Dissolving Partnerships

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

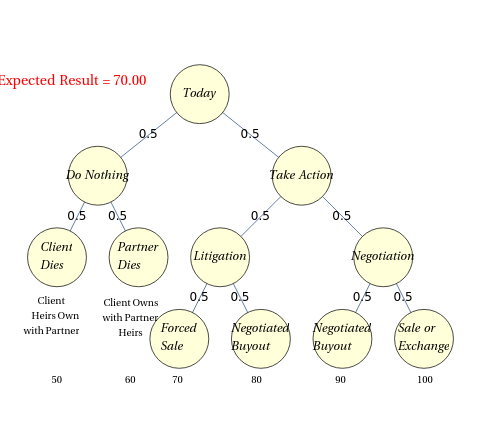

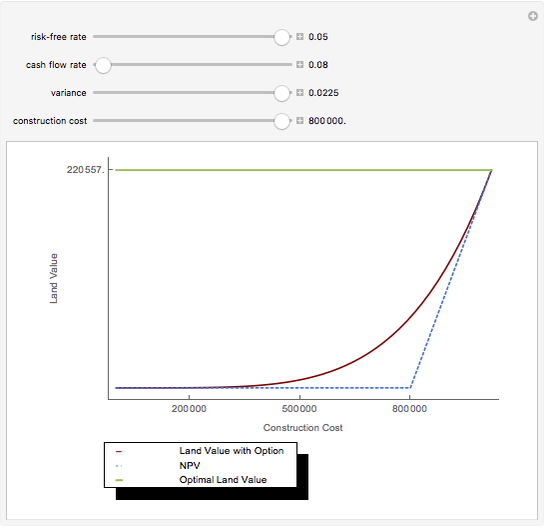

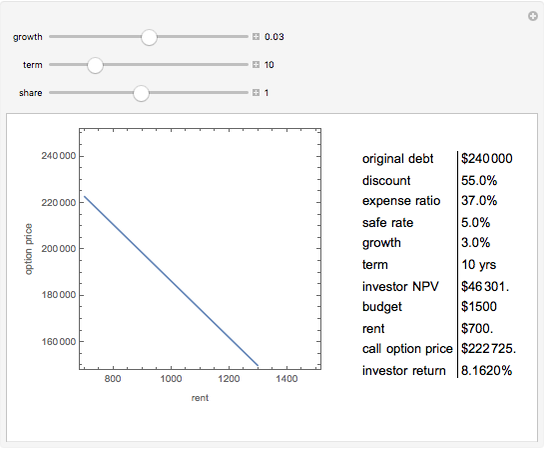

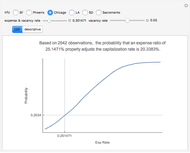

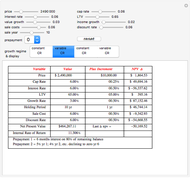

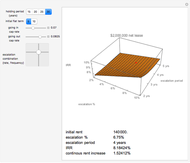

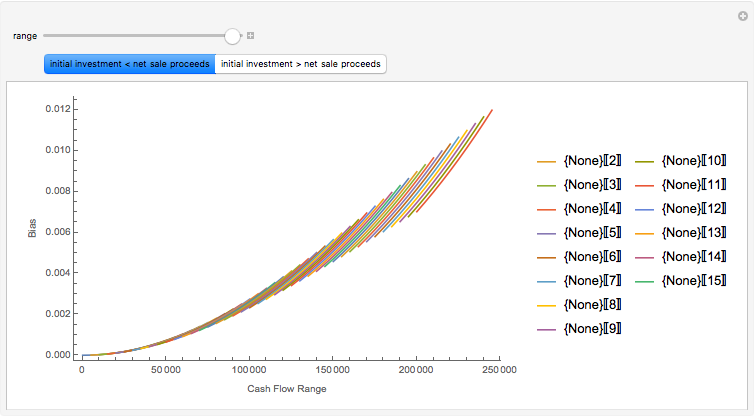

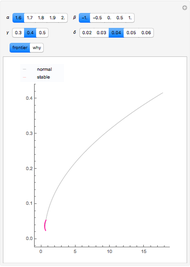

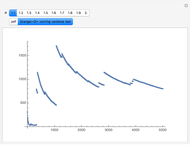

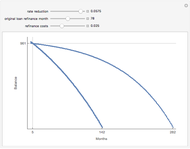

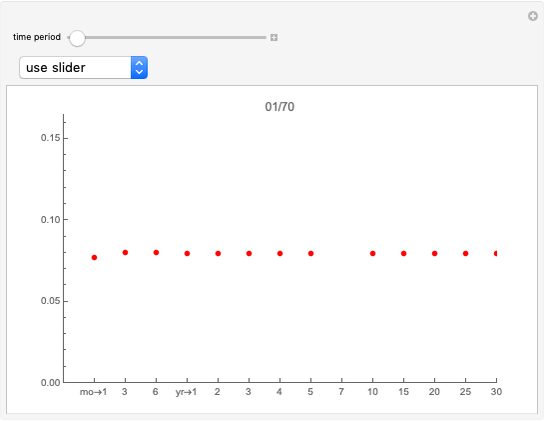

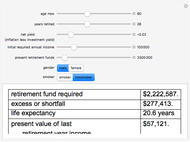

Modifying ownership of assets not divisible in kind, such as real estate or a business, can be a problem. Disputes arise in partnerships composed of heirs of one founder and the surviving founders. Similar to divorce, litigation that often results is expensive and inefficient. Choosing between a sale to a third party (yielding cash proceeds that can be divided) and a buyout of one party by another introduces complexity and trust issues. This Demonstration uses a decision tree to assign payoffs and probabilities to the circumstance where two founding partners discuss what happens when one dies.

[more]

Contributed by: Roger J. Brown (September 2016)

Open content licensed under CC BY-NC-SA

Snapshots

Details

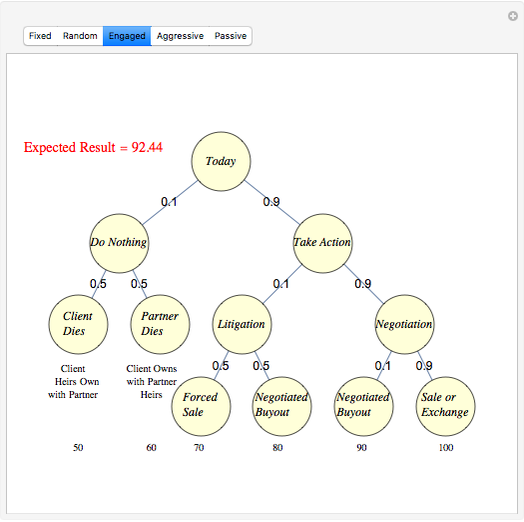

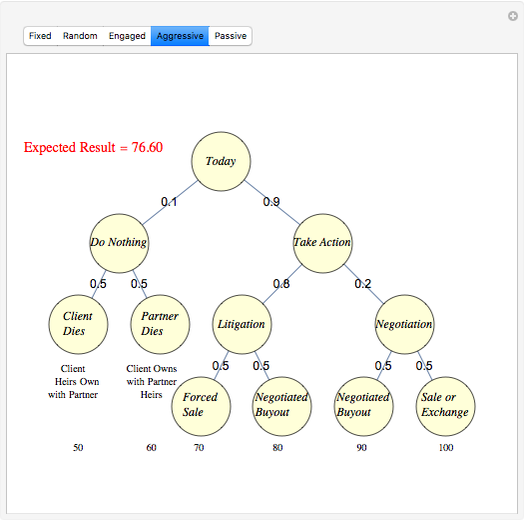

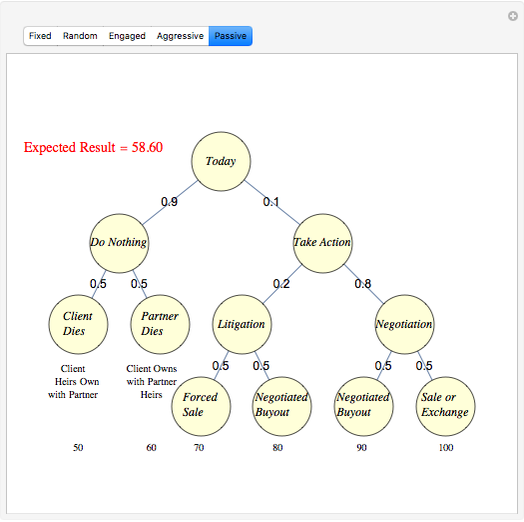

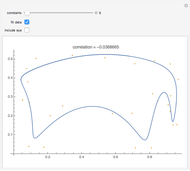

Behavioral science has much to say about the right combination of advocacy, agreement, domination and submission in human relationships. The three mindsets, Engaged, Aggressive and Passive, suggest that this mix might be quantified. Setting payoffs high-to-low as one goes right to left along the outcomes at the bottom tilts the story toward "Engaged" as the optimal among three, admittedly narrow, possible positions. Assume that both parties are the same age and health so that death is a 50-50 proposition. Likewise, assume that courtroom endings are essentially the toss of a fair coin. Setting the probabilities such that negotiation and market solutions are favored leads to the highest expected value when one is engaged, neither aggressive nor passive. The permutations are endless. Decision trees offer an analytic methodology to introduce rationality into what might otherwise disintegrate into an emotionally charged situation.

Permanent Citation

"Dissolving Partnerships"

http://demonstrations.wolfram.com/DissolvingPartnerships/

Wolfram Demonstrations Project

Published: September 1 2016