Exploring the Black-Scholes Formula

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

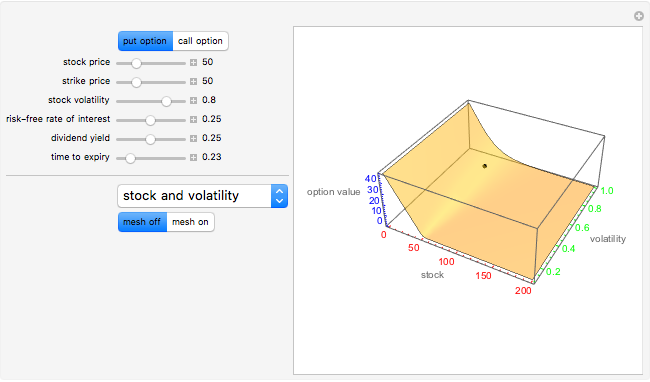

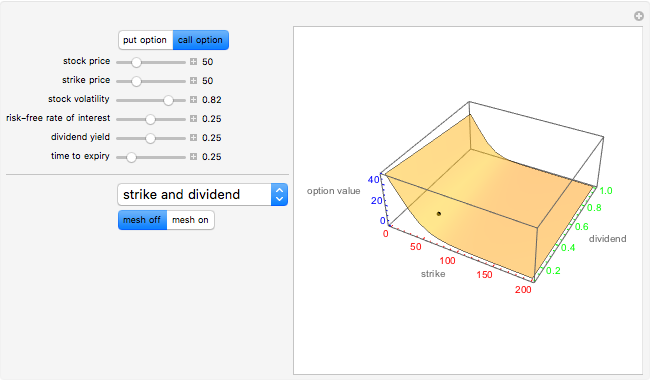

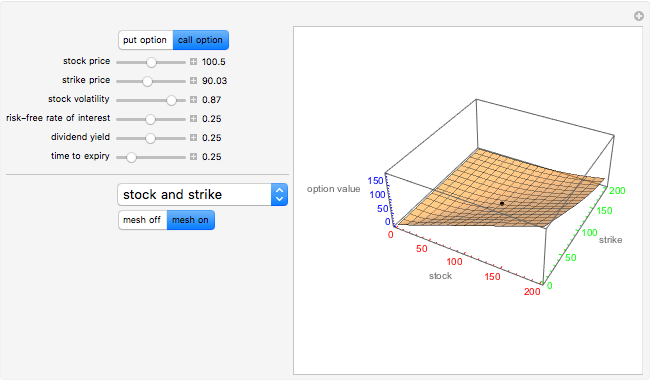

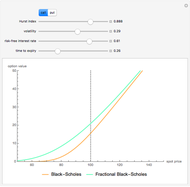

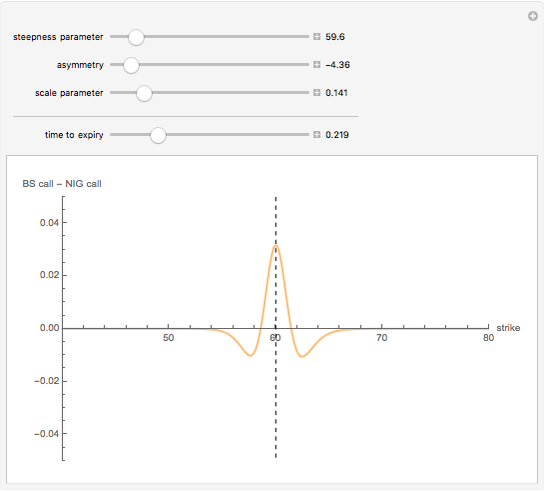

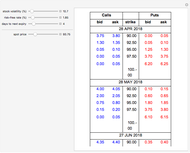

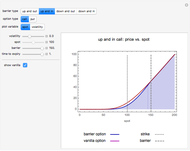

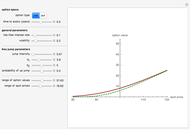

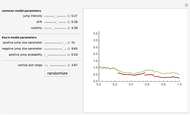

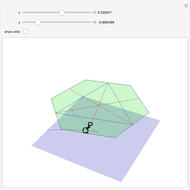

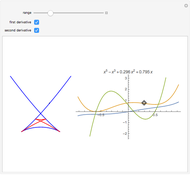

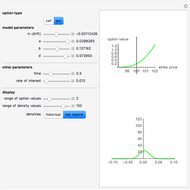

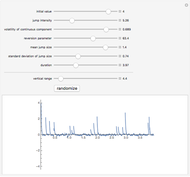

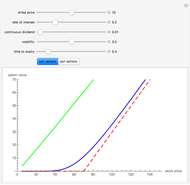

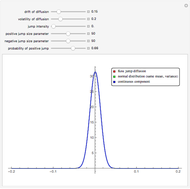

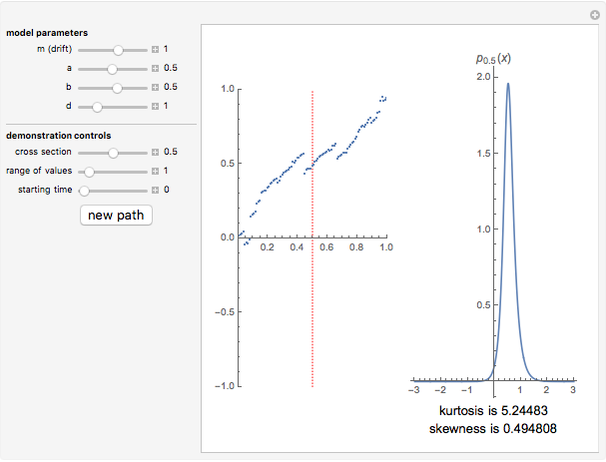

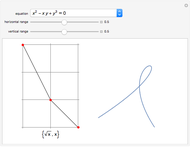

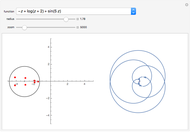

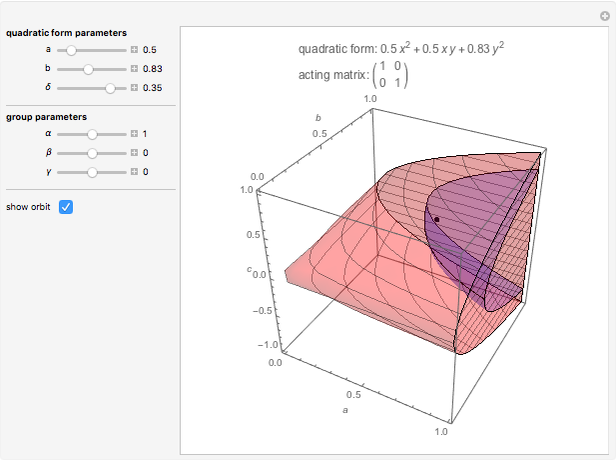

This Demonstration graphically explores the Black–Scholes formula for the value of European call and put options. First, choose whether you wish to explore a call option or a put option. Next, using the pull-down menu, choose two (out of six) parameters that will be treated as independent variables in the graph (the option value being the dependent variable). Vary the remaining parameters (or the two chosen variables) to explore the changes in the option value and the shape of the surface. A point on the surface represents the option value for given values of the variables and parameters. To see the option value, turn the mesh off and place the mouse over the point.

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

A call option on an asset (usually stock) gives its holder the right to buy the asset at a prescribed price at or before the time of expiry of the option. A put option on an asset gives its holder the right to sell the asset at a prescribed price at or before the time of expiry of the option. A European option (call or put) can be exercised only at the time of expiry (an American option can be exercised on or before the time of expiry). In the case of European options, under the assumption that the stock price process is an exponential Brownian motion with drift, there is a famous explicit formula (the Black–Scholes formula) that gives the value of the option in terms of several parameters. In 1997 the Nobel Prize in Economics was awarded to Robert C. Merton and Myron Scholes for work on which the formula is based (Fischer Black was not eligible, having died two years earlier). The term "Black–Scholes" was first used by Merton in a paper that built on the initial work by Black and Scholes.

Permanent Citation

"Exploring the Black-Scholes Formula"

http://demonstrations.wolfram.com/ExploringTheBlackScholesFormula/

Wolfram Demonstrations Project

Published: March 7 2011