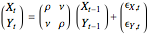

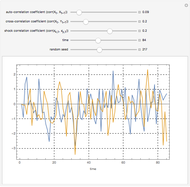

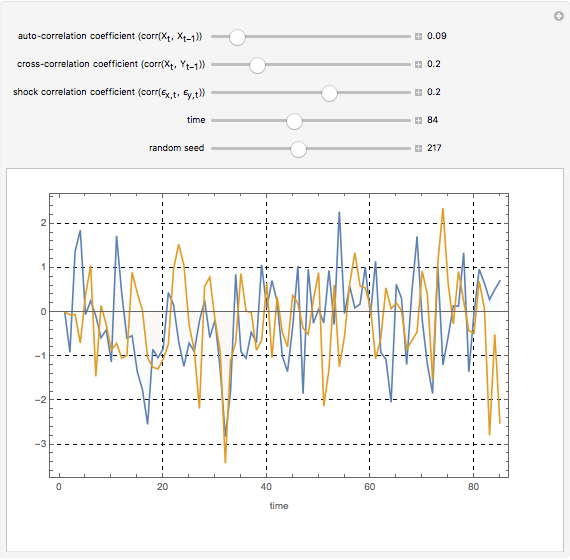

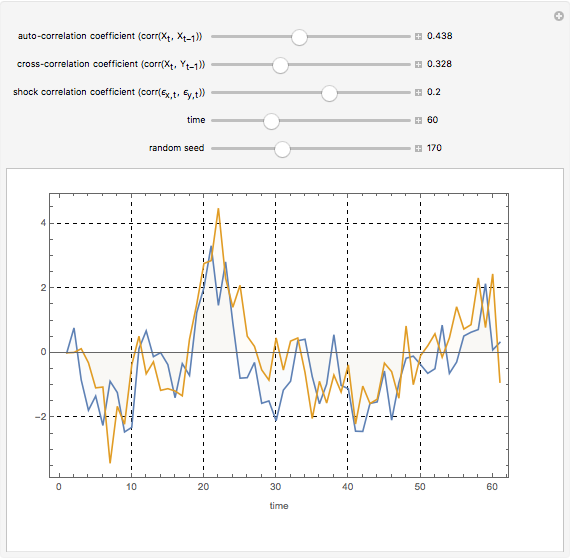

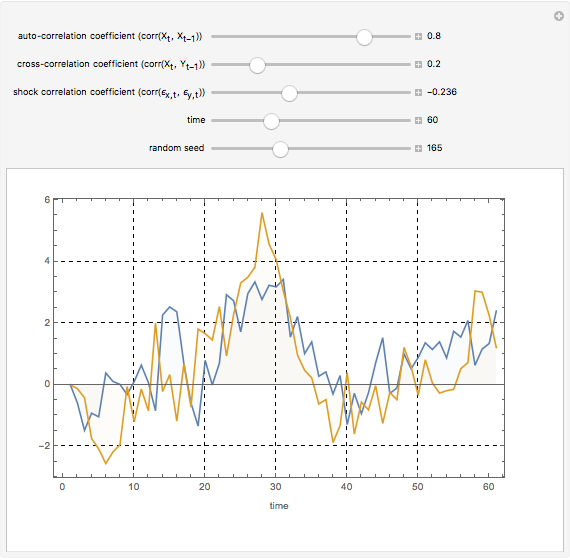

Bivariate First-Order Vector Autoregression Model with Correlated Random Shocks

Initializing live version

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

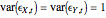

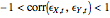

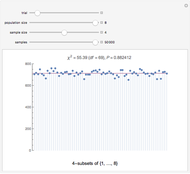

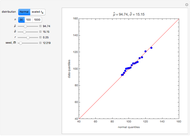

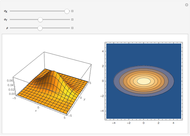

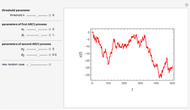

This Demonstration generates and visualizes a bivariate first-order vector autoregression (VAR) model with a symmetric coefficient matrix and correlated random shocks.

[more]

Contributed by: N. Baris Vardar (January 2013)

Paris School of Economics, Université Paris, 1 Panthéon Sorbonne

Open content licensed under CC BY-NC-SA