Estimating Conditional Expectations with Monte Carlo Simulation and Least Squares Regression

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

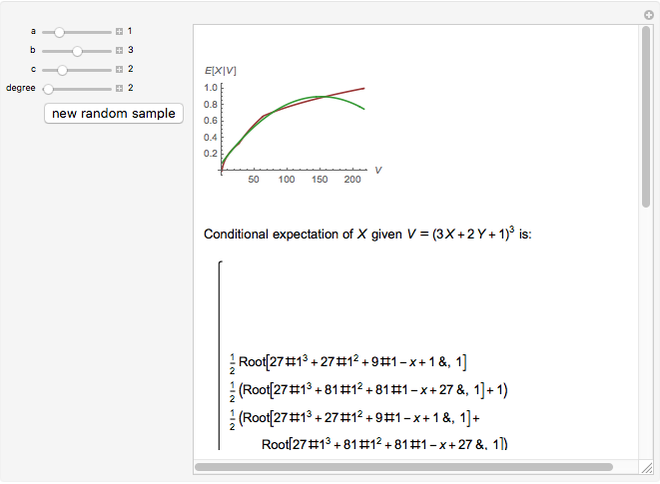

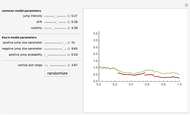

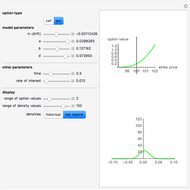

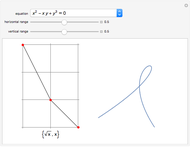

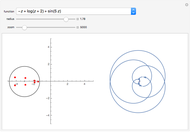

In this Demonstration we consider three random variables,  and

and  , which are uniformly distributed on the interval [0,1] and

, which are uniformly distributed on the interval [0,1] and  , where

, where  ,

,  , and

, and  are (user-specified) non-negative integers. The purpose is to compute the conditional expectation

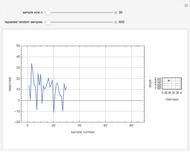

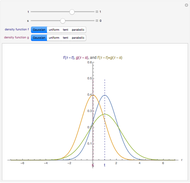

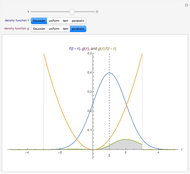

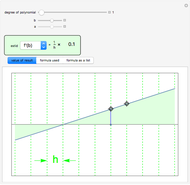

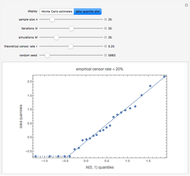

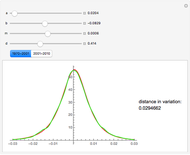

are (user-specified) non-negative integers. The purpose is to compute the conditional expectation  symbolically and by polynomial regression on data obtained from randomly generated sequences (

symbolically and by polynomial regression on data obtained from randomly generated sequences ( ,

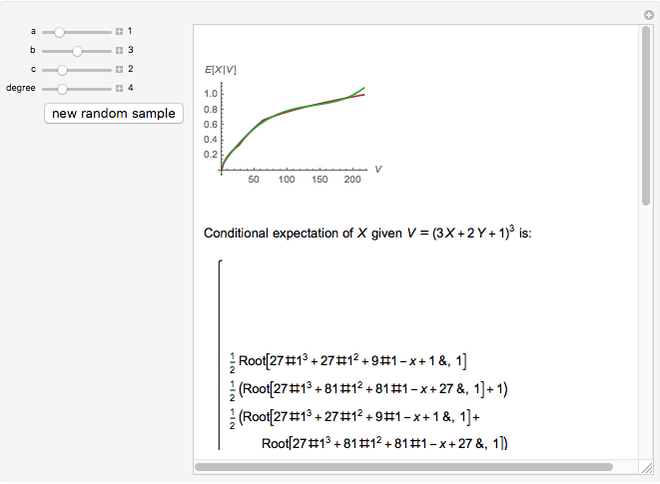

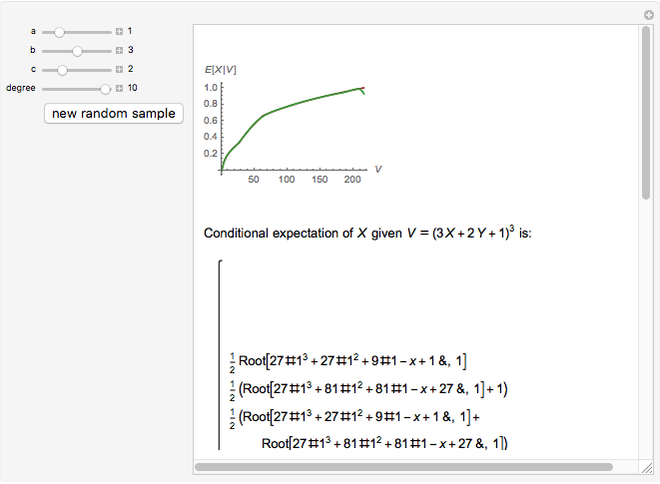

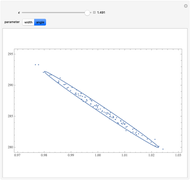

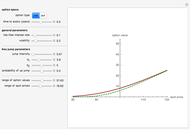

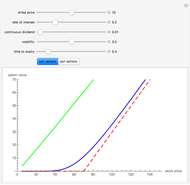

,  ). The display shows the graphs of the conditional expectation function (red) and an estimate (green), explicit formulas giving the exact value of the conditional expectation and its polynomial estimate, and the

). The display shows the graphs of the conditional expectation function (red) and an estimate (green), explicit formulas giving the exact value of the conditional expectation and its polynomial estimate, and the  (square-integrable) error of the estimate, obtained by integrating the square of the difference between the true conditional expectation and the estimated one.

(square-integrable) error of the estimate, obtained by integrating the square of the difference between the true conditional expectation and the estimated one.

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

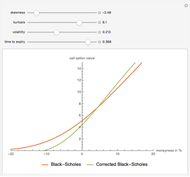

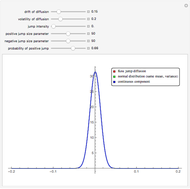

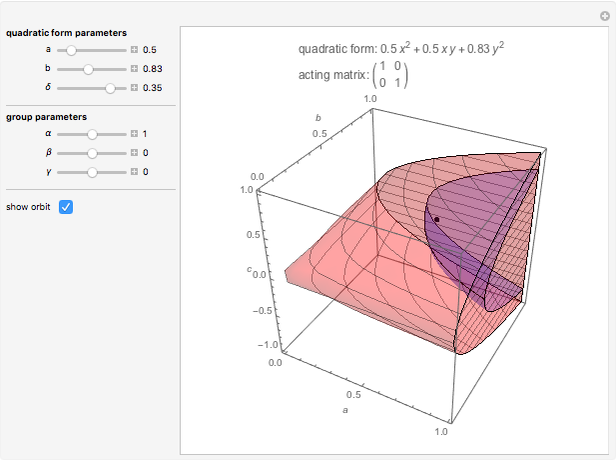

Many problems in science, economics, finance, and so on require us to compute conditional expectations. If  and

and  are

are  random variables with nice density, then the conditional expectation

random variables with nice density, then the conditional expectation  can be defined as the orthogonal projection of

can be defined as the orthogonal projection of  on the linear subspace space of all functions of

on the linear subspace space of all functions of  in Hilbert space of all

in Hilbert space of all  (square-integrable) random variables. Thus the conditional expectation can be though of as a function of

(square-integrable) random variables. Thus the conditional expectation can be though of as a function of  with the minimum

with the minimum  distance from

distance from  . This justifies the well‐known Monte Carlo method of approximating

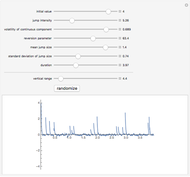

. This justifies the well‐known Monte Carlo method of approximating  by generating a sample of (

by generating a sample of ( ,

,  ) pairs and regressing

) pairs and regressing  on

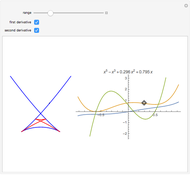

on  by solving a least-squares problem for a polynomial of some chosen degree. In this Demonstration we start with two independent random variables

by solving a least-squares problem for a polynomial of some chosen degree. In this Demonstration we start with two independent random variables  and

and  with uniform distribution on [0,1]. As

with uniform distribution on [0,1]. As  we take a random variable

we take a random variable  for some positive integers

for some positive integers  ,

,  , and

, and  . In this case Mathematica is able to compute the exact formula for

. In this case Mathematica is able to compute the exact formula for  , so that we can assess the accuracy of the estimate by computing the

, so that we can assess the accuracy of the estimate by computing the  norm using numerical integration.

norm using numerical integration.

The idea of this Demonstration is based on an example in chapter 11.6 of

K. L. Judd, Numerical Methods in Economics, Cambridge, MA: The MIT Press, 1998.

Permanent Citation