Expected Utility: Optimal Asset Investment

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

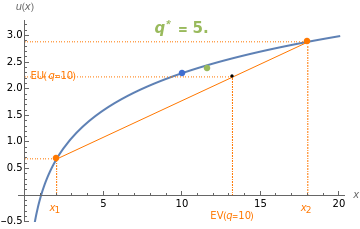

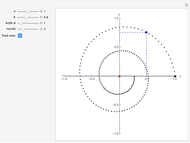

An investor begins with 10 units of wealth that can be invested in a risky asset, or maintained as cash with no return. Assume the risky asset yields a rate of return of  or

or  with probabilities

with probabilities  and

and  , respectively, and let

, respectively, and let  be the number of units of wealth that the investor decides to invest in the asset. The value of the investor's portfolio at the end of the period will be

be the number of units of wealth that the investor decides to invest in the asset. The value of the investor's portfolio at the end of the period will be  . Let the two possible end-of-period values of the portfolio be

. Let the two possible end-of-period values of the portfolio be  and

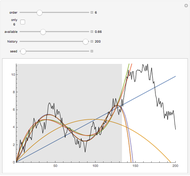

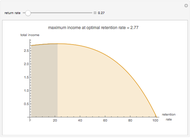

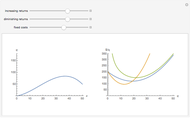

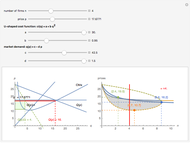

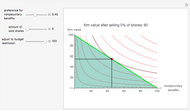

and  , shown above along the horizontal axis. The Bernoulli logarithmic utility function of wealth (constant relative risk aversion, CRRA) is plotted in blue. The orange line is a plot of the expected value and the corresponding expected utility of the portfolio for different values of

, shown above along the horizontal axis. The Bernoulli logarithmic utility function of wealth (constant relative risk aversion, CRRA) is plotted in blue. The orange line is a plot of the expected value and the corresponding expected utility of the portfolio for different values of  . The optimal portfolio is the one for which the expected utility is a maximum, as shown by the green dot.

. The optimal portfolio is the one for which the expected utility is a maximum, as shown by the green dot.

Contributed by: Loreto Llorente (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

detailSectionParagraphPermanent Citation

"Expected Utility: Optimal Asset Investment"

http://demonstrations.wolfram.com/ExpectedUtilityOptimalAssetInvestment/

Wolfram Demonstrations Project

Published: March 7 2011