Retiree Stop-Loss Reinsurance

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

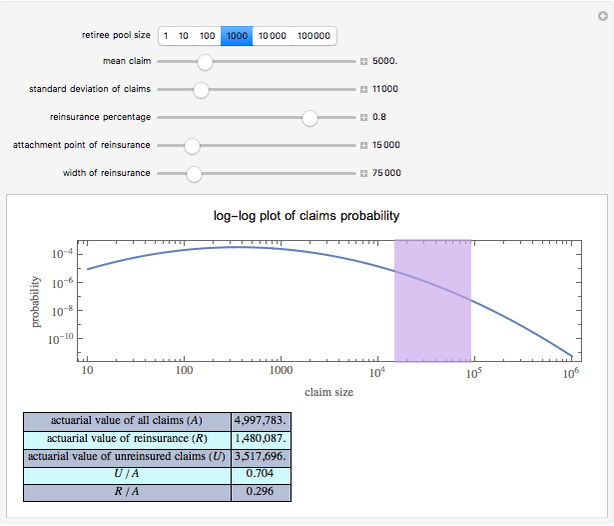

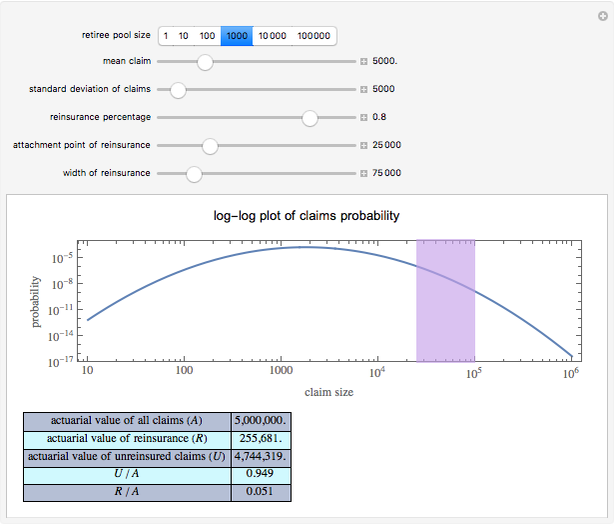

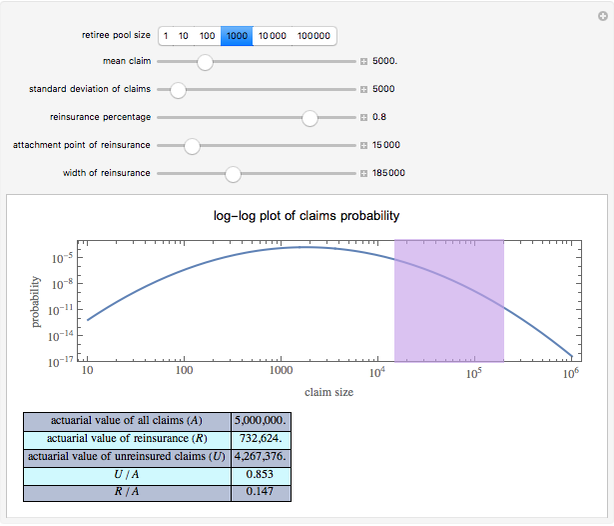

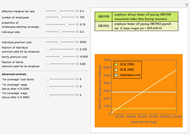

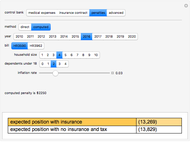

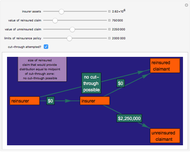

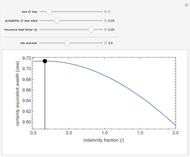

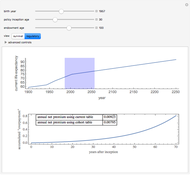

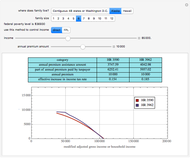

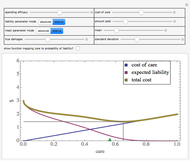

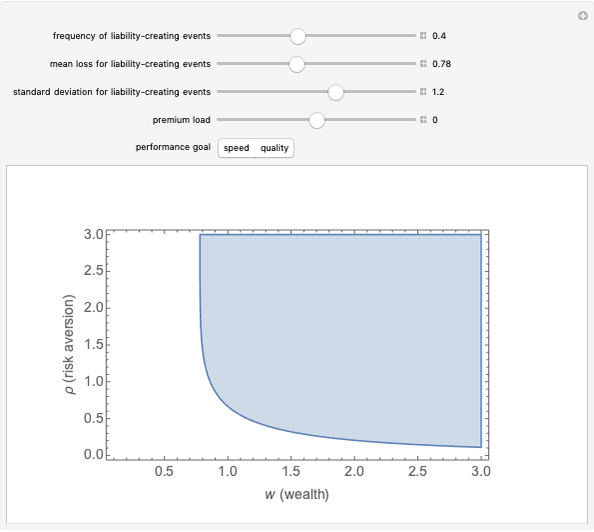

Healthcare reform bills pending in the United States Congress in 2009 create incentives for employers to continue providing certain retirees with health insurance. They do so by providing free partial reinsurance for annual claims within a certain band. This Demonstration explores the value of the reinsurance subsidy provided under the two leading reform contenders, H.R.3590, the Patient Protection and Affordable Care Act (Senate), and H.R.3962, the Affordable Health Care for America Act (House of Representatives).

[more]

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

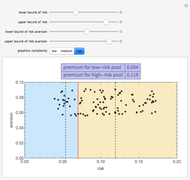

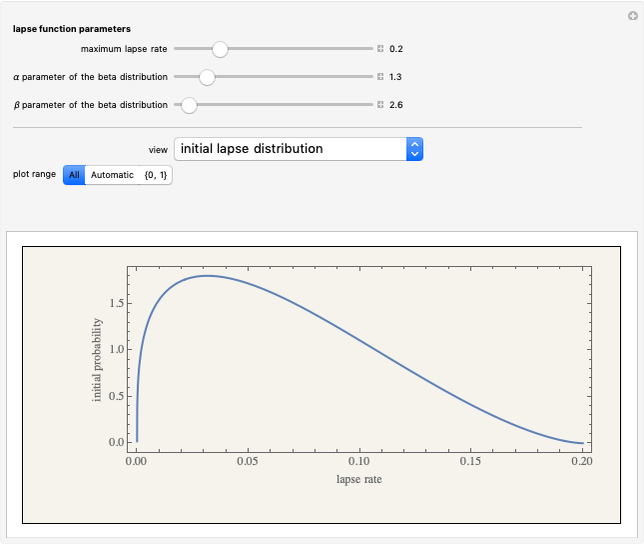

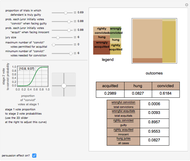

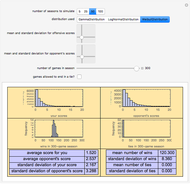

Snapshot 1: changing the standard deviation of annual claims can have a significant effect on the value of the reinsurance even when the mean value of the claims is preserved

Snapshot 2: increasing the attachment point can have a significant effect on the value of the reinsurance

Snapshot 3: increasing the maximum size claim for which reinsurance is provided typically does not have a large effect on the value of the reinsurance

Reinsurance subsidies are further described in section 111 of H.R.3962 and section 1102 of H.R.3590.

There is respectable evidence that health insurance claims can be plausibly modeled as draws from a lognormal distribution. G. W. de Wit and W. M. Kastelijn, "An Analysis of Claim Experience in Private Health Insurance to Establish a Relation between Deductibles and Premium Rebates," ASTIN Bulletin, 9, 1977 pp. 257–266.

Permanent Citation

"Retiree Stop-Loss Reinsurance"

http://demonstrations.wolfram.com/RetireeStopLossReinsurance/

Wolfram Demonstrations Project

Published: March 7 2011