Simulating a Catastrophe Insurer

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

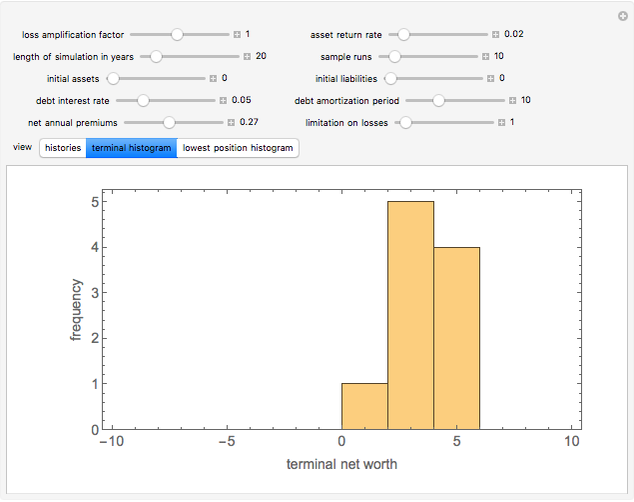

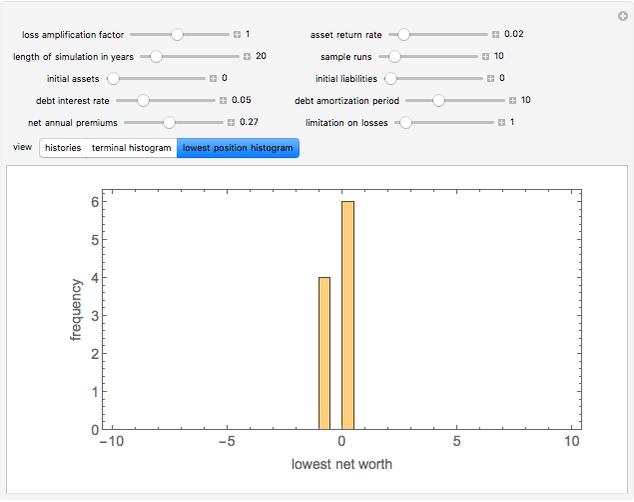

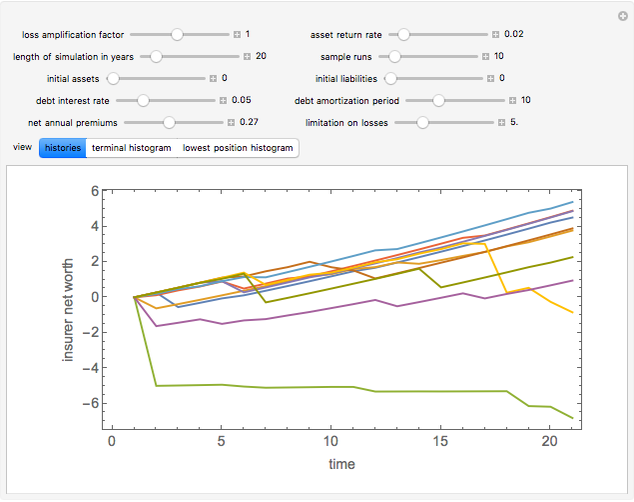

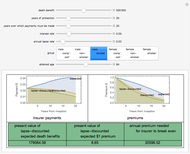

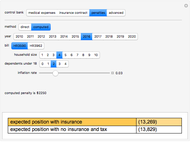

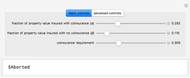

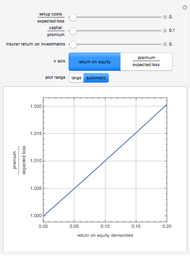

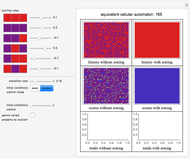

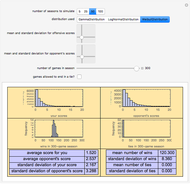

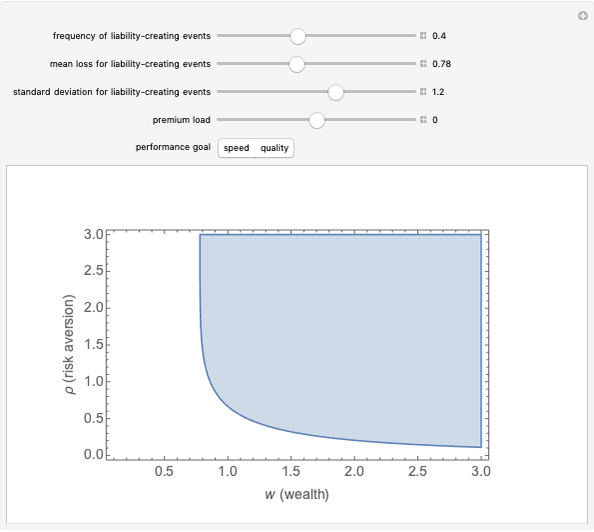

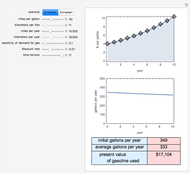

This Demonstration simulates the financial history of a catastrophe insurer. You select a variety of parameters that affect that financial history and the Demonstration responds with a graphic showing the annual net worth of the insurer for each of a user-chosen number of sample runs. You can also choose to display a histogram showing the distribution of the net worth of the insurer either at the end of the simulations or at its lowest annual value.

[more]

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

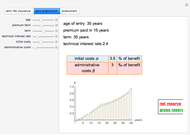

The data from which the event sets are calculated is based on the projected losses of the Texas Windstorm Insurance Association from hurricanes as of 2007.

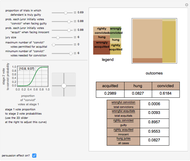

Snapshot 1: the distribution of the terminal net worth of the insurer using the default settings

Snapshot 2: the distribution of the lowest annual net worth of the insurer using the default settings

Snapshot 3: the financial history of the insurer if maximum losses are capped at 5 instead of the default value of 1

Snapshot 4: the financial history of the insurer if it has to borrow at 8% instead of the default value of 5%

Snapshot 5: the financial history of the insurer if losses are amplified by 50%

Snapshot 6: the financial history of the insurer if premiums are increased by about 50% over their default value

Snapshot 7: the financial history of the insurer using 50-year runs

Snapshot 8: the distribution of the lowest annual net worth of the insurer using 50-year runs

Permanent Citation

"Simulating a Catastrophe Insurer"

http://demonstrations.wolfram.com/SimulatingACatastropheInsurer/

Wolfram Demonstrations Project

Published: March 7 2011