Interest Rate Swap

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

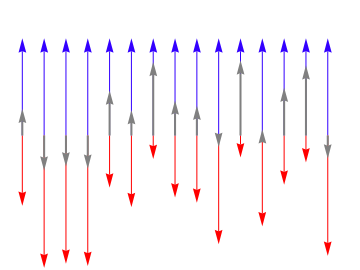

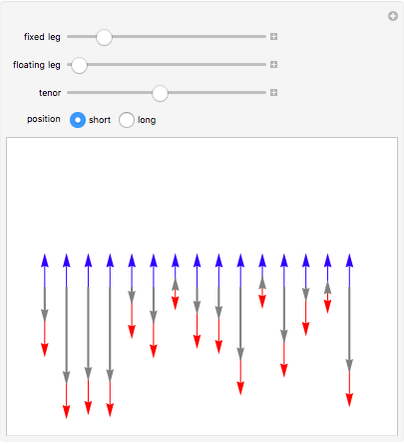

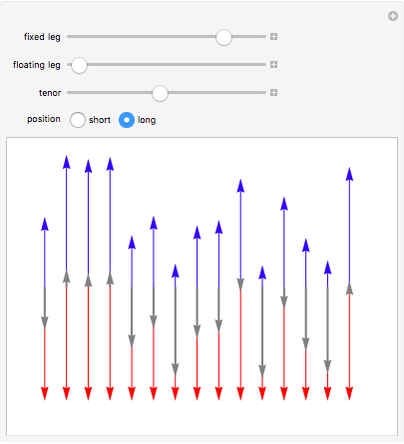

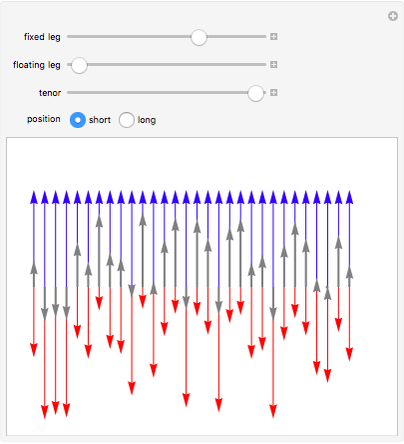

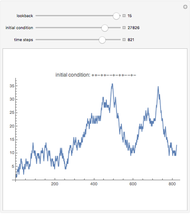

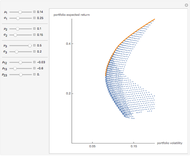

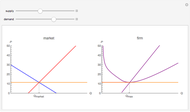

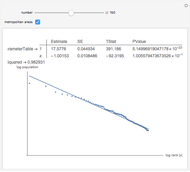

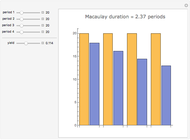

In a plain vanilla interest rate swap, the long side trades a series of fixed interest payments for a series of stochastic floating interest payments. The size of the payments is determined by the relevant interest rate times a notional principal. The upward pointing arrows represent positive cash flows (receipts), while the downward pointing arrows represent negative cash flows (payments). The net amount of the positive and negative cash flows, represented by the gray arrows, is the amount that changes hands in each period. Thus, if the fixed rate is greater than the floating rate in a given period, the long side makes a payment to the short side. The tenor of the swap is the length of time over which the payments are made. Payments are usually made semi-annually.

Contributed by: Fiona Maclachlan (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

detailSectionParagraphPermanent Citation

"Interest Rate Swap"

http://demonstrations.wolfram.com/InterestRateSwap/

Wolfram Demonstrations Project

Published: March 7 2011