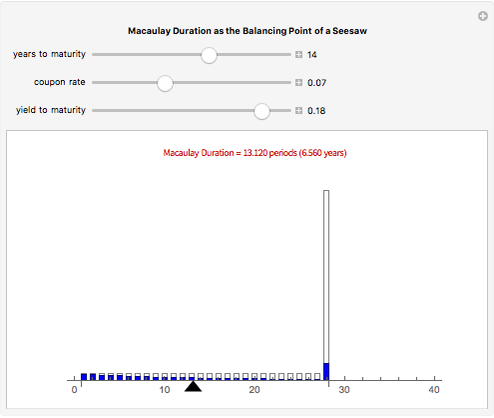

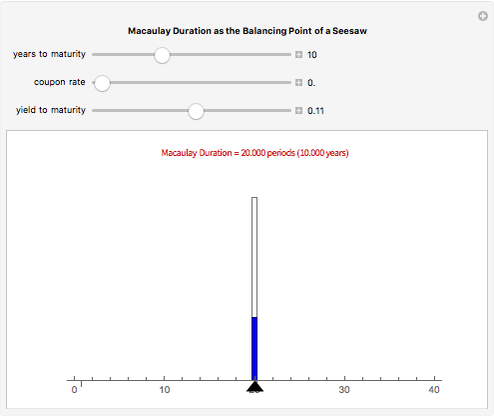

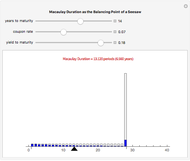

Macaulay Duration as the Balancing Point of a Seesaw

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

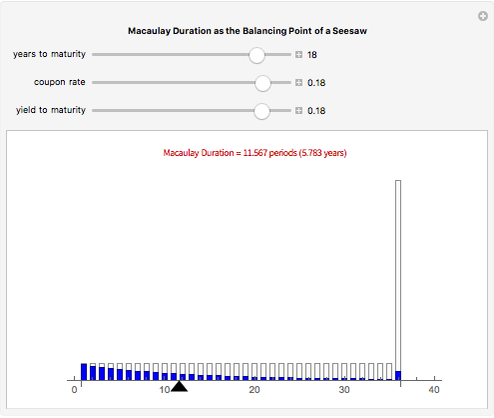

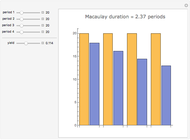

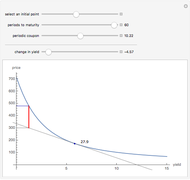

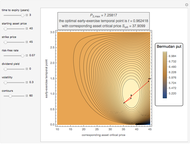

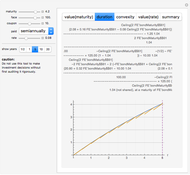

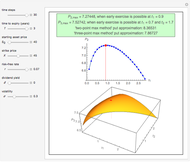

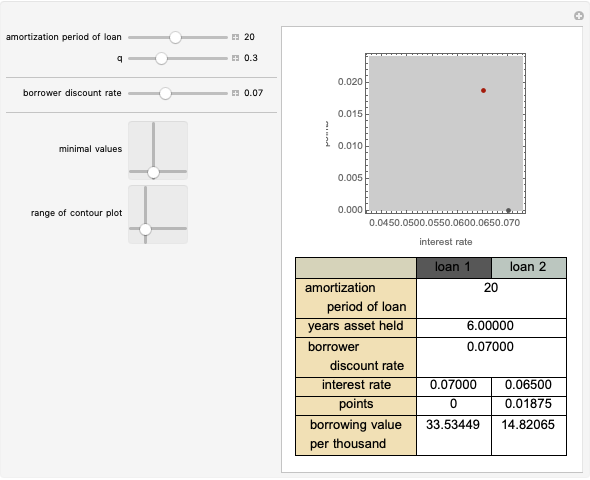

Macaulay's duration is a weighted average of the time until the cash flows are received, where the weights are the present value of the cash flows as a percentage of the security's price. This visualization helps students to understand why increasing the yield and/or coupon rate decreases the duration, while increasing the term to maturity increases the duration (and vice-versa). Imagine a seesaw with several (one for each cash flow) buckets that are the height of the nominal cash flows. The buckets are filled with water to a level that represents the present value of the cash flows. Duration is the location of the fulcrum that results in a balanced seesaw.

Contributed by: Timothy R. Mayes (January 2012)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The author has found this visualization technique to be useful in teaching the concept of duration. It was inspired by [1].

Reference

[1] R.W. Kopprasch, "Understanding Duration and Volatility," The Handbook of Fixed Income Securities (F. J. Fabozzi and I. M. Pollack, eds.), Homewood, IL: Dow Jones–Irwin, 1987 pp. 86–120.

Permanent Citation

"Macaulay Duration as the Balancing Point of a Seesaw"

http://demonstrations.wolfram.com/MacaulayDurationAsTheBalancingPointOfASeesaw/

Wolfram Demonstrations Project

Published: January 16 2012