Spectral Measures

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

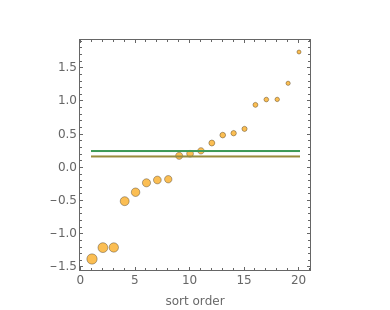

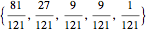

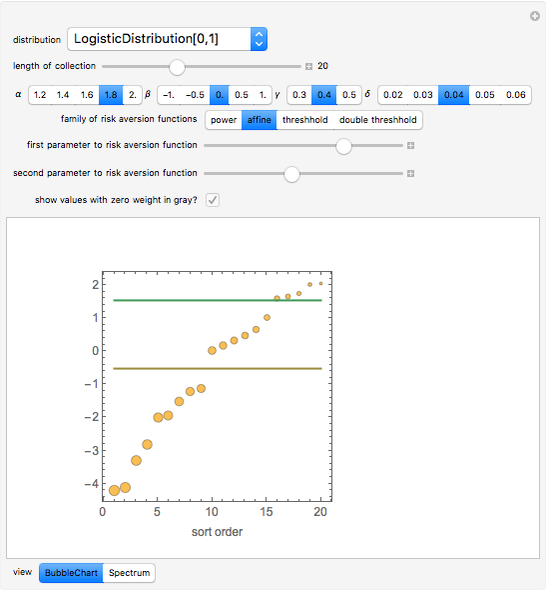

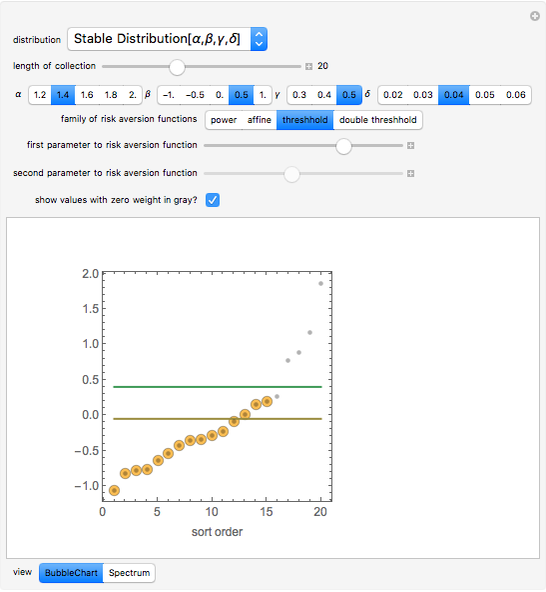

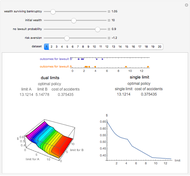

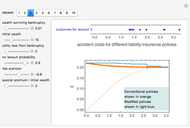

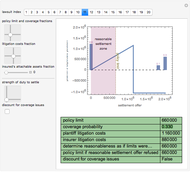

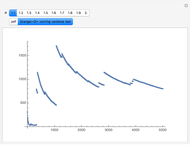

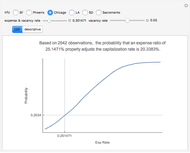

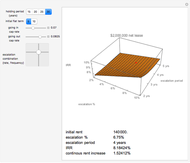

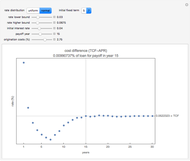

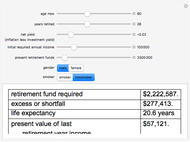

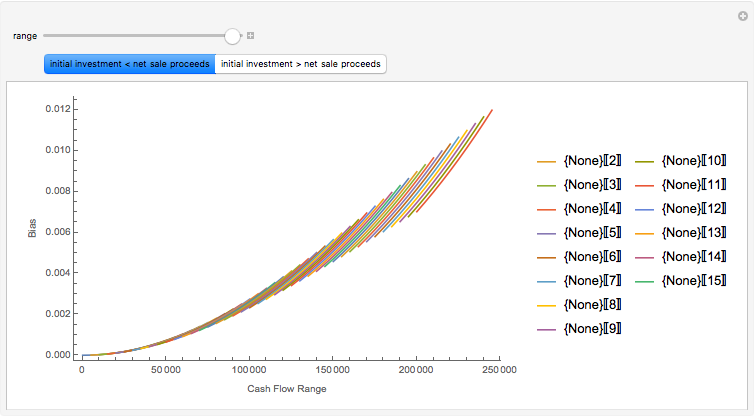

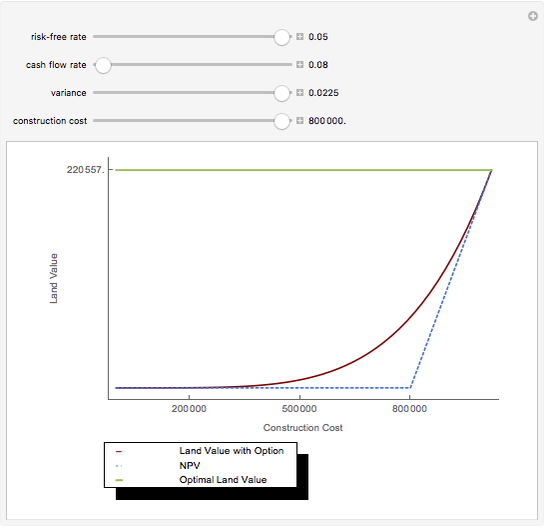

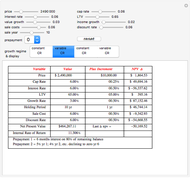

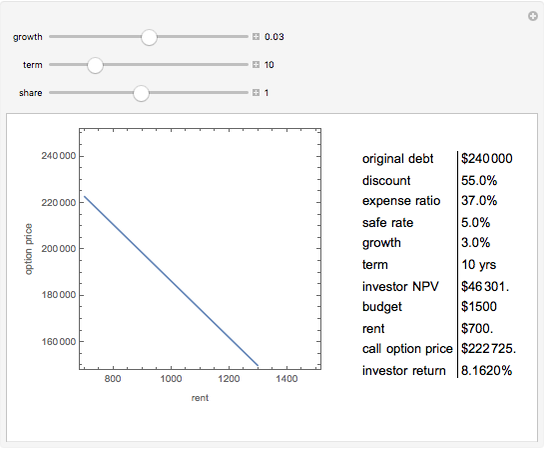

Analyses of investments, insurance, and economic policies often depend on an ability to collapse a large set of probability-weighted outcomes to just a few numbers. Examples of this process are computations of "expected utility", (or its cousin, "certainty equivalent wealth"), means and standard deviations of the outcomes, and "value at risk". Each of these measures has strengths as well as deficiencies, the latter including frequent difficulty in coping with negative outcomes in expected utility theory, the theoretical nonexistence of standard deviations for outcomes drawn from certain distributions, and the lack of sensitivity of value at risk to the magnitude of the worst outcomes.

[more]

Contributed by: Seth J. Chandler and Roger J. Brown (October 2010)

Open content licensed under CC BY-NC-SA

Snapshots

Details

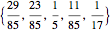

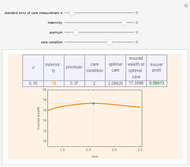

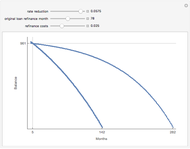

The "threshold" family of spectra has only two values: a constant value up to some position in the spectrum and zero thereafter. The risk measure "expected shortfall", which is growing in popularity and is also known as "conditional value at risk (cvar)", can be generated using a member from this family.

Pioneering work by Carlo Acerbi has been done in the field. A brief discussion of spectral measures may be found at Spectral risk measure.

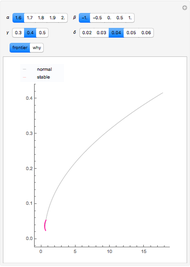

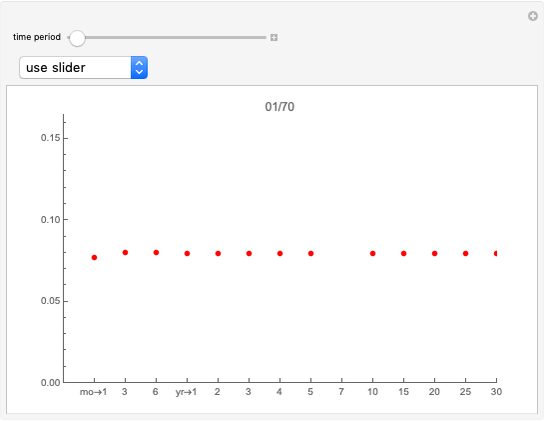

The set of permissible spectral weights is the set of nonincreasing probability density functions (sometimes also known as probability mass functions for discrete distributions).

Permanent Citation