Hurst Exponent of Stock Price

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

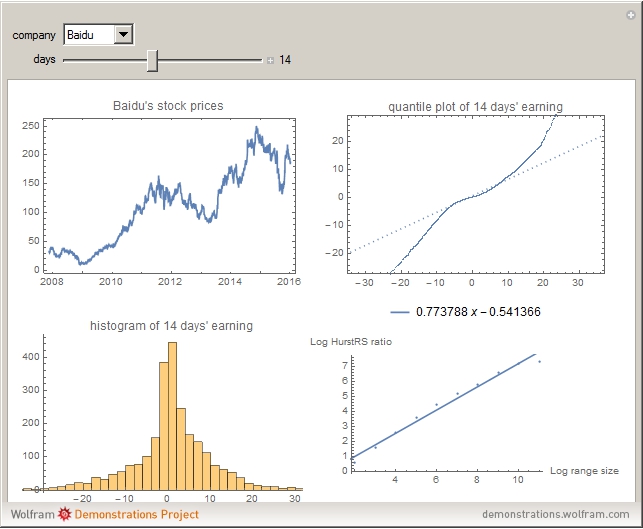

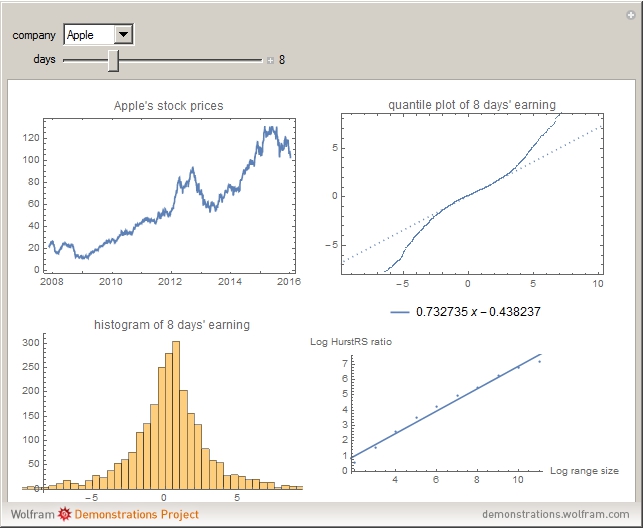

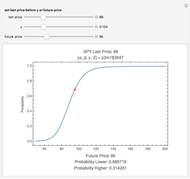

The Hurst exponent  is used as a measure of long-term memory of a time series [1]. If

is used as a measure of long-term memory of a time series [1]. If  , there is white noise (i.e. there is no memory for the time series or, more technically, the random walk). The larger the value of

, there is white noise (i.e. there is no memory for the time series or, more technically, the random walk). The larger the value of  , the more the time series has some type of memory.

, the more the time series has some type of memory.

Contributed by: Yushi Wang (January 2016)

Open content licensed under CC BY-NC-SA

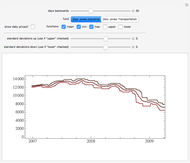

Snapshots

Details

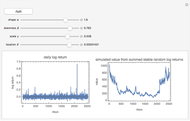

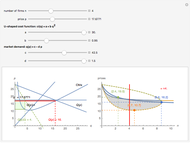

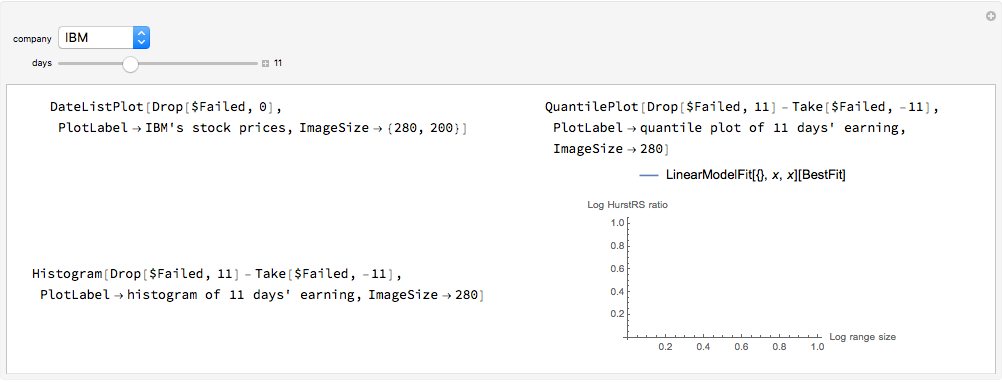

To calculate rescale range [2], calculate  days' market returns with values

days' market returns with values  . The HurstR function calculates the range of the values (max-min). HurstS gives the standard deviation of the values. HurstRS is the range divided by the standard deviation.

. The HurstR function calculates the range of the values (max-min). HurstS gives the standard deviation of the values. HurstRS is the range divided by the standard deviation.

For the whole sequence  , we can calculate a HurstRS value of the whole range, and we do the same by splitting the sequence into two parts

, we can calculate a HurstRS value of the whole range, and we do the same by splitting the sequence into two parts  and

and  to calculate the HurstRS of the two ranges and average them. Then we repeat iteratively for four parts, eight parts, etc. until the range is small enough.

to calculate the HurstRS of the two ranges and average them. Then we repeat iteratively for four parts, eight parts, etc. until the range is small enough.

When we get all the HurstRS values of different range scales, we can plot them on a log-log plot of the range sizes and their HurstRS values, then do a linear model fit to the data, so that the slope of the line is the estimated Hurst exponent of the data.

References

[1] Wikipedia. "Hurst Exponent." (Jan 6, 2016) en.wikipedia.org/wiki/Hurst_exponent.

[2] Wikipedia. "Rescaled Range." (Jan 6, 2016) en.wikipedia.org/wiki/Rescaled_range.

Permanent Citation