Reinsurance Cut-Through

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

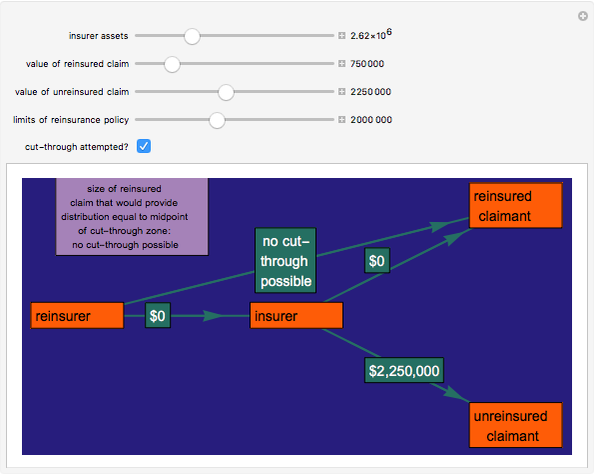

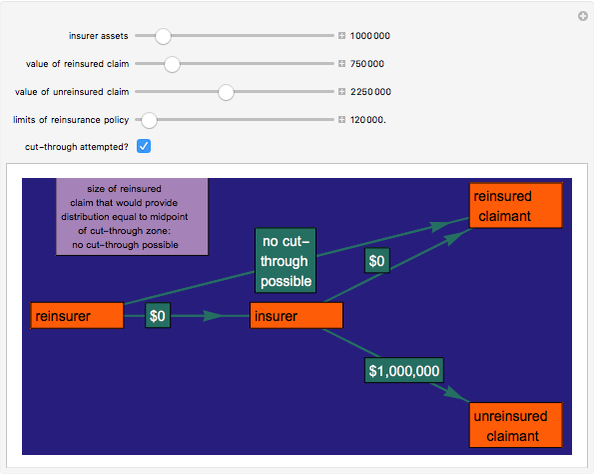

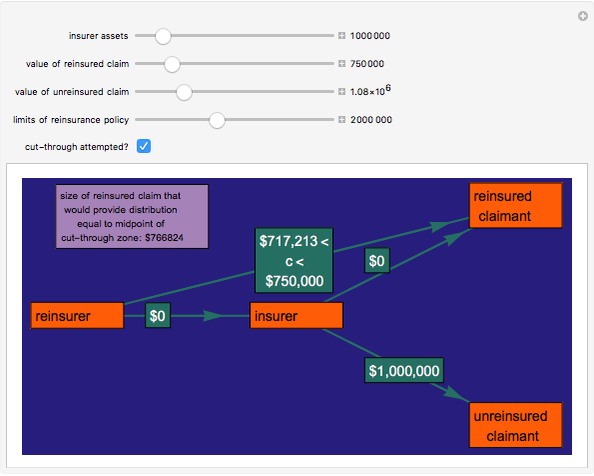

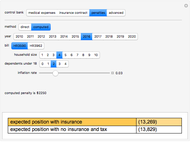

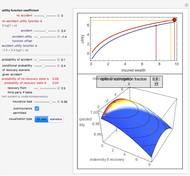

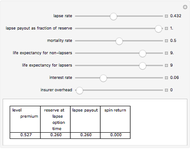

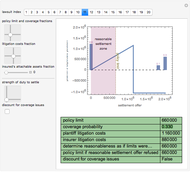

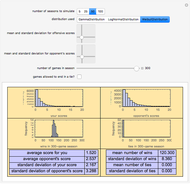

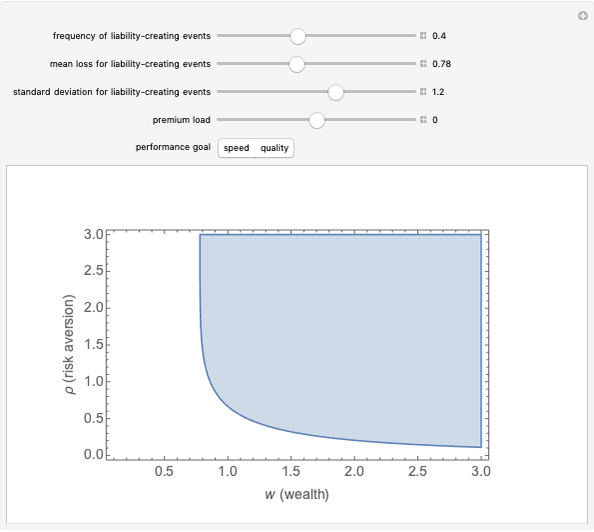

Insurers frequently have reinsurance for some incomplete subset of the potential claims against them. A problem arises when the insurers become insolvent. Ordinarily, the proceeds of the reinsurance belong to the insurer and are supposed to be distributed according to the priorities set by insurer insolvency laws. Moreover, at least in most American jurisdictions, as a result of laws governing the accounting treatment of reinsurance, contracts governing reinsurance prohibit the reinsurer from directly conditioning its obligation to the insurer on the solvency of the insurer (otherwise, both the reinsurer and insurer might want to eliminate the liability). If, however, the reinsurer can directly negotiate with the reinsured claimants and "cut-through" the insolvency proceedings, the reinsurer can pay less than it otherwise would, and the reinsured claimant can get more than he or she would in the insolvency proceedings. The loser in what amounts to a zero-sum game is the unreinsured claimant.

[more]

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Some jurisdictions and courts make cut-through unlawful for precisely the reasons suggested in this Demonstration. From one perspective, it subverts the insurer insolvency distribution scheme. If parties know about cut-through in advance, however, it is not clear that cut-through is inequitable.

The reinsurance described here is assumed to be first dollar reinsurance. There are many other kinds of reinsurance. Their inclusion in this Demonstration, however, would not alter the basic issue explored here.

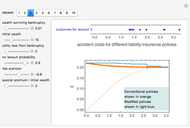

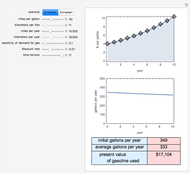

Snapshot 1: cut-through will not be profitable for the reinsurer under some circumstances even if the insurer is insolvent.

Snapshot 2: cut-through will not be profitable for the reinsured claimant if the amount of reinsurance is too low.

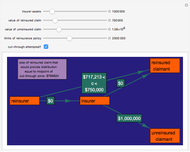

Snapshot 3: having a larger unreinsured claim may actually increase the minimum amount the reinsured claimant will receive after cut-through.

Permanent Citation

"Reinsurance Cut-Through"

http://demonstrations.wolfram.com/ReinsuranceCutThrough/

Wolfram Demonstrations Project

Published: March 7 2011