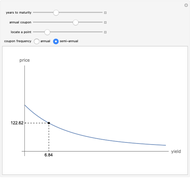

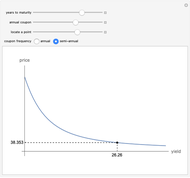

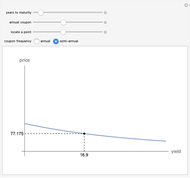

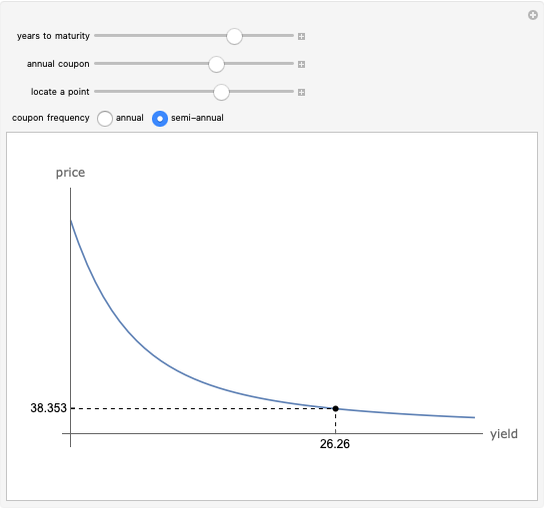

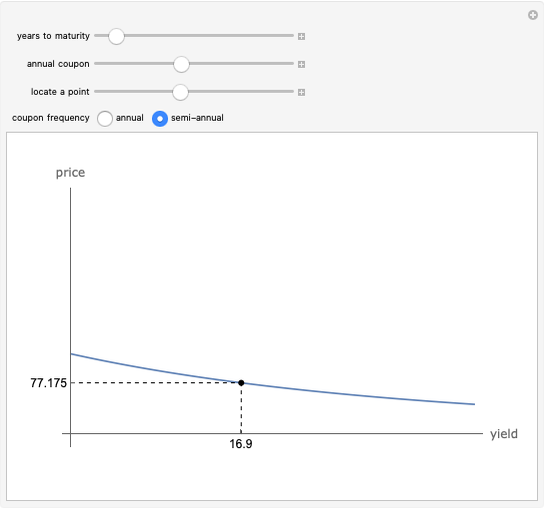

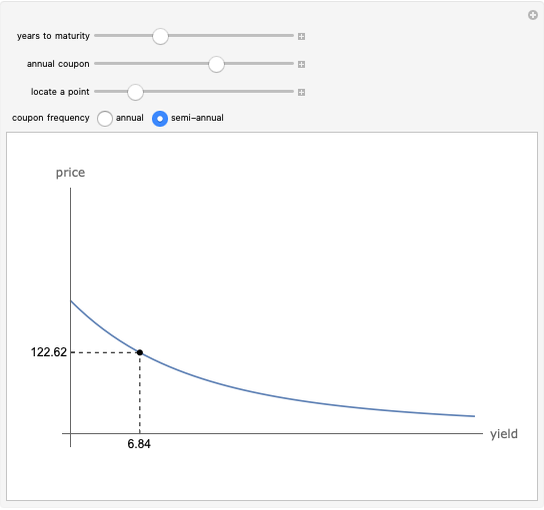

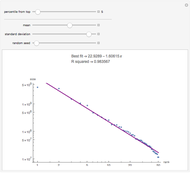

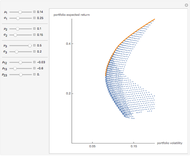

Price-Yield Curve

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

The price-yield curve relates the annual yield on a coupon bond to its price. Coupon payments are a fixed percentage of the face value of a bond and are typically paid semi-annually. At maturity, the holder of a bond receives the last coupon payment, in addition to the face value. The price is quoted as a percentage of the face value, so a price of 88.53 means that $1,000 of face value is priced at $885.30. The yield is quoted on an annual basis and is also a percentage.

Contributed by: Fiona Maclachlan (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Permanent Citation