Premium Assistance Calculator for HR 3590 and HR 3962

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

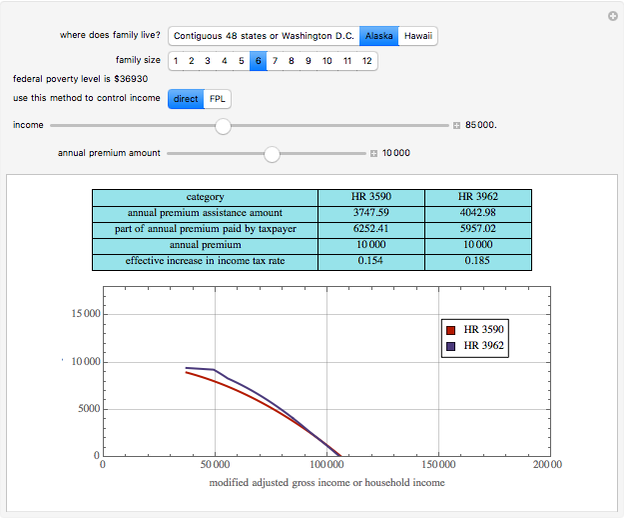

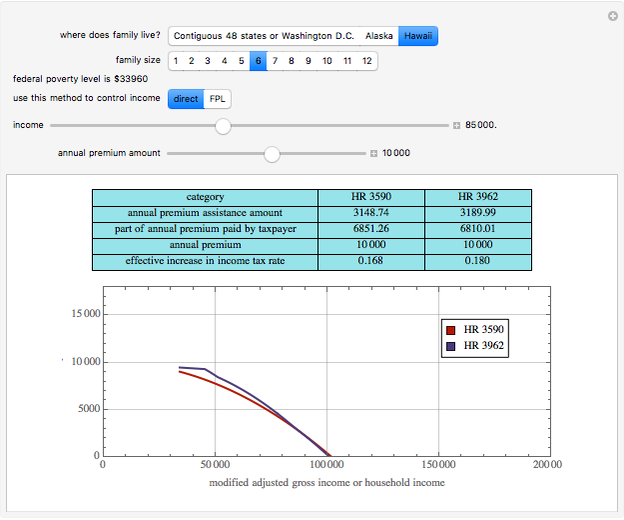

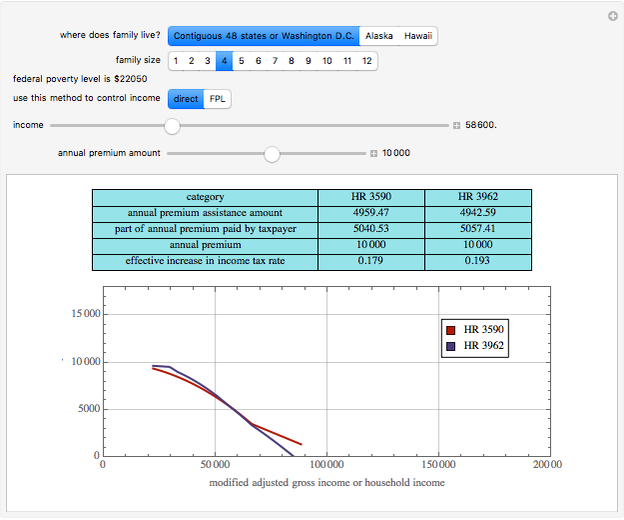

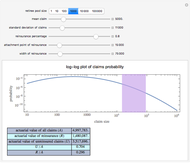

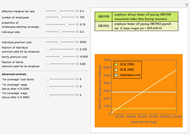

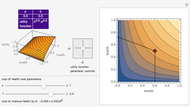

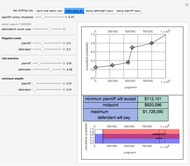

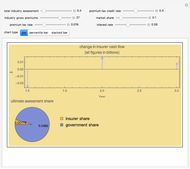

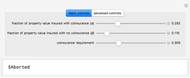

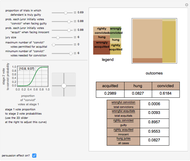

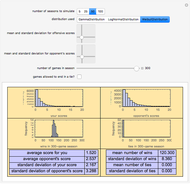

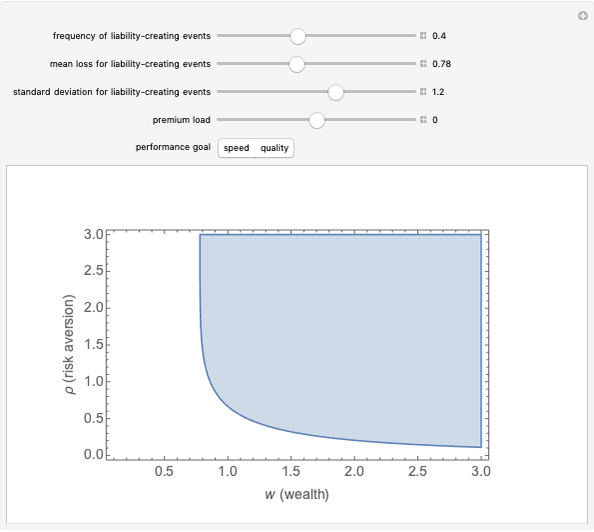

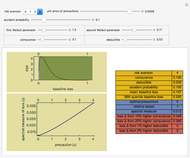

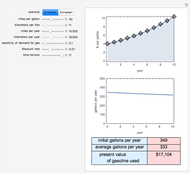

Health care reform bills pending in the United States Congress in 2009 generally penalize individuals in some fashion for failing to acquire health insurance coverage but subsidize individuals who purchase insurance if their income is within certain bounds. This Demonstration explores the extent of the premium subsidy provided under the two leading reform contenders, HR 3590, the Patient Protection and Affordable Care Act (Senate), and HR 3962, the Affordable Health Care for America Act (House of Representatives). These bills generally make the amount of the subsidy a function of one's income relative to the "federal poverty level". You select where the person lives as well as the size of the family. These selections determine the applicable federal poverty level. You then set the family's income using either a direct method or one in which income is a multiple of the applicable federal poverty level. You also determine the annual amount the law uses as a basis for computing the subsidy. This amount will reflect conditions in the post-reform health insurance market.

[more]

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Although they arrive there by different routes, the bills define income in an essentially similar way. HR 3590 relies on the concept of "household income", which is defined in section 1501(b) of the bill as essentially the sum of the "modified adjusted gross incomes" of the beneficiaries of the insurance policy. HR 3962 relies directly on the concept of "modified adjusted gross income" but then in section 342(a)(2) specifies that members of a family be lumped together for purposes of computing the premium credit.

The provisions underlying this Demonstration may be found in section 1401 of HR 3590 and section 343 of HR 3962. Both of these provisions insert section 36B into the Internal Revenue Code.

The federal poverty level is calculated using data contained in the Federal Register and may be found online at http://aspe.hhs.gov/poverty/09fedreg.shtml

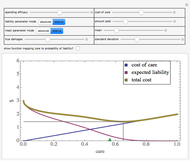

This Demonstration does not compute subsidies for "out-of-pocket" expenses that are provided by section 344 of HR 3590 and section 1402 of the Act. These subsidies further increase the effective marginal tax rate on income created by health care reform.

Permanent Citation

"Premium Assistance Calculator for HR 3590 and HR 3962"

http://demonstrations.wolfram.com/PremiumAssistanceCalculatorForHR3590AndHR3962/

Wolfram Demonstrations Project

Published: March 7 2011