Value at Risk

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

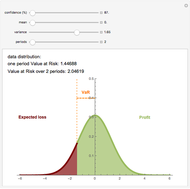

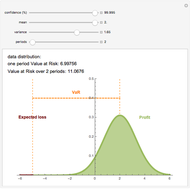

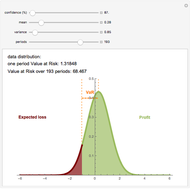

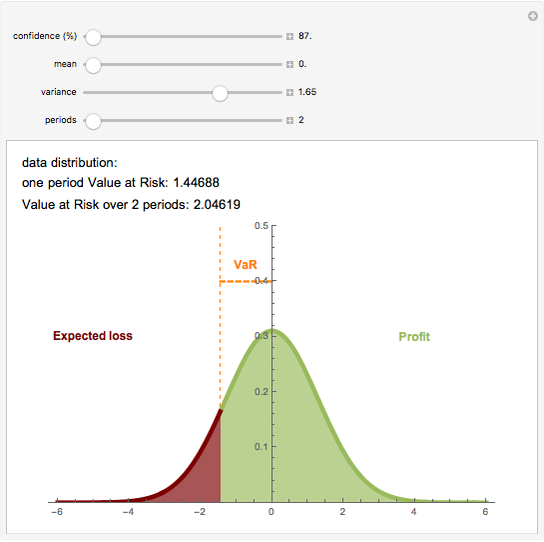

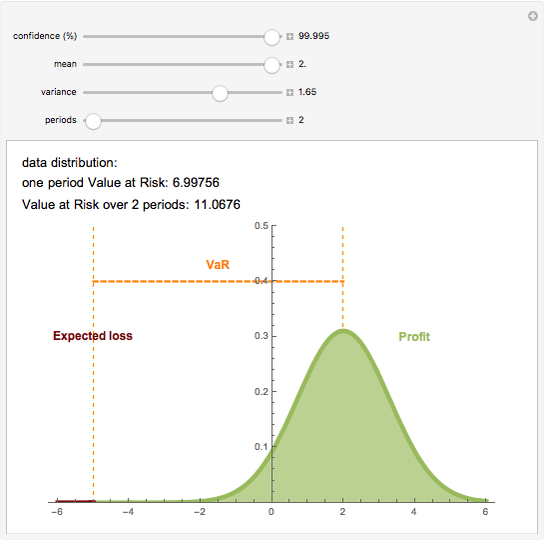

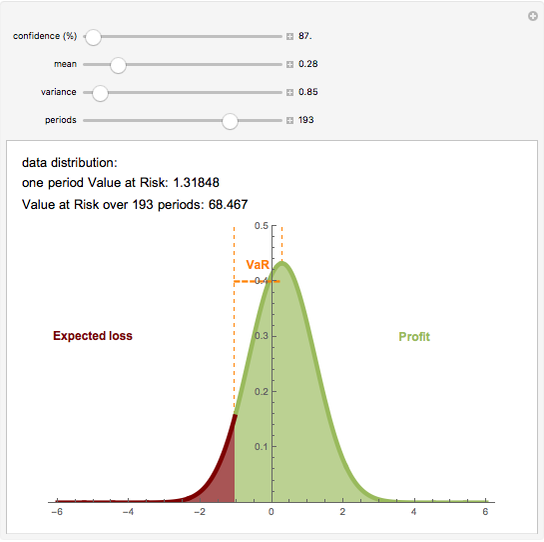

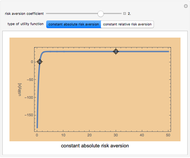

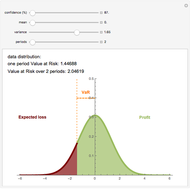

Value at Risk (VaR) and volatility are the most commonly used risk measurements. VaR is easy to calculate and can be used in many fields. VaR is defined as the sum of the data mean and the product of data volatility and an appropriate quantile of  distribution. This quantile indicates the confidence level of the result. This interpretation of VaR assumes that the data is normally distributed; however the calculation works in any setting.

distribution. This quantile indicates the confidence level of the result. This interpretation of VaR assumes that the data is normally distributed; however the calculation works in any setting.

Contributed by: Gergely Nagy (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Interpretation of VaR

Suppose the VaR over a one-day holding period is 1000 (the VaR is expressed as an absolute number amount) at a confidence level of 99%. That means that 99% of the time (i.e., 99 out of 100 trading days), a maximum loss of 1000 is expected once and the second largest loss in 100 days is expected to be no more than 1000. For the worst 1% of days the minimum loss of 1000 is expected.

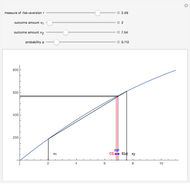

The VaR for a  -long period (e.g.

-long period (e.g.  days) is calculated as the product of one period VaR (with mean zero) and

days) is calculated as the product of one period VaR (with mean zero) and  , where

, where  is the data mean.

is the data mean.

Permanent Citation