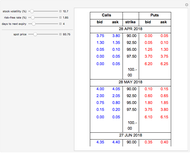

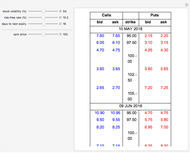

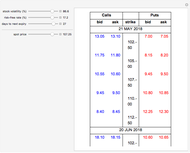

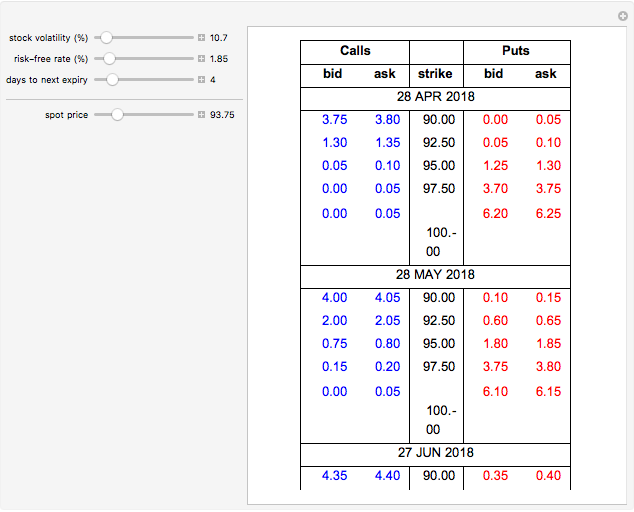

Options Board Using Black-Scholes Prices

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

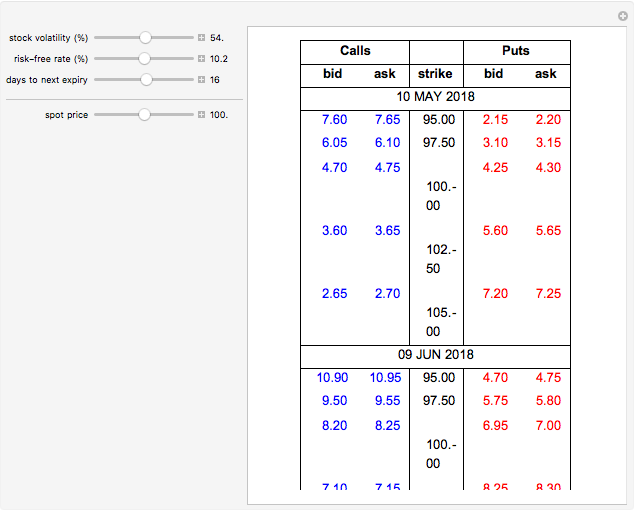

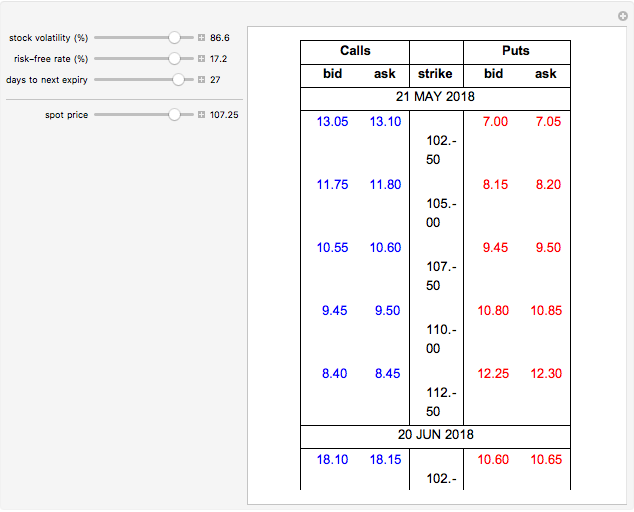

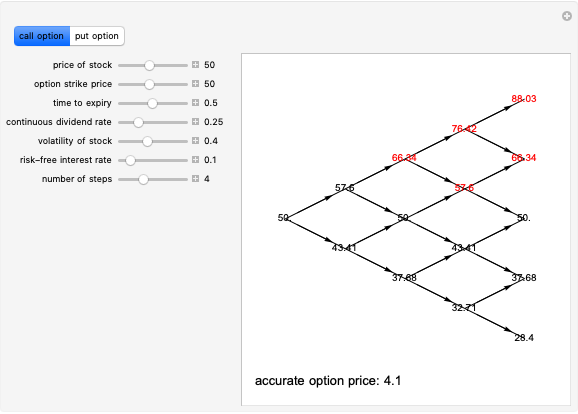

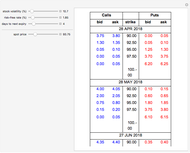

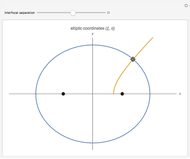

In this Demonstration, we show a simple options board for a hypothetical stock. The board shows bid and ask prices for calls and puts for several monthly expiration dates and a range of strike prices that are close to the money. The prices are calculated using the Black–Scholes model and the bid-ask spread are five cents wide (and are about the actual Black–Scholes price). By changing the model parameters (volatility, interest rate, and time to expiry), together with the underlying stock price, it is possible to get a feel for how option prices of different strike and expiry are affected.

Contributed by: Peter Falloon (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

detailSectionParagraphPermanent Citation

"Options Board Using Black-Scholes Prices"

http://demonstrations.wolfram.com/OptionsBoardUsingBlackScholesPrices/

Wolfram Demonstrations Project

Published: March 7 2011