The Return Distribution of the Variance Gamma Process

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

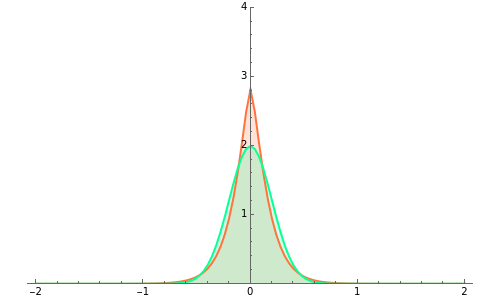

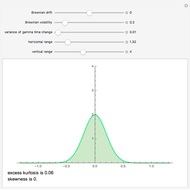

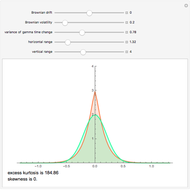

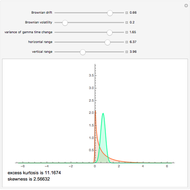

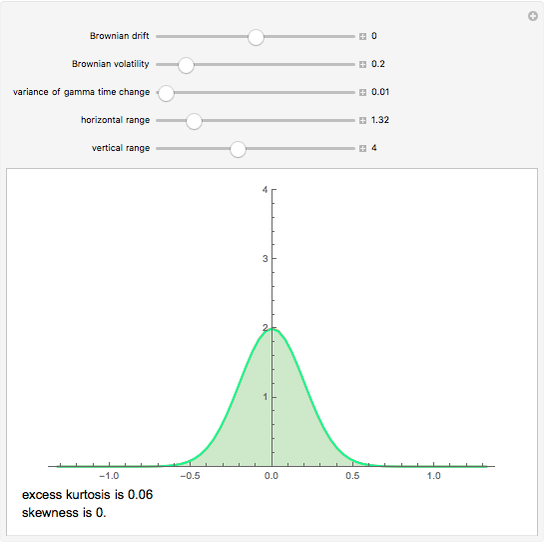

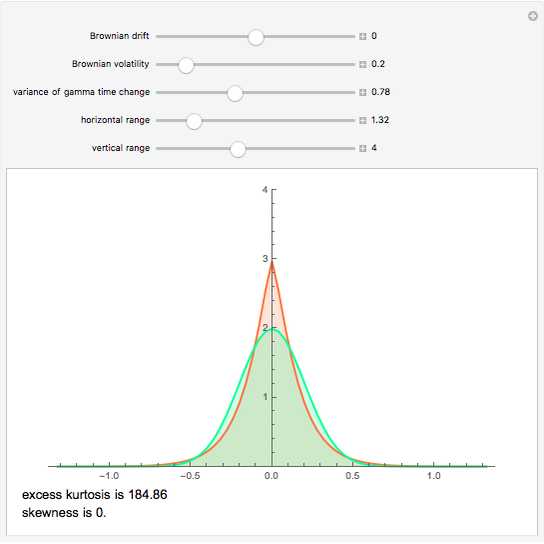

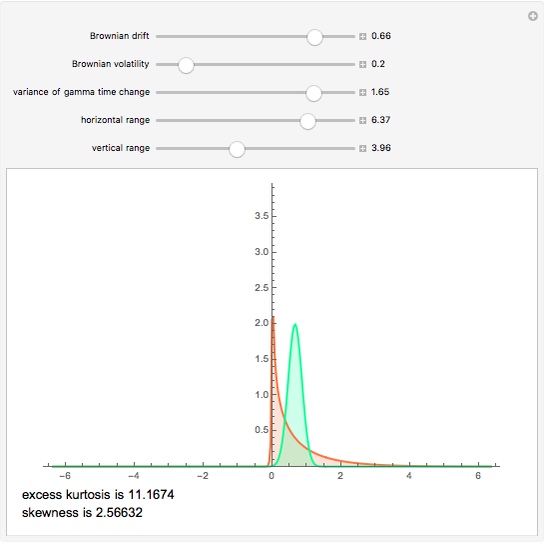

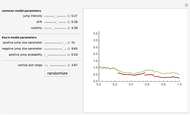

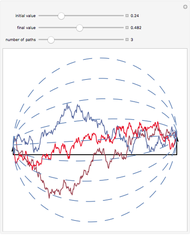

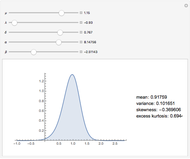

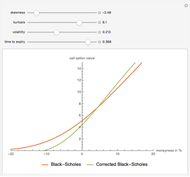

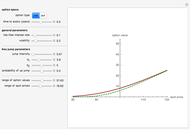

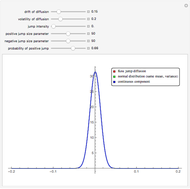

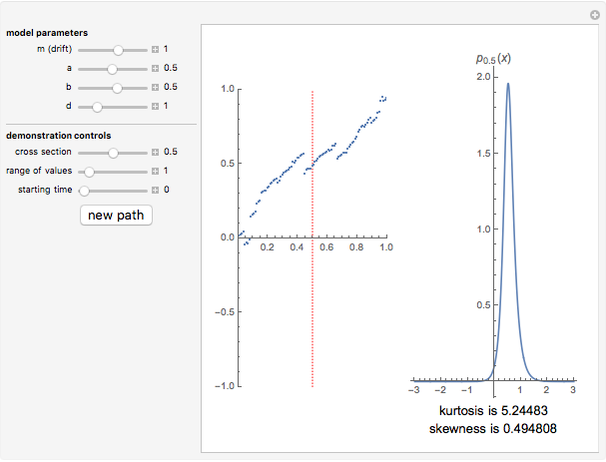

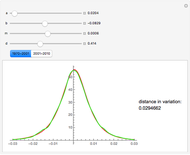

This Demonstration shows the graphs of the density function of the unit period of a variance gamma process (red) and a Brownian motion process with drift (green). The variance gamma process is a three-parameter stochastic process that generalizes Brownian motion and was developed as a model for the dynamics of log stock prices. The process can be constructed as a Brownian motion with drift evaluated at random times given by a gamma process. The process thus has three parameters: the drift and volatility of the Brownian motion and the volatility of the gamma time change. Together they make it possible to control the skewness and kurtosis of the return distribution, which makes it possible to correct for the well-known biases of the Black–Scholes model (based on Brownian motion).

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The variance gamma process is a high-activity pure-jump Lévy process—that is, unlike for example the Merton Jump Diffusion Process—it does not contain a continuous martingale component. It has an infinite number of jumps in any finite interval of time, but only finitely many of them are larger than any specified positive real number. The exponential variance gamma model has been shown to perform better in modelling stock returns than the Black–Scholes model.

[1] D. B. Madan and E. Seneta, "The Variance Gamma Process (V.G.) Model for Share Market Returns," Journal of Business, 63(4), 1990 pp. 511–524.

[2] D. B. Madan, P. P. Carr, and E. C. Chang, "The Variance Gamma Model and Option Pricing," European Finance Review, 2(1), 1998 pp. 79–105.

[3] K. Lam, E. Chang, and M. C. Lee, "An Empirical Test of the Variance Gamma Option Pricing Model," Pacific Basin Finance Journal, 10(3), 2002 pp. 267–285.

Permanent Citation

"The Return Distribution of the Variance Gamma Process"

http://demonstrations.wolfram.com/TheReturnDistributionOfTheVarianceGammaProcess/

Wolfram Demonstrations Project

Published: March 7 2011