Stock Option Strategies

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

This Demonstration shows a wide variety of stock option strategies using current price information. Each strategy can include, as input, one stock position (long or short) and up to four stock option positions. The stock option positions can be long or short, and can use call options or put options. The Demonstration assumes the options have the same time to expiration. The input also includes initial stock price, price of options, and strike prices. The expiration values are plotted for each individual position and for all positions combined. The results are on a per-share basis. Mouse over the points to get numeric (per share) values. Students will find this Demonstration a useful tool for studying and comparing various stock option strategies while using current prices.

Contributed by: Joseph D. Haley (February 2014)

(St. Cloud State University)

Open content licensed under CC BY-NC-SA

Snapshots

Details

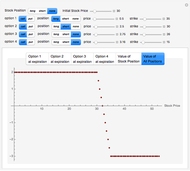

Snapshot 1 shows a bear spread. This spread uses two option positions: a long call with a $35 strike price and a short call with a $30 strike price. (All other choices are selected as "none".) If the share price of the underlying stock at expiry is below $30 a $2 per share profit is made, whereas if the share price exceeds $35 at expiry, there is a $3 per share loss.

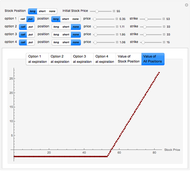

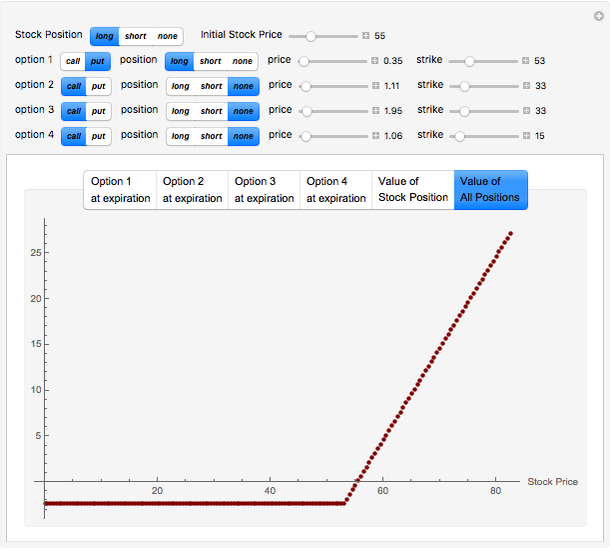

Snapshot 2 shows a protective put. This strategy buys a share of stock at $55 and buys a put option for $0.35 with a strike price of $53. Downside risk is limited to a loss of $2.35 on the share.

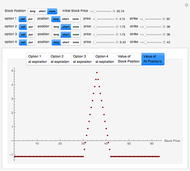

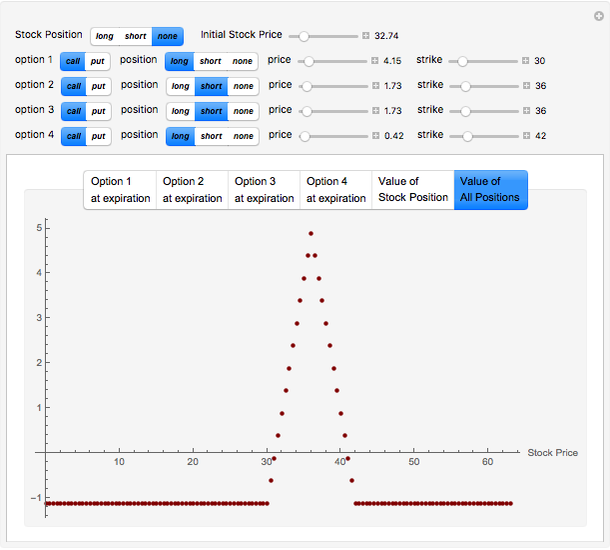

Snapshot 3 displays a butterfly spread. This spread uses four option positions: one long call with a strike price of $30, two short calls with a strike price of $36, and another long call with a strike price of $42. The spread is profitable if, at expiry, the share price is between $31.11 and $40.89.

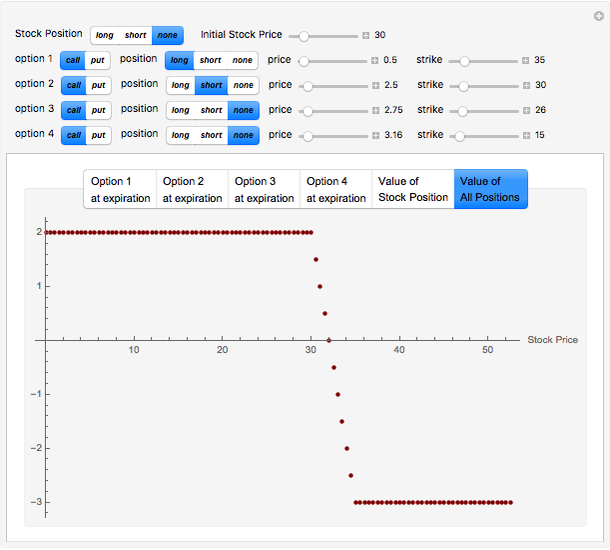

Snapshot 4 displays a straddle. This strategy uses a long call option and a long put option, each having a strike price of $36. A profit is earned if the share price of the underlying stock, at expiry, is less than $31.72 or greater than $40.28.

Snapshot 5 displays a strangle. This strategy uses a long put option with a strike price of $41 and a long call option with a strike price of $47. A profit is earned if the share price of the underlying stock, at expiry, is less than $38.98 or greater than $49.02.

Reference

[1] D. M. Chance and R. Brooks, Introduction to Derivative and Risk Management, 9th ed., Mason, OH: South-Western Cengage Learning, 2013.

Permanent Citation

"Stock Option Strategies"

http://demonstrations.wolfram.com/StockOptionStrategies/

Wolfram Demonstrations Project

Published: February 5 2014