Real Estate Recessions

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

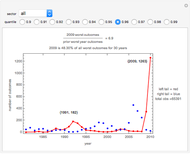

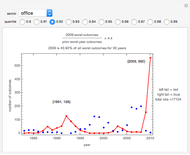

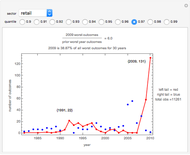

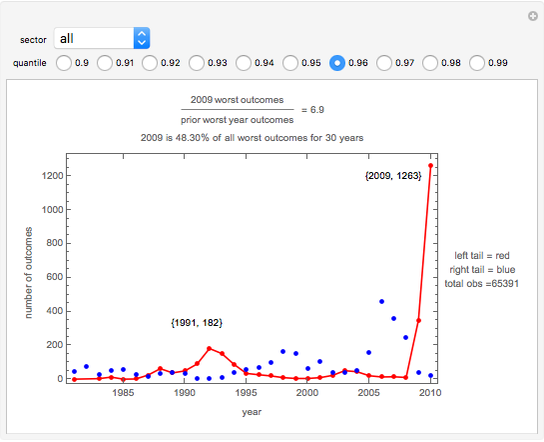

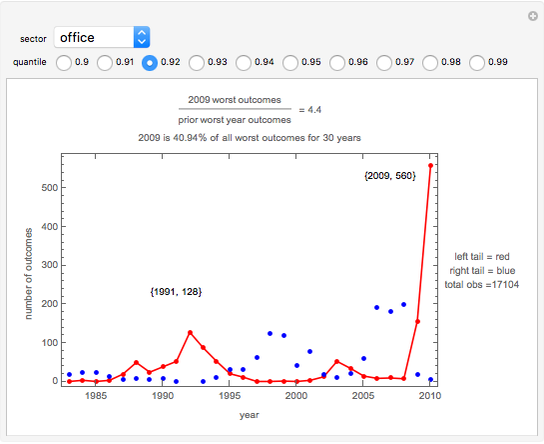

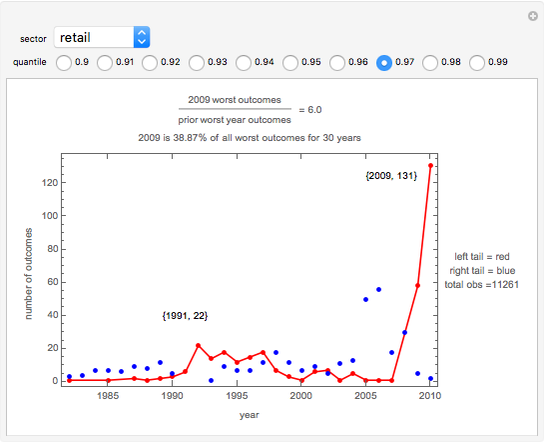

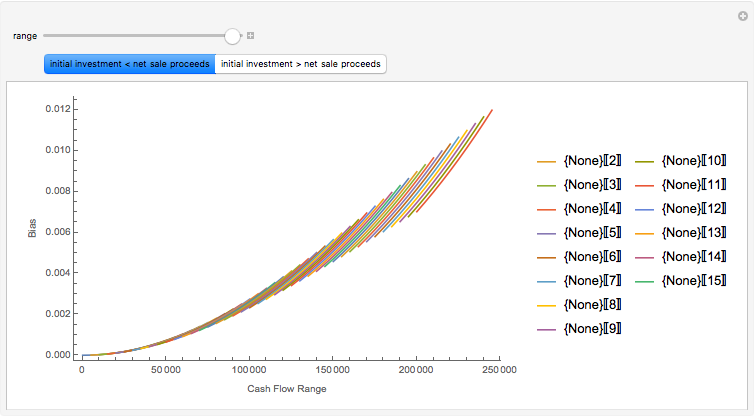

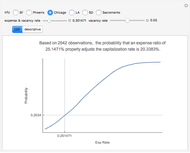

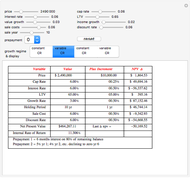

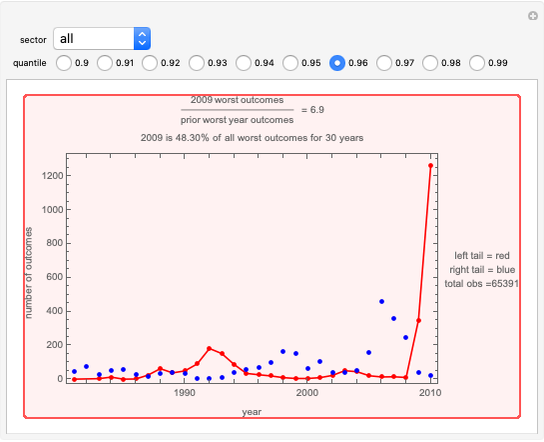

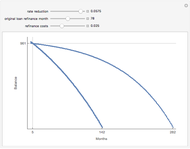

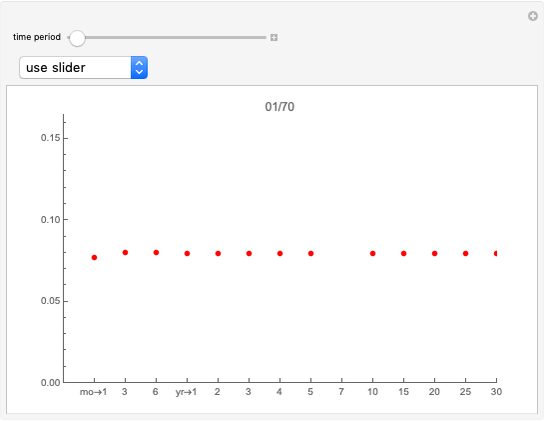

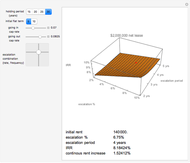

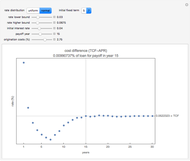

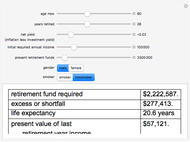

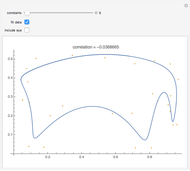

Much has been made of the real estate crash of 2008. With perfect hindsight and data, we can now form some impressions about how that downturn related to past falling markets. Using data from the National Council of Real Estate Investment Fiduciaries (NCREIF), more than 65,000 annual return observations over 30 years (21 years in the case of residential properties), you may first choose to set the degree of "terrible" by choosing a quantile. Working with that segment of outcomes, the plot shows the number that occurred in 2009 and the number that occurred in the prior worst year (usually in the early 1990s).

[more]

Contributed by: Roger J. Brown (December 2019)

Appreciation for data: National Council of Real Estate Investment Fiduciaries

Open content licensed under CC BY-NC-SA

Details

Large datasets for investment real estate are rare. One important lesson of this Demonstration is how much you can do with a single column of numbers indexed only to a year, classified by product type. Real estate economics is characterized by long cycles, the study of which may lead to an explanation behind the boom-bust behavior generally attributed to real estate.

Snapshots

Permanent Citation