The Duty to Settle

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

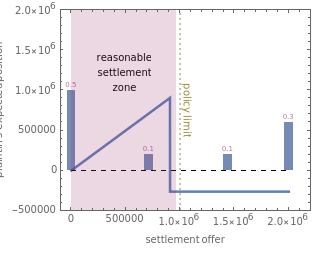

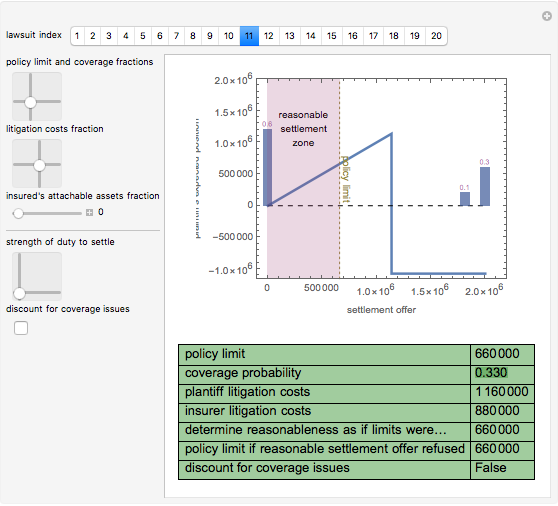

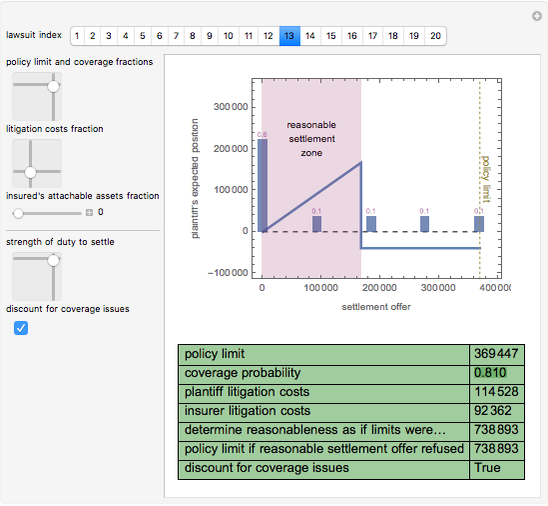

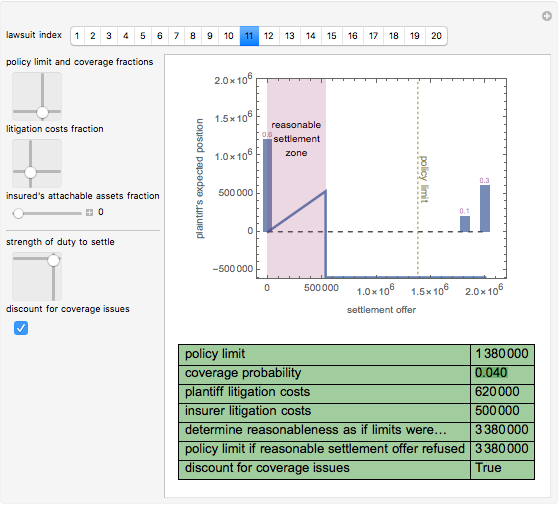

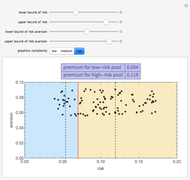

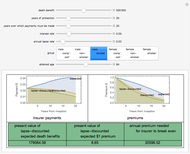

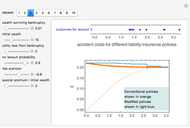

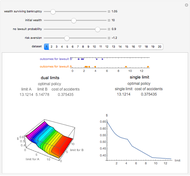

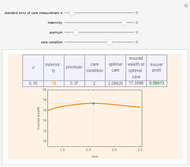

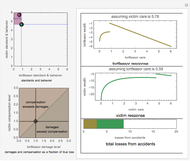

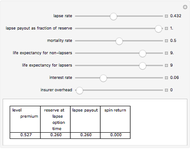

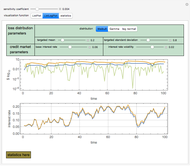

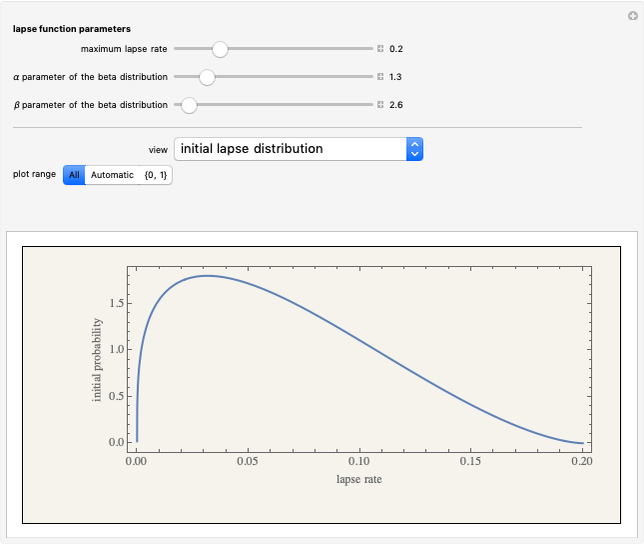

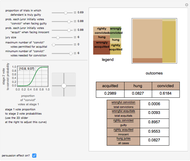

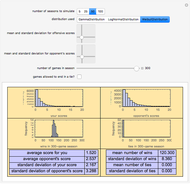

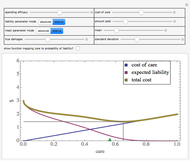

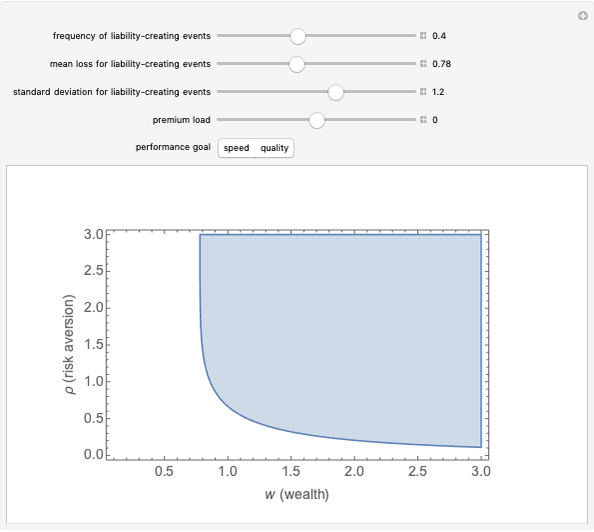

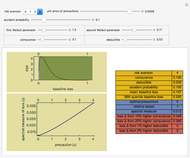

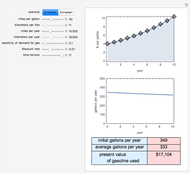

Courts imply a "duty to settle" on the part of the insurer into almost all American liability insurance contracts. This Demonstration creates a rich model in which to explore the effects of this on the likely outcomes of lawsuits. For each of the 20 sample lawsuits, you may specify the policy limit, coverage probability, litigation costs, and attachable assets of the insured as well as factors related to the strength of the duty to settle: (a) the size of the "as-if" policy the insurer must pretend it has in determining whether a settlement offer is reasonable, (b) the size of the "as-if" policy the insurer will be deemed to have written if it rejects a "reasonable" settlement offer, and (c) whether the insurer may discount for coverage issues the size of the "as-if" policy the insurer must pretend it has. The top panel of the Demonstration outputs a graph showing the plaintiff's expected position for each settlement offer it makes and superimposes on that graph information relating to the distribution of judgments in the underlying lawsuit, the policy limit and the zone of settlement offers that a court will deem reasonable. The parameters you set are shown in a table at the bottom of the Demonstration.

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The two‐dimensional slider labeled "policy limit and coverage fractions" works as follows. The  axis determines the per occurrence limit of the liability insurance policy rescaled to run from 0 to the size of the largest possible judgment against the insured. The

axis determines the per occurrence limit of the liability insurance policy rescaled to run from 0 to the size of the largest possible judgment against the insured. The  axis determines the probability [0,1] that a court will ultimately determine that "coverage" exists, that is, that the insurer has a duty to pay on behalf of the insured all sums for which the insured is liable, subject to applicable limits of liability.

axis determines the probability [0,1] that a court will ultimately determine that "coverage" exists, that is, that the insurer has a duty to pay on behalf of the insured all sums for which the insured is liable, subject to applicable limits of liability.

The two-dimensional slider labeled "litigation costs fraction" works as follows. The  axis determines the litigation costs the plaintiff will bear. The

axis determines the litigation costs the plaintiff will bear. The  axis determines the litigation costs the insurer will bear. Both values are rescaled to run from 0 to the size of the largest possible judgment against the insured.

axis determines the litigation costs the insurer will bear. Both values are rescaled to run from 0 to the size of the largest possible judgment against the insured.

The slider labeled "insured's attachable assets fraction" determines the amount of assets the plaintiff could collect from the insured defendant in the event a court rendered a judgment in excess of the per occurrence limit. The value is rescaled to run from 0 to the size of the largest possible judgment against the insured.

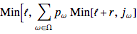

The two-dimensional slider labeled "strength of duty to settle" works as follows. The  axis determines the extra amount in addition to policy limits that will be taken into account in determining whether a settlement offer is reasonable or not. A settlement is reasonable if it is less than

axis determines the extra amount in addition to policy limits that will be taken into account in determining whether a settlement offer is reasonable or not. A settlement is reasonable if it is less than  ] where ω is a possible outcome of the lawsuit (all possible outcomes are

] where ω is a possible outcome of the lawsuit (all possible outcomes are  ),

),  is the probability of that outcome,

is the probability of that outcome,  is the policy limit,

is the policy limit,  is the extra amount set by this slider, and

is the extra amount set by this slider, and  is the size of the judgment corresponding to outcome ω. This slider thus helps determine the size of the "reasonable settlement zone" marked on the top panel. Both the

is the size of the judgment corresponding to outcome ω. This slider thus helps determine the size of the "reasonable settlement zone" marked on the top panel. Both the  and

and  values are rescaled to run from 0 to the size of the largest possible judgment against the insured.

values are rescaled to run from 0 to the size of the largest possible judgment against the insured.

The checkbox "discount for coverage issues" allows simulation of settings in which a court permits the insurer to discount the amount of any possible judgment by the probability that it would not be covered. It thus affects the size of the reasonable settlement zone.

Permanent Citation