American Call and Put Option

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

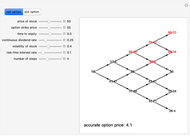

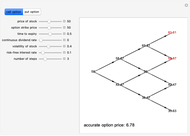

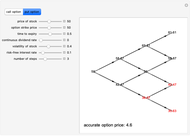

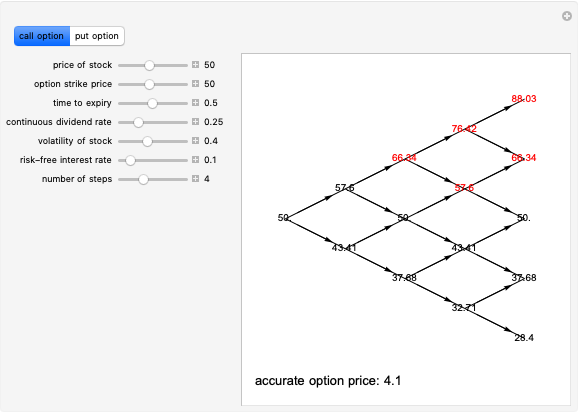

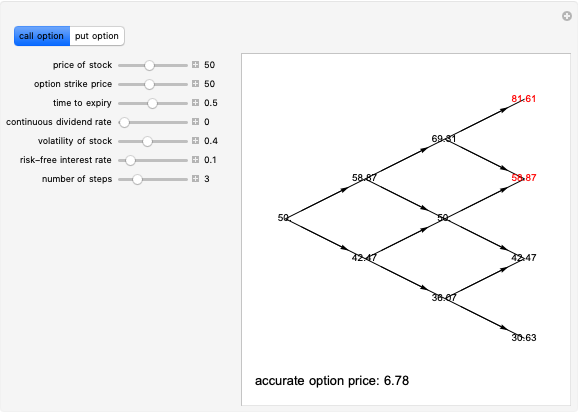

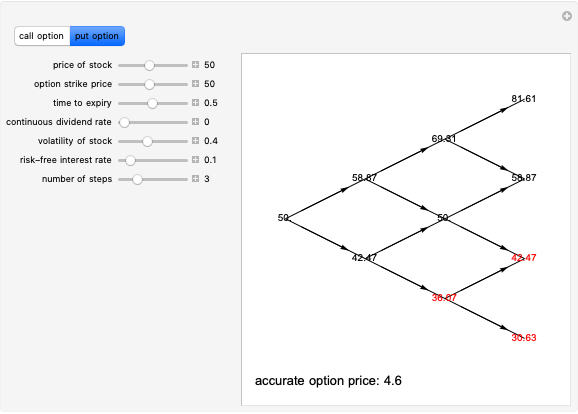

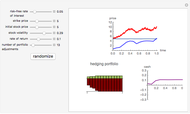

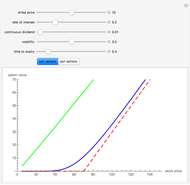

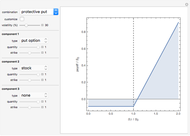

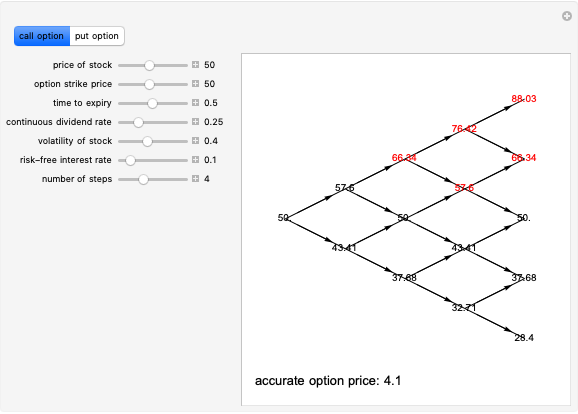

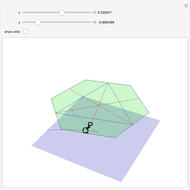

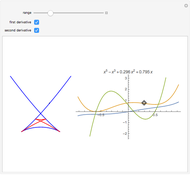

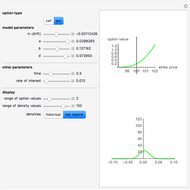

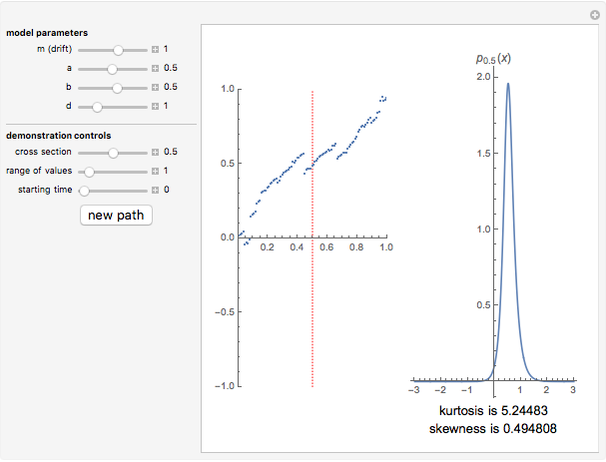

This illustrates the Cox–Ross–Rubenstein binomial tree method of computing the value of a standard American call and put option. Values at the tree nodes show the stock price. Red denotes nodes where it is optimal to exercise the option. A more accurate option value (using 100 time steps) is shown in the bottom left corner.

[more]

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

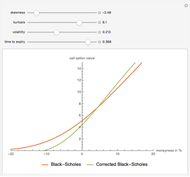

A call option on an asset (usually stock) gives its holder the right to buy the asset at a prescribed price at or before the time of expiry of the option. A put option on an asset gives its holder the right to sell the asset at a prescribed price at or before the time of expiry of the option. A European option (call or put) can be exercised only at the time of expiry; an American option can be exercised on or before the time of expiry. In the case of European options, under the assumption that the stock price process is an exponential Brownian motion with drift, there is a famous explicit formula (the Black–Scholes formula) that gives the value of the option in terms of several parameters. In the case of American options there is no such explicit formula and numerical methods have to be used. One of the most popular is the lattice or "binomial tree" method, as shown here. This method, due to Cox–Ross–Rubenstein, uses a random walk approximation to the Black–Scholes model of stock price motion. For each moment in time and each stock price, the stock price can go either up or down by a certain amount and with a certain probability. The possible values of the stock price are shown at the nodes of the binomial tree, representing the random walk performed by the stock price. The value of the option at this particular node is shown when the pointer is moved to this node. Red-colored nodes represent situations when it is optimal to exercise the option early rather than wait until expiration. Red-colored nodes at expiry mean that the option expires with positive value.

Note that it is customary to measure time to expiry in years, which means that in general, if the volatility is set to, say, 0.4, that means that the random variable  has standard deviation 0.4, where

has standard deviation 0.4, where  is the initial value of stock and

is the initial value of stock and  the value at the end of the first year.

the value at the end of the first year.

Note also that it is well known that for an American call option with no dividend, exercise before expiry is never optimal. This means that the value of an American call with zero dividend is the same as that of the European call with the same parameters. Thus the accuracy of the model can be estimated by comparing these values with those obtained from the Black–Scholes formula. For more details see J. C. Hull, Options, Futures and Other Derivatives,  ed., Upper Saddle River, NJ: Prentice Hall, 2003 pp. 392–406.

ed., Upper Saddle River, NJ: Prentice Hall, 2003 pp. 392–406.

The author is grateful to Michael Trott for help with the interface.

Permanent Citation