Modeling Return Distributions

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

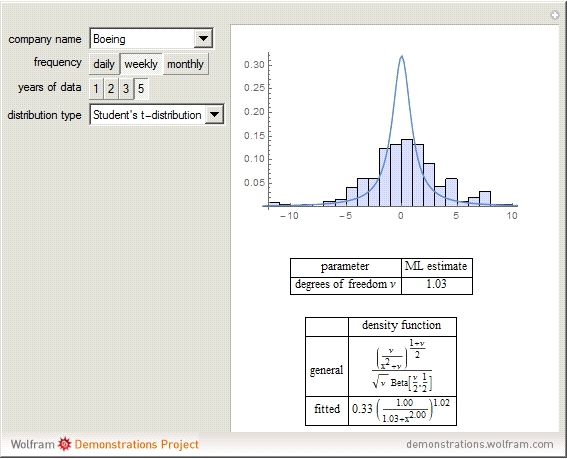

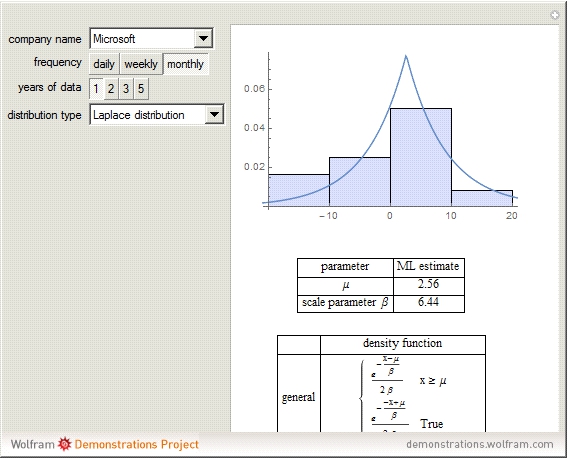

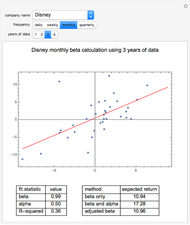

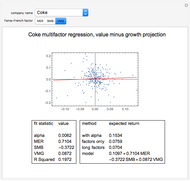

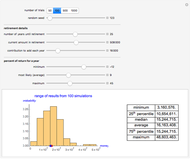

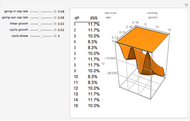

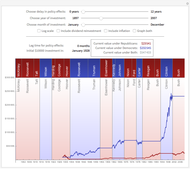

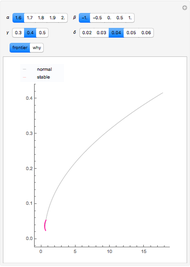

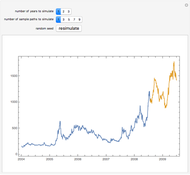

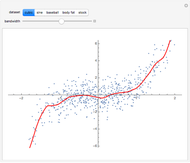

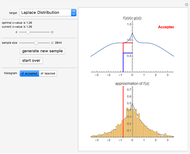

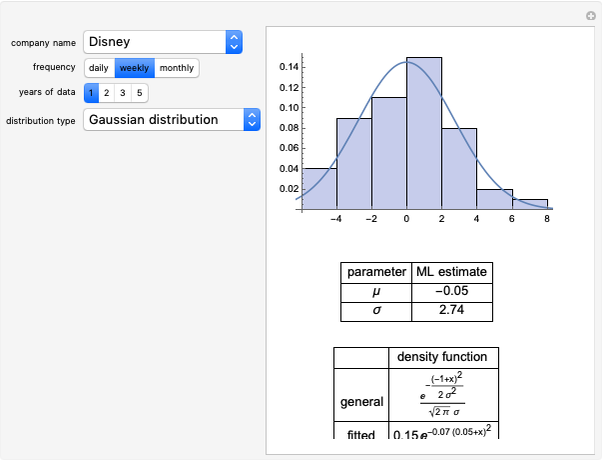

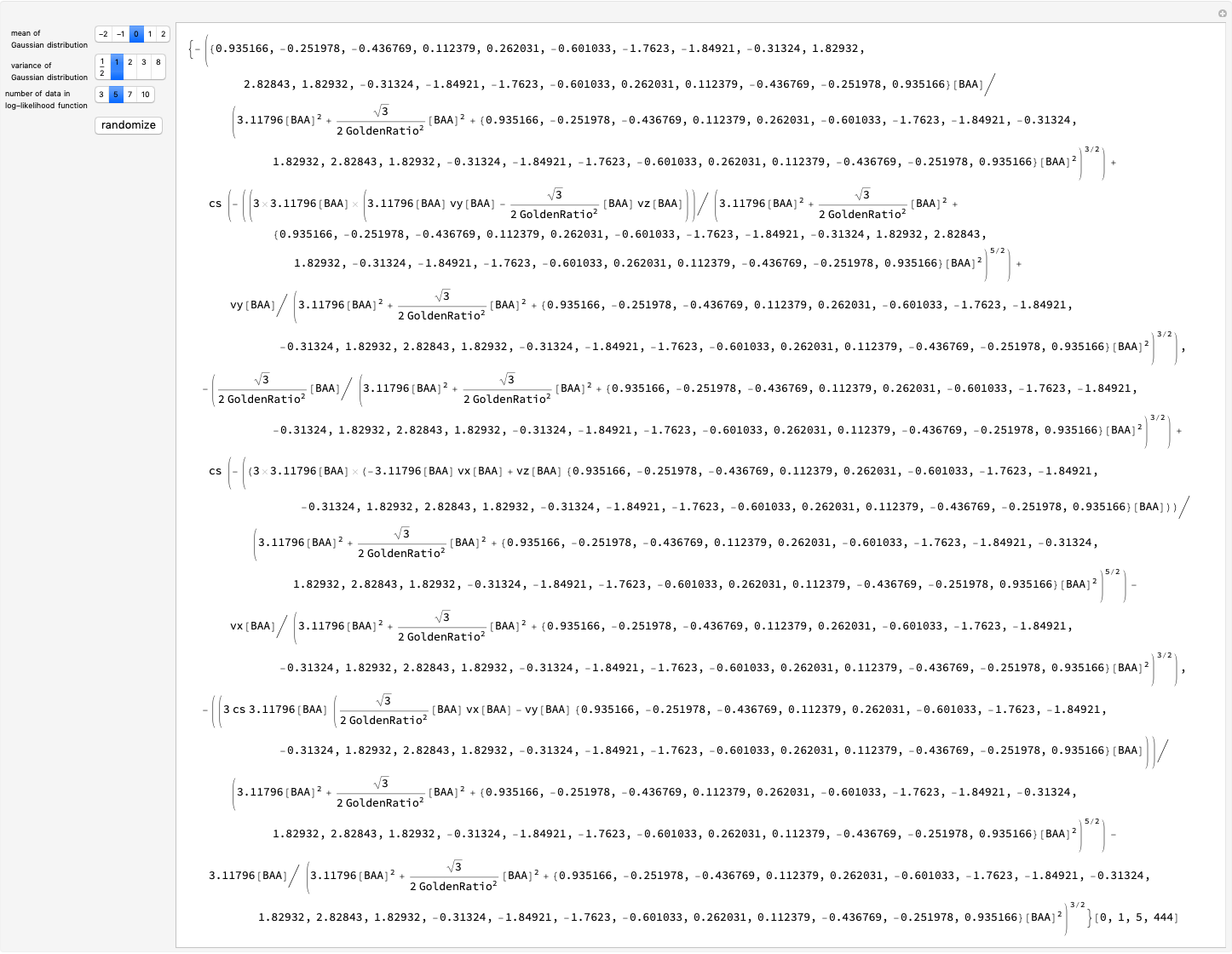

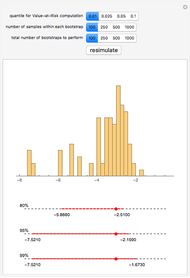

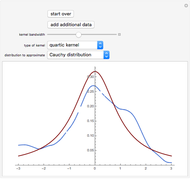

We use numerical maximum likelihood estimation to obtain the parameters governing probability distributions that might plausibly generate the daily, weekly, monthly, or quarterly return distributions of stocks from the Dow 30. The candidate distribution types should probably be continuous and supported on the whole real line. So, we choose to investigate the Gaussian distribution, Student's  -distribution, the Gumbel distribution, the Cauchy distribution, and the Laplace distribution. We show a histogram of the return data for a particular time horizon and frequency, as well as the density function with the fitted parameters.

-distribution, the Gumbel distribution, the Cauchy distribution, and the Laplace distribution. We show a histogram of the return data for a particular time horizon and frequency, as well as the density function with the fitted parameters.

Contributed by: Jeff Hamrick (March 2011)

Additional contributions by: Jason Cawley

Open content licensed under CC BY-NC-SA

Snapshots

Details

In this Demonstration, we define the returns of a stock  by

by  for

for  . Hence, the number

. Hence, the number  corresponds to a positive 5% return and

corresponds to a positive 5% return and  corresponds to a negative 9% return.

corresponds to a negative 9% return.

Permanent Citation