumer is a saver or a borrower (given by the distance between the blue dashed line and the green dotted line).

Contributed by: Andres F. Rodriguez (April 2013)

Open content licensed under CC BY-NC-SA

Snapshots

Details

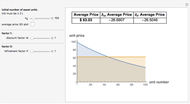

Snapshot 1: net borrower

Snapshot 2: net saver

Snapshot 3: neither saver or borrower

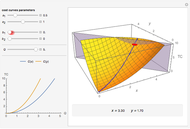

The utility function used in this model is Cobb–Douglas:  .

.

The budget constraint is:  , with

, with  if the consumer is a saver rather than a borrower.

if the consumer is a saver rather than a borrower.

If the green dotted line is located on a value of  greater than the blue dashed line, the consumer saves; otherwise, the consumer borrows.

greater than the blue dashed line, the consumer saves; otherwise, the consumer borrows.

Permanent Citation