The Refinance Decision

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

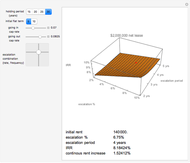

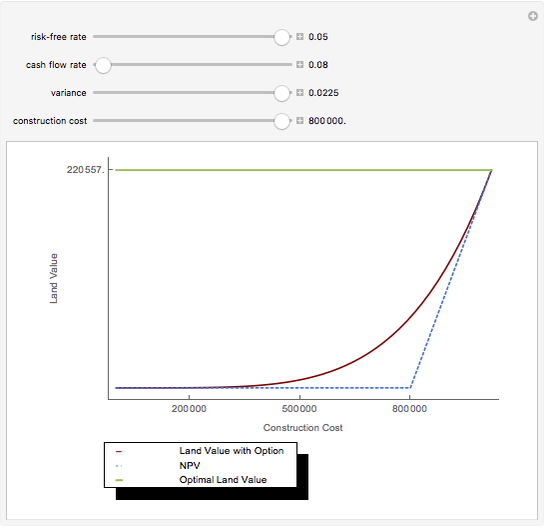

According to real estate folklore, refinancing is recommended when the new rate is at least two percent lower than the old rate. This maxim is driven by average refinance costs and some reference to how long one will keep the loan. In fact, the refinance decision turns on the relationship between all three elements: rate change, cost, and term following refinance.

Contributed by: Roger J. Brown (April 2013)

Open content licensed under CC BY-NC-SA

Snapshots

Details

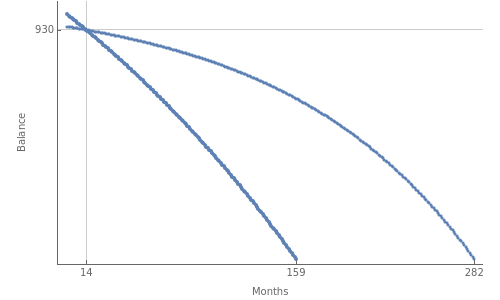

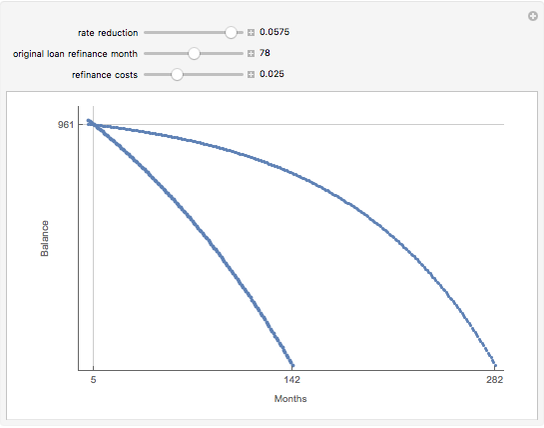

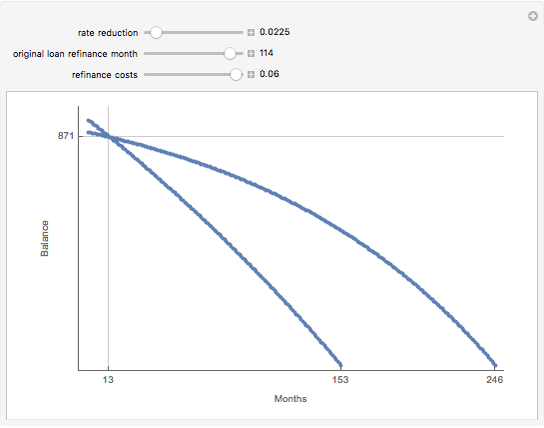

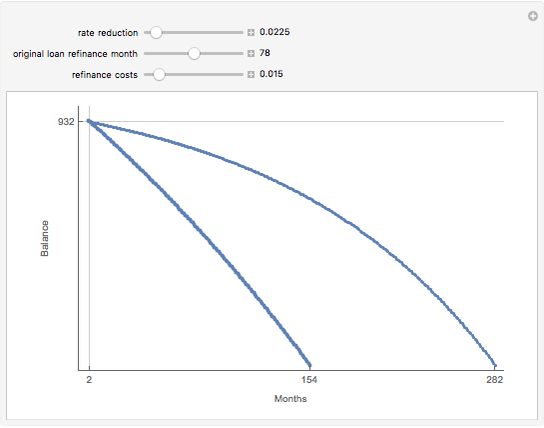

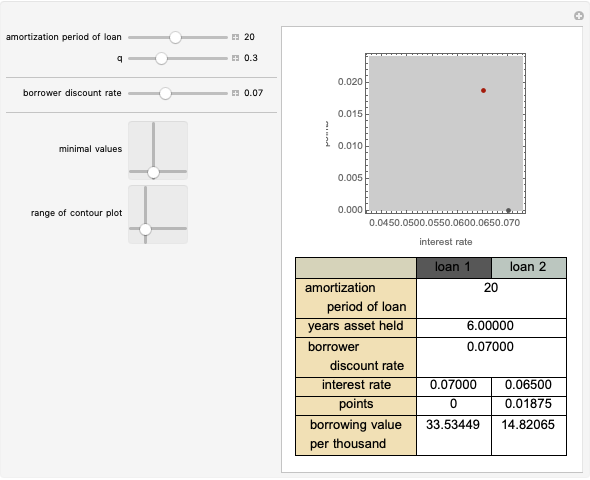

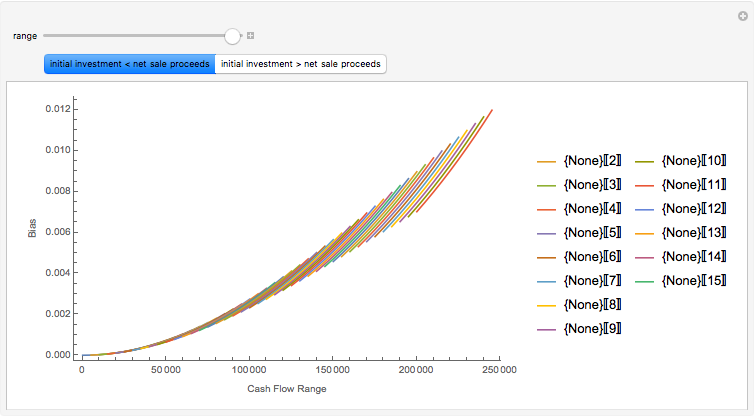

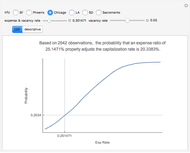

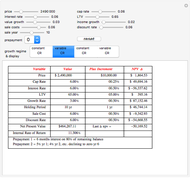

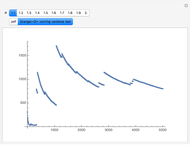

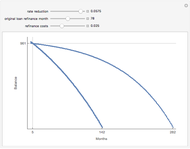

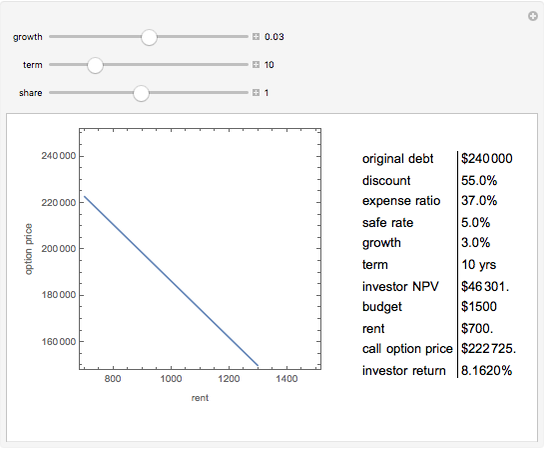

The decision to refinance may be viewed as a decision to exchange one loan for another with a lower rate. As most refinancing involves origination costs, one reasonably asks if the benefits are worth the costs. If no new money is generated, the loan balance increases as a result of the origination costs. One way to analyze this is to artificially force both loans to have the same payment (even if one is offered a new loan with a lower payment because it has a longer term than the remaining term of the original loan). The result is, naturally, that—given equal payments—the new loan will have a shorter term and the balance of the two will at some point be equal.

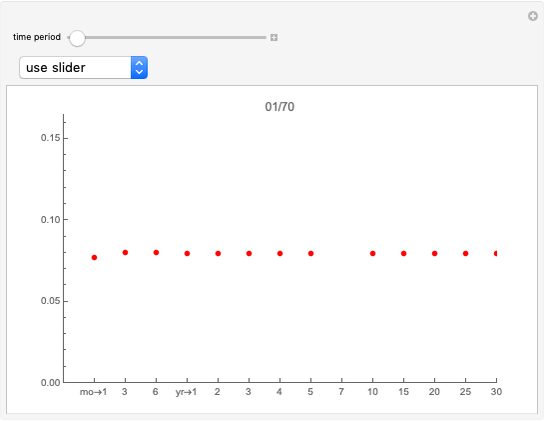

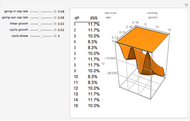

In this Demonstration you can choose the rate change, refinance costs as a percent of the new loan, and the refinance month for a $1,000 original loan that becomes eligible for refinancing due to falling interest rates during the first 10 years. The crosspoint of the two amortizations represents the time at which the origination costs have been recovered. If the borrower expects to keep the loan less than that time, he should not refinance. The cost recovery period is of course least when rate reduction is maximized and refinance costs are minimized.

Permanent Citation

"The Refinance Decision"

http://demonstrations.wolfram.com/TheRefinanceDecision/

Wolfram Demonstrations Project

Published: April 22 2013