Macroeconomic Effects of Interest Rate Cuts

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

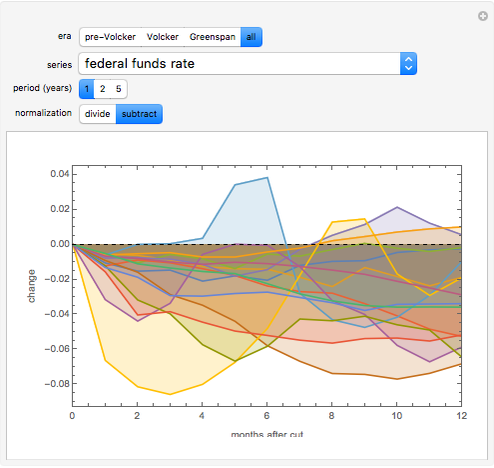

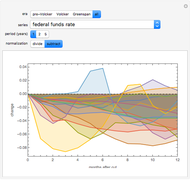

Major Fed rate cuts can have wide and varying effects on major macroeconomic variables. This Demonstration shows the change in selected time series following reductions in the Fed Funds rate of 0.5% or more, after a period of rising or level interest rates.

Contributed by: Jason Cawley and Fred Meinberg (Wolfram Research) (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

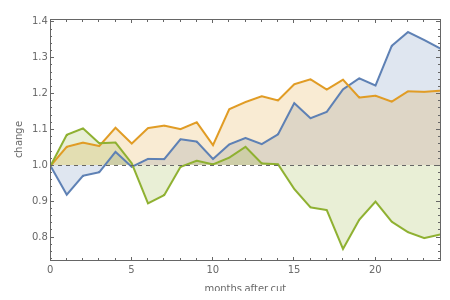

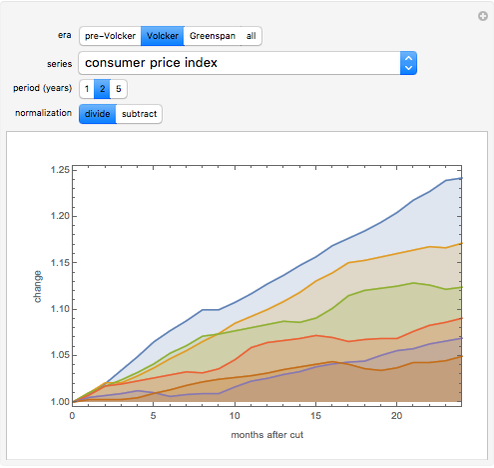

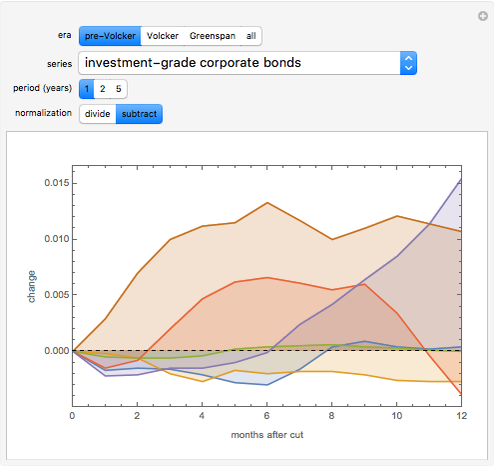

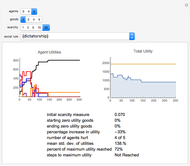

The graphic shows the evolution of the selected macroeconomic value after all major interest rate cuts in a given Fed period.

The vertical axis shows the change of the macroeconomic variable with respect to the value of the series in the month of the initial rate cut. Changes can be given as a relative portion (current value divided by the initial series level), or as an absolute change (subtracting the initial series level from the current level).

The horizontal axis gives the number of months elapsed since the cut. A tooltip over each line gives the date of the interest rate cut at the beginning of a period.

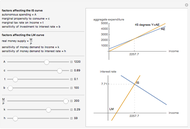

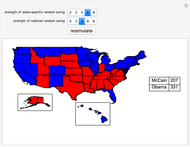

The Fed era control breaks the data into the period before 1979, when interest rates were rising and inflation gradually became a major problem, followed by the Volcker period in the 1980s, in which interest rates reversed their long-term trend, and finally the Greenspan-Bernanke period from 1987 to the present. It is also possible to overlay all periods.

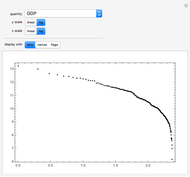

It is possible to switch between several macroeconomic variables, including the real GDP, the unemployment rate, the consumer price index, and major stock indices.

"Best-grade corporate bonds" is the interest rate on AAA-rated, long-dated corporates. "Investment-grade" gives the rate on BBB-rated long corporates.

The "major currencies" exchange rate series gives the trade-weighted value of the dollar against "hard" currencies, while the "broad" series gives it against the world as a whole.

Two stock indices are provided, and give the level of the index, not its total return (dividends are not counted).

The first snapshot shows that the first large cut is seldom the last, and usually the Fed Funds rate goes significantly lower over the next 2 years.

The second snapshot shows the gradual reduction in the rate of inflation throughout the successive cutting periods of the Volcker Fed.

The third snapshot shows how corporate rates sometimes rose significantly after Fed rate reductions in the pre-Volcker period, a sign that inflation expectations were increasing.

The fourth snapshot shows that the future direction of unemployment has been fairly unpredictable in the wake of Fed rate cuts, despite control of this variable often being the ostensible purpose of such reductions. Of course, this is probably a side effect of Fed cuts coinciding with recessions.

The last snapshot shows exchange rate reactions for the recent Fed. There are often sizable early movements, but they occur in both directions and sometimes reverse themselves within two years.

Permanent Citation

"Macroeconomic Effects of Interest Rate Cuts"

http://demonstrations.wolfram.com/MacroeconomicEffectsOfInterestRateCuts/

Wolfram Demonstrations Project

Published: March 7 2011