Two-Regime Threshold Autoregressive Model Simulation

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

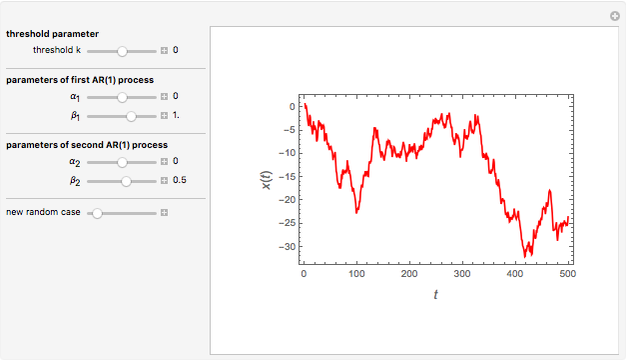

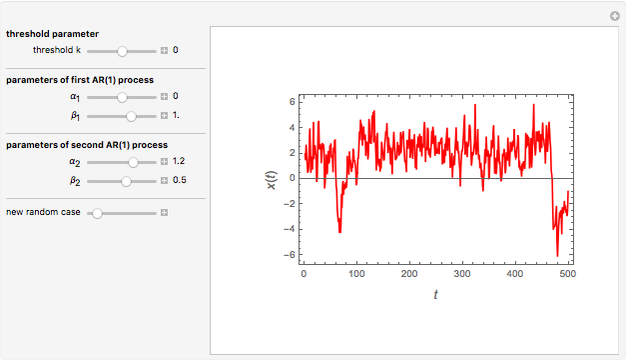

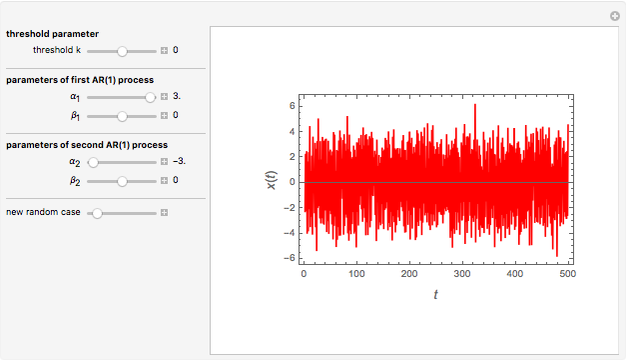

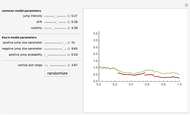

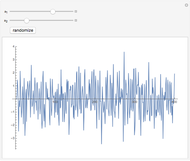

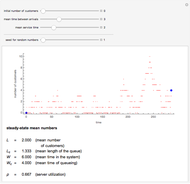

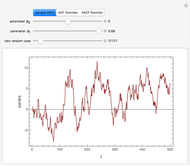

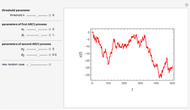

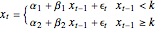

This Demonstration allows you to study realizations from a two-regime threshold autoregressive (TAR) process of the first order by changing its parameters. The two-regime TAR(1) model is represented by:

Parameters are initially set to

Parameters are initially set to  ,

,  , and

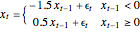

, and  to obtain the following two-regime TAR(1) process:

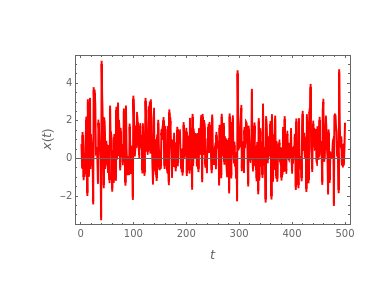

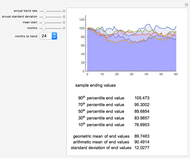

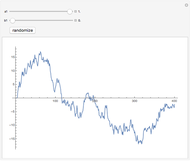

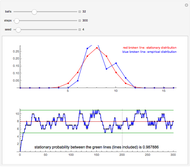

to obtain the following two-regime TAR(1) process:  Note that the process is stationary and geometrically ergodic despite the coefficient -1.5 in the first regime. The series contains large upward jumps when it becomes negative (due to the -1.5 coefficient) and there are more positive than negative jumps. The model also contains no constant term, but

Note that the process is stationary and geometrically ergodic despite the coefficient -1.5 in the first regime. The series contains large upward jumps when it becomes negative (due to the -1.5 coefficient) and there are more positive than negative jumps. The model also contains no constant term, but  is not zero.

is not zero.

Contributed by: Jozef Barunik (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The TAR model is motivated by empirically observed nonlinear characteristics such as asymmetry in declining and rising patterns of a process. It is used for financial time series modeling. The model uses a simple threshold to improve linear approximation.

More information about TAR processes can by found at:

R. S. Tsay, Analysis of Financial Time Series, New York: Wiley, 2001.

Permanent Citation

"Two-Regime Threshold Autoregressive Model Simulation"

http://demonstrations.wolfram.com/TwoRegimeThresholdAutoregressiveModelSimulation/

Wolfram Demonstrations Project

Published: March 7 2011