Portfolio Diversification Benefit from Subadditive VaR

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

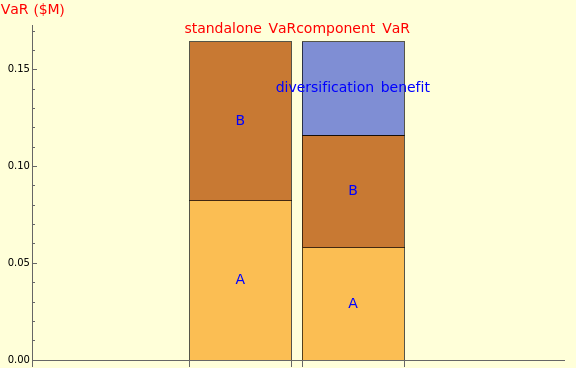

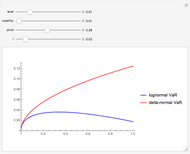

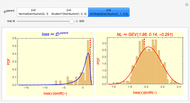

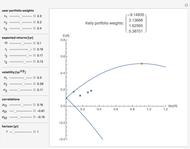

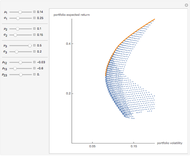

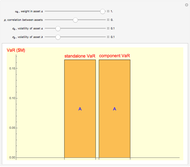

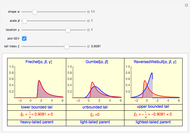

Portfolio diversification benefit derives from investing in various assets whose values do not rise and fall in perfect harmony. Because of this imperfect correlation, the risk of a diversified portfolio is smaller than the weighted average risk of its constituent assets. In term of Value at Risk (VaR), portfolio VaR is smaller than the sum of its constituent VaRs because VaR is a subadditive risk measure:  .

.

Contributed by: Pichet Thiansathaporn (July 2012)

Open content licensed under CC BY-NC-SA

Snapshots

Details

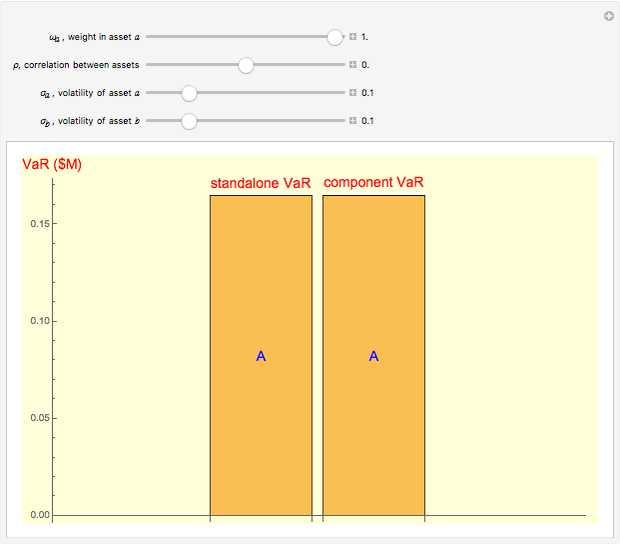

Snapshot 1: when assets are perfectly correlated ( ), there is no diversification benefit and

), there is no diversification benefit and

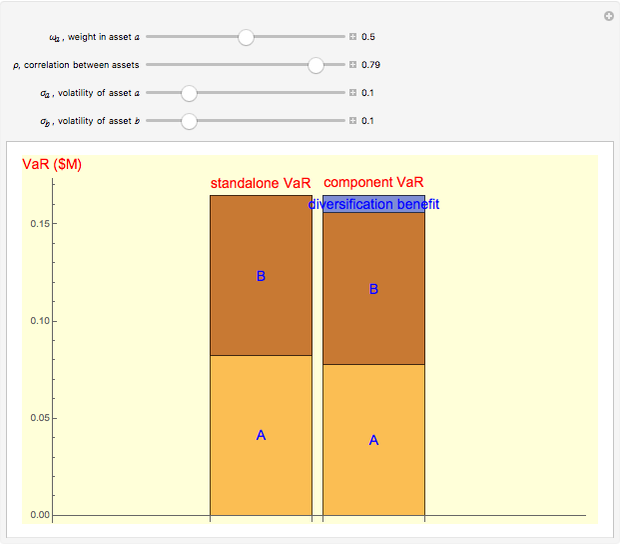

Snapshot 2: when assets are less than perfectly correlated ( ), there is some diversification benefit and

), there is some diversification benefit and

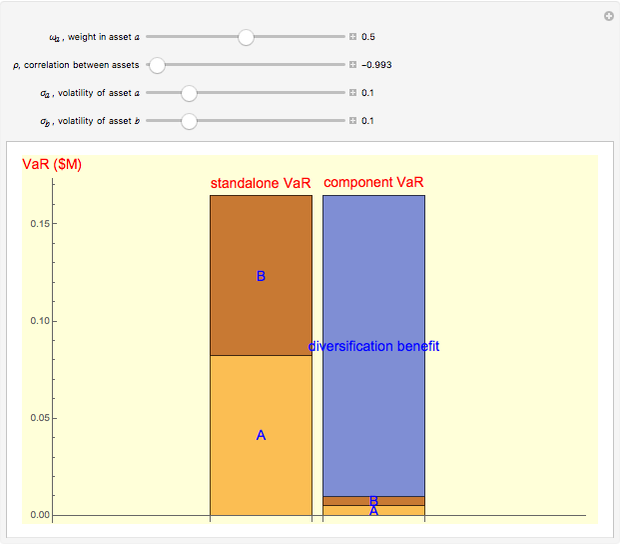

Snapshot 3: when assets are perfectly contrarian ( ), the diversification benefit is maximized

), the diversification benefit is maximized

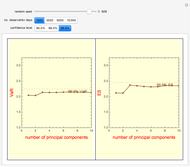

Snapshot 4: when assets are over concentrated ( or

or  ), the diversification benefit is reduced

), the diversification benefit is reduced

Snapshot 5: assets that are negatively correlated with other assets in the portfolio can serve as a natural hedge, since they contribute negatively to portfolio VaR (i.e. their component VaRs are negative)

Reference

[1] Kevin Dowd, Measuring Market Risk, 2nd ed., West Sussex, England: Wiley, 2005 pp. 271–274.

Permanent Citation