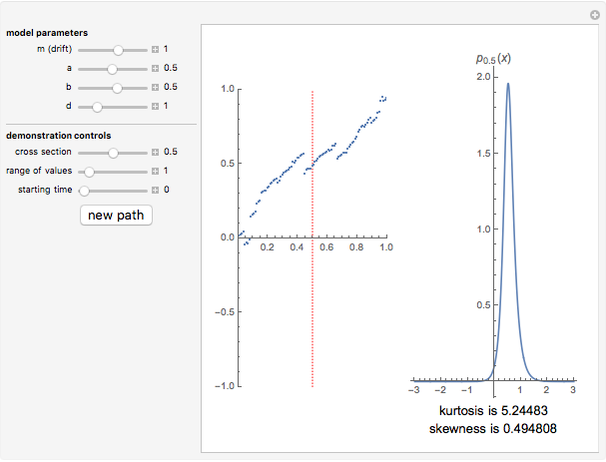

Implied Volatility in the Variance Gamma Model

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

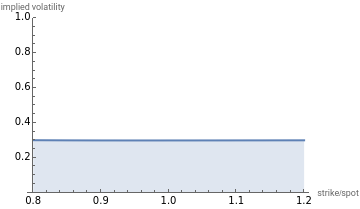

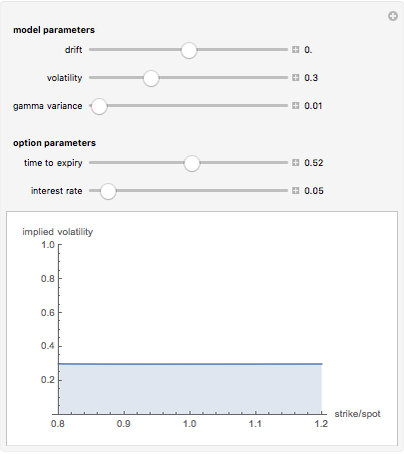

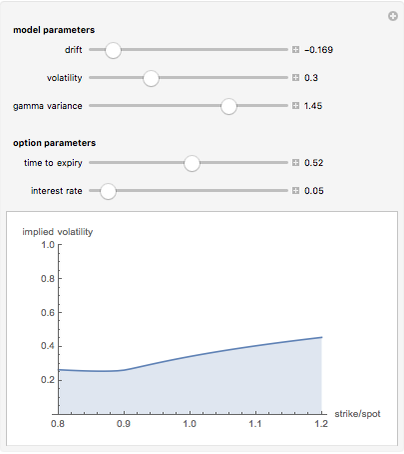

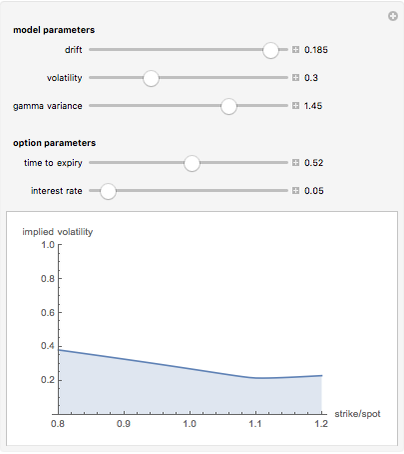

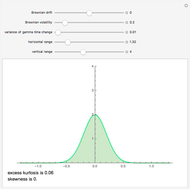

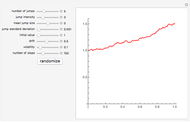

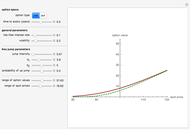

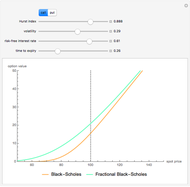

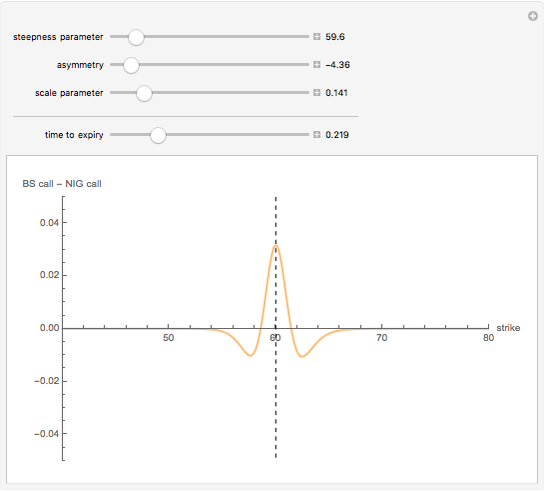

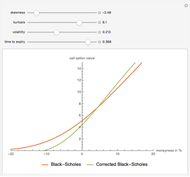

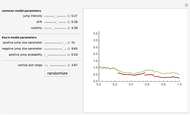

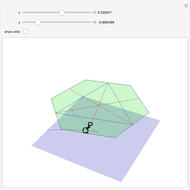

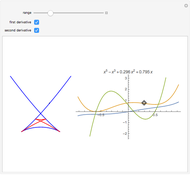

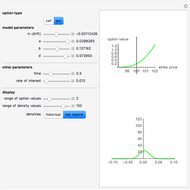

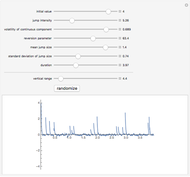

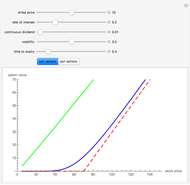

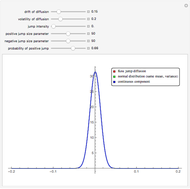

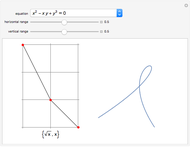

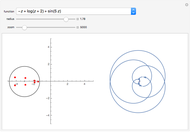

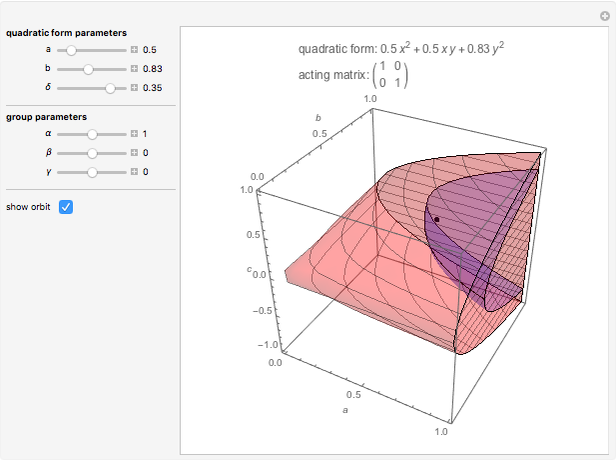

This Demonstration explores the implied volatility "smile" and "skews" for the variance gamma model. "Implied volatility" means the value of the volatility parameter in the Black–Scholes model (assumed to be constant in the model), which gives the same option value as the one quoted on an options exchange. It is well known that implied volatility for market option prices when plotted against the strike price shows "skews" and "smiles". This Demonstration shows that skews and smiles are also obtained if, instead of market option prices, you use option prices generated by the three-parameter variance gamma model.

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The variance gamma process was first used in option pricing models by Madan and Seneta [1] and generalized by Madan, Carr, and Chang [2]. Explicit formulas for European-style options can be given, generalizing the Black–Scholes formulas. The model has been shown to perform better than the Black–Scholes model under the "historical approach" [3].

[1] D. B. Madan and E. Seneta, "The Variance Gamma Process (V.G.) Model for Share Market Returns," Journal of Business, 63(4), 1990 pp. 511–524.

[2] D. B. Madan, P. P. Carr, and E. C. Chang, "The Variance Gamma Process and Option Pricing," European Finance Review, 2(1), 1998 pp. 79–105.

[3] K. Lam, E. Chang, and M. C. Lee, "An Empirical Test of the Variance Gamma Option Pricing Model," Pacific Basin Finance Journal, 10(3), 2002 pp. 267–285.

Permanent Citation

"Implied Volatility in the Variance Gamma Model"

http://demonstrations.wolfram.com/ImpliedVolatilityInTheVarianceGammaModel/

Wolfram Demonstrations Project

Published: March 7 2011