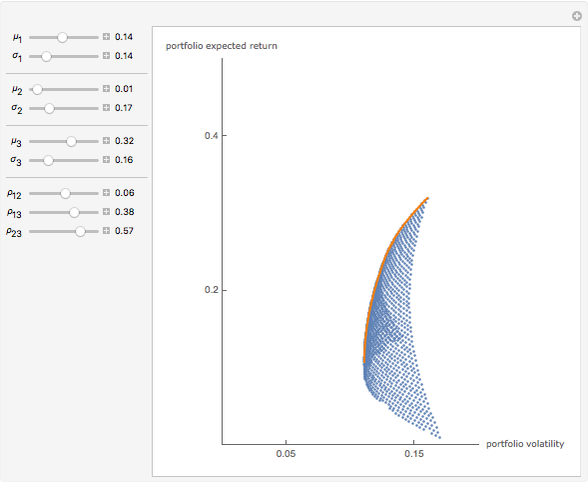

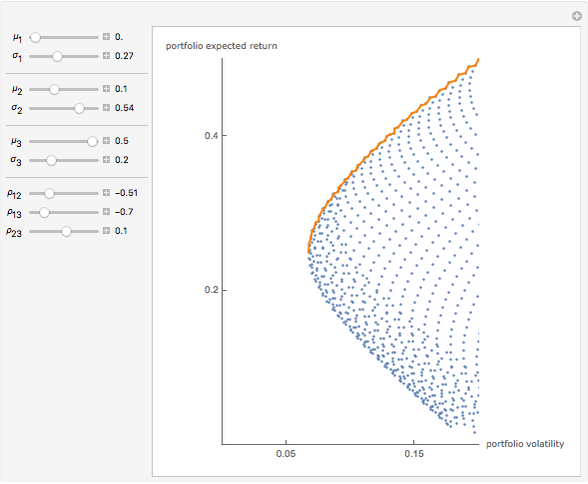

Three-Asset Efficient Frontier

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

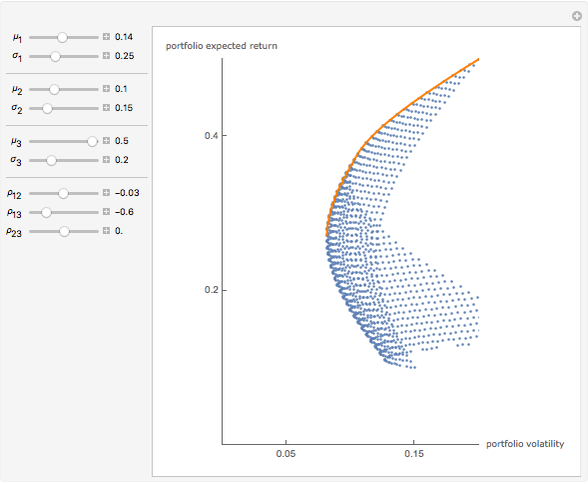

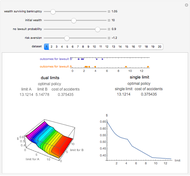

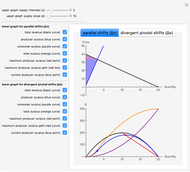

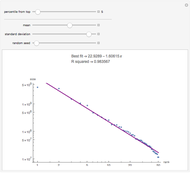

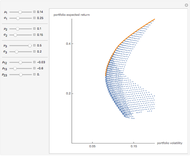

Consider three assets with expected returns  and standard deviations of returns

and standard deviations of returns  ; i = 1, 2, 3. Let the correlation coefficient between asset i and asset j be

; i = 1, 2, 3. Let the correlation coefficient between asset i and asset j be  . Each blue point represents the expected return and the standard deviation of return of a portfolio created by a specific combination of the three assets. The orange line, known as the efficient frontier, sketches out the portfolio combinations such that for any expected return, the volatility (or standard deviation of return) is the lowest; and for any level of volatility, the expected return is the highest.

. Each blue point represents the expected return and the standard deviation of return of a portfolio created by a specific combination of the three assets. The orange line, known as the efficient frontier, sketches out the portfolio combinations such that for any expected return, the volatility (or standard deviation of return) is the lowest; and for any level of volatility, the expected return is the highest.

Contributed by: Fiona Maclachlan (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

detailSectionParagraphPermanent Citation

"Three-Asset Efficient Frontier"

http://demonstrations.wolfram.com/ThreeAssetEfficientFrontier/

Wolfram Demonstrations Project

Published: March 7 2011