Lawsuit Settlement Calculator

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

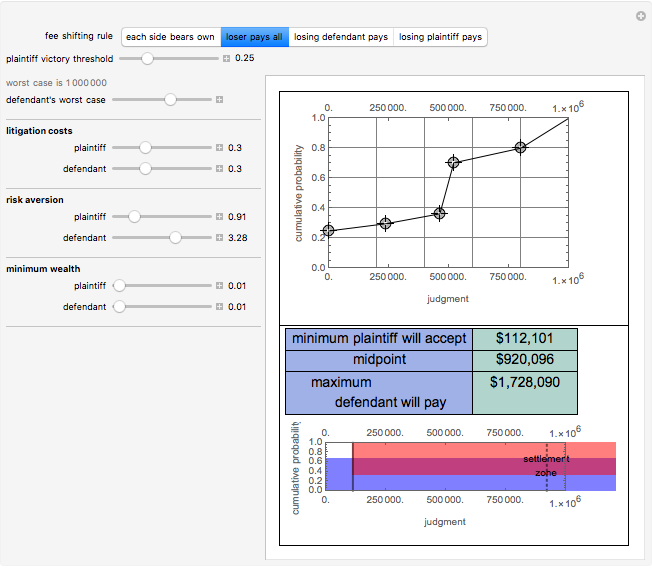

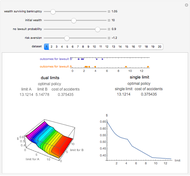

Most lawsuits filed in the United States never go to any sort of trial but are instead settled out of court through the agreement of the parties. An issue frequently arising in the resolution of these disputes is the appropriate amount of the settlement. This Demonstration provides attorneys, litigants, mediators, judges, and scholars a tool by which to rationally bound appropriate settlement values.

[more]

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

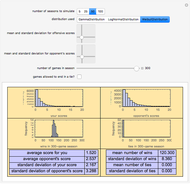

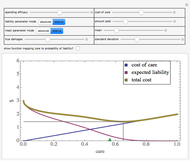

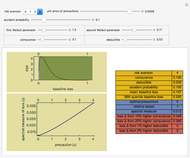

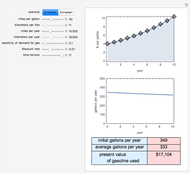

Snapshot 1: the model can be used for very small disputes

Snapshot 2: the model can be used for large disputes

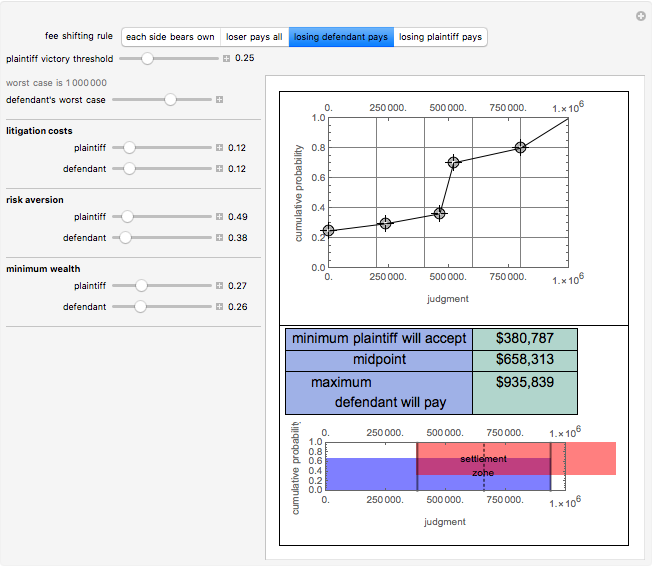

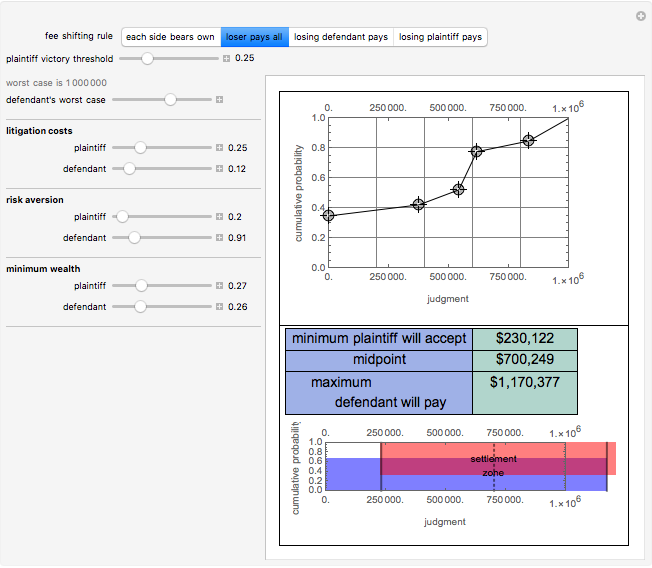

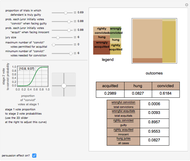

Snapshot 3: changing the fee shifting rules has a large effect on the settlement bounds and the settlement midpoint

Snapshot 4: a scenario in which the settlement midpoint is $233,586

Snapshot 5: increasing the plaintiff's risk aversion relative to Snapshot 4 reduces the settlement midpoint to $198,700

Snapshot 6: increasing the defendant's risk aversion relative to Snapshot 4 increases the settlement midpoint to $514,596

Snapshot 7: extremely protective bankruptcy laws (implemented by increasing the "defendant's min. wealth" parameter to 0.96) slightly decrease the settlement midpoint relative to Snapshot 4

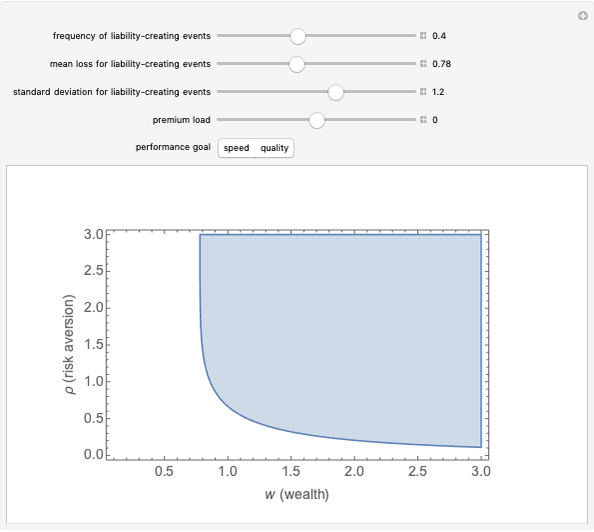

The scaling slider on the top left of the Demonstration employs a logarithmic scale to permit this Demonstration to be used with some precision over a large domain of lawsuits.

The parties are assumed to have utility functions exhibiting constant relative risk aversion. They are normalized such that their utility would be one if their wealth was equal to the amount of the largest possible judgment and their utility would be two if their wealth was equal to twice the amount of the largest possible judgment.

Permanent Citation

"Lawsuit Settlement Calculator"

http://demonstrations.wolfram.com/LawsuitSettlementCalculator/

Wolfram Demonstrations Project

Published: March 7 2011