Net Lease Economics

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

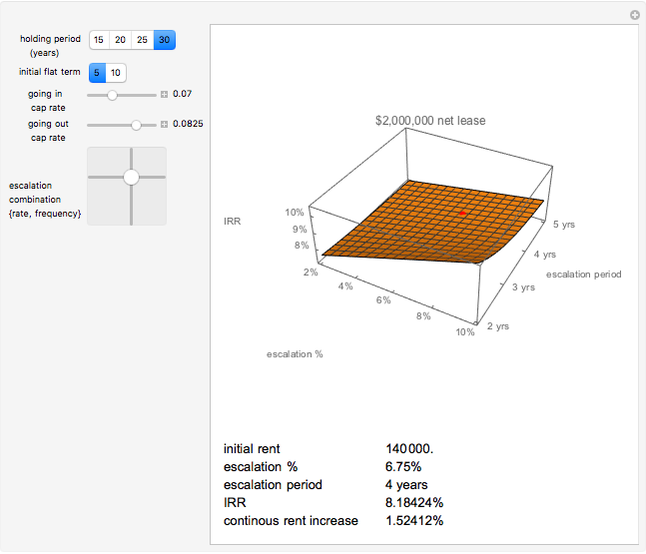

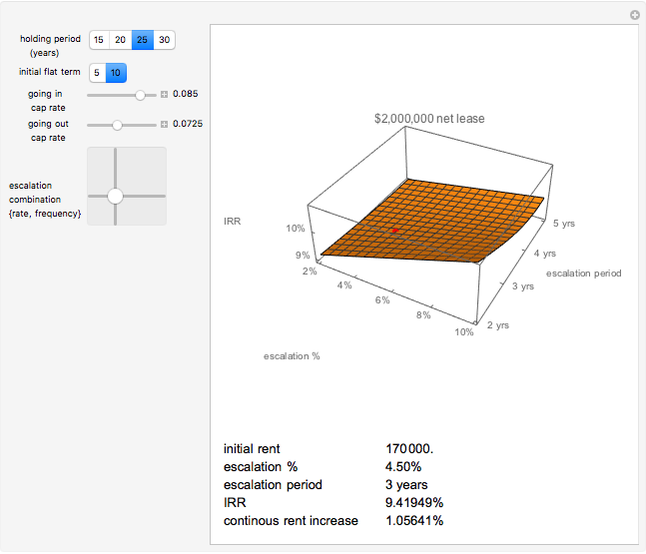

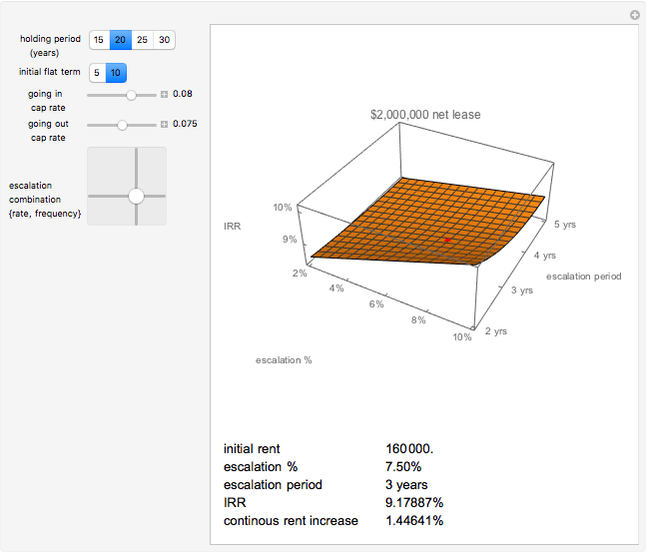

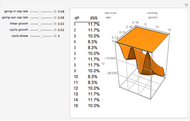

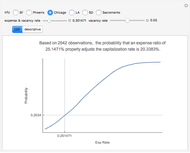

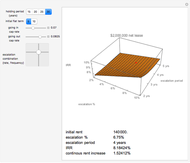

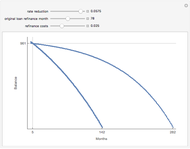

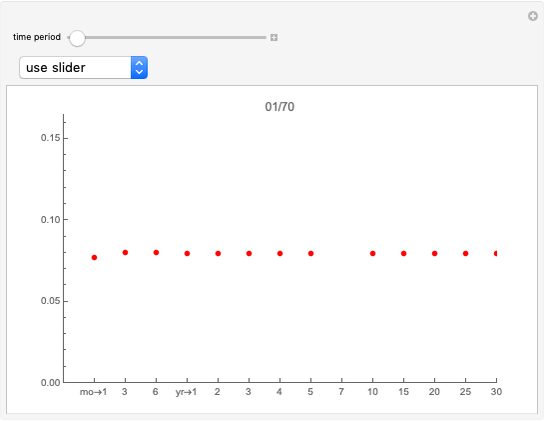

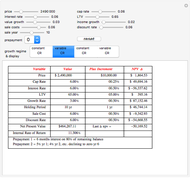

The proliferation of national chains, franchises, and the marketing concept of "branding" has produced a real estate investment commonly known as the "single tenant net lease investment". This vehicle essentially trades as real estate's equivalent of bonds with two important differences. First, the final payment of a standard bond is usually a fixed, known amount. In the net lease investment, the reversion of possession at lease expiration makes the residual value of the property the equivalent "final payment". Second, while bond interest rates are typically fixed for the term, net lease payments are rent, typically adjusted at regular intervals over time, based on a fixed escalation or cost-of-living increase.

[more]

Contributed by: Roger J. Brown (April 2008)

Reproduced by permission of Academic Press from Private Real Estate Investment ©2005

Open content licensed under CC BY-NC-SA

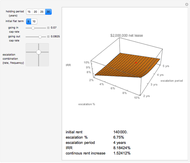

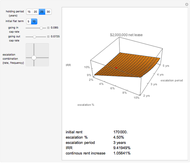

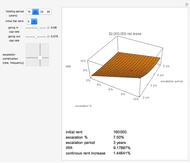

Snapshots

Details

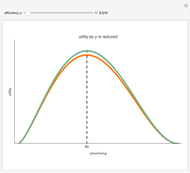

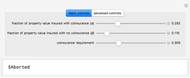

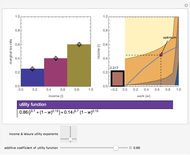

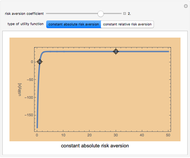

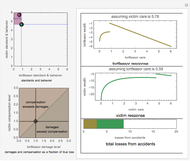

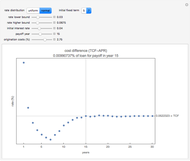

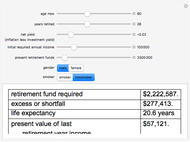

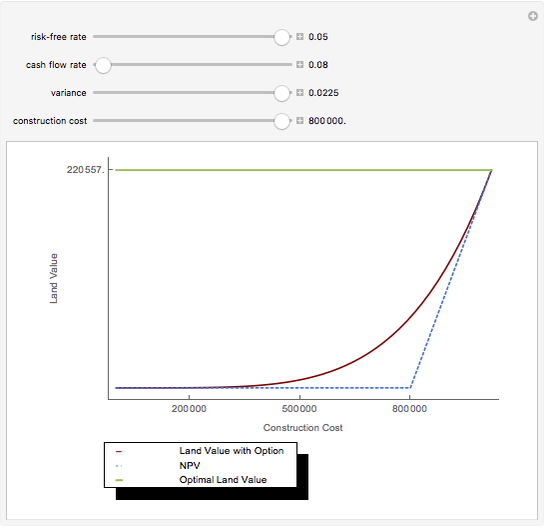

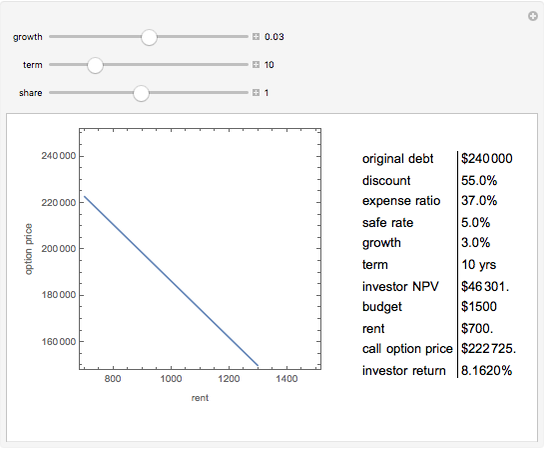

The negotiation process between landlord and tenant becomes an important aspect of this analysis. The consequence of transferring possession of a well-located parcel of realty to a user for decades has a material effect on value. Both parties overwork their respective crystal balls as they balance the trade-off of initial rent, future escalations and terminal value at expiration.

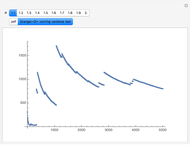

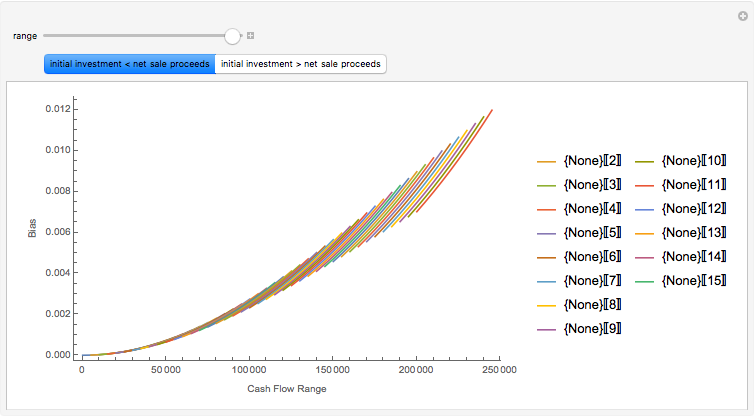

The valuation of the reversion is the subject of much speculation, namely because it is so far into the future. There are also ramifications over time as local rental market conditions fluctuate. Over a 25-year period at different points in time, depending on the relationship between market rent and contract rent, there will either be a "bargain element" in the rent for the tenant when market rents exceed the lease rate (making the lease an asset in the tenant's hands and a liability in the landlord's hands); or for the landlord when the contract rent exceeds the local market rent (making the lease an asset to the landlord and a burden on the tenant).

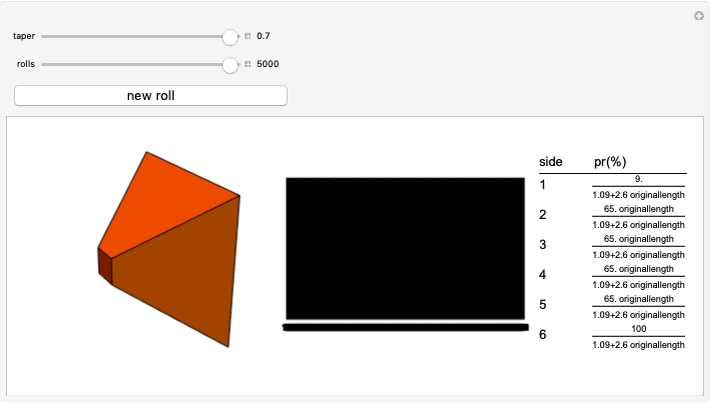

A popular variation to the net lease concept is the net ground lease. Under this scenario the landlord leases only the ground and the tenant builds its own building on the land. Many new issues emerge in this scenario. The building may be viewed as a large "security deposit" assuring performance of the lease. The reversion of the land means the landlord receives the tenant's building (a variation on the notion that "you can't take it with you"). Typically this results in a longer net lease term (or a series of renewal options) that permits the tenant to amortize the building.

More information is available in Chapter Four of [1] and at mathestate.com.

Reference

[1] R. J. Brown, Private Real Estate Investment: Data Analysis and Decision Making, Burlington, MA: Elsevier Academic Press, 2005.

Permanent Citation