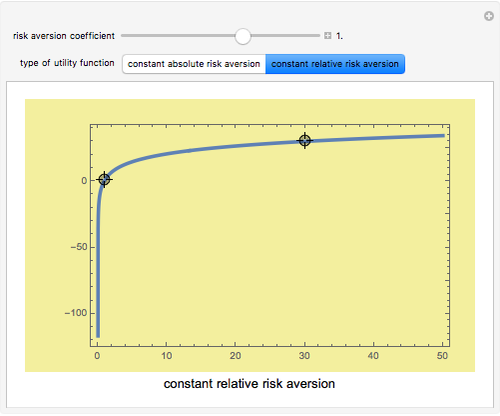

Constant Risk Aversion Utility Functions

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

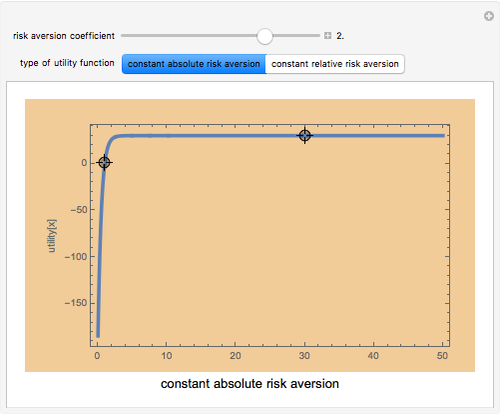

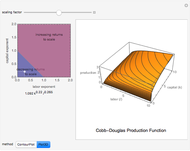

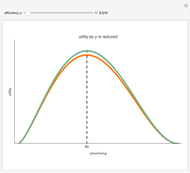

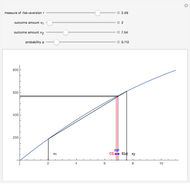

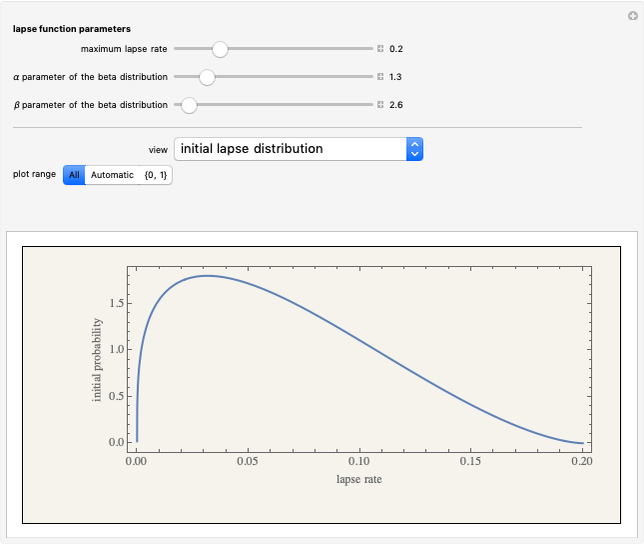

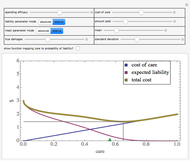

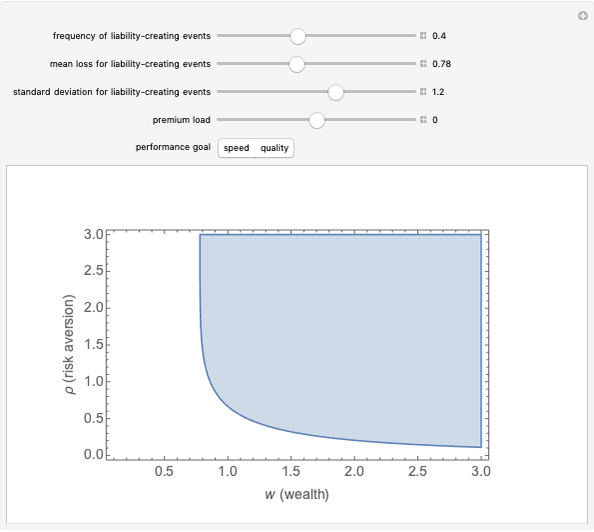

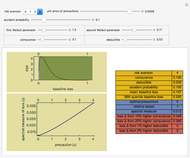

Utility functions are said to exhibit constant risk aversion under the Arrow–Pratt measure if they satisfy a secondâ€Âorder differential equation. You can set a risk aversion coefficient—the higher it is, the more risk averse—as well as the values at two points along the curve; this Demonstration plots the resulting utility function. You can choose between constant absolute risk aversion and constant relative risk aversion. The class of utility functions shown in this Demonstration are frequently used in economic analyses of risk, including finance and insurance.

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Although it appears that the locators are constrained to stay along the original curve, this is not the case: the locators are unconstrained. The fact that the curve does not change its shape is the result of constant risk aversion and the use of the  option.

option.

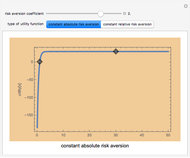

Snapshot 1: a high level of constant risk aversion results in a rapid flattening of the utility function

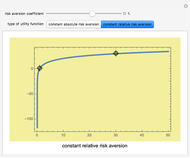

Snapshot 2: a logarithmic utility function results when constant relative aversion is set to one

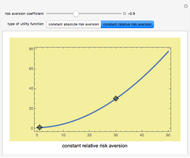

Snapshot 3: a utility function reflecting negative risk aversion

Permanent Citation

"Constant Risk Aversion Utility Functions"

http://demonstrations.wolfram.com/ConstantRiskAversionUtilityFunctions/

Wolfram Demonstrations Project

Published: March 7 2011