Saving for Retirement

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

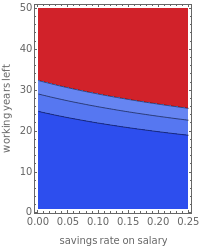

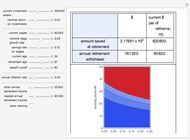

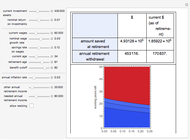

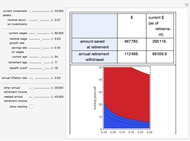

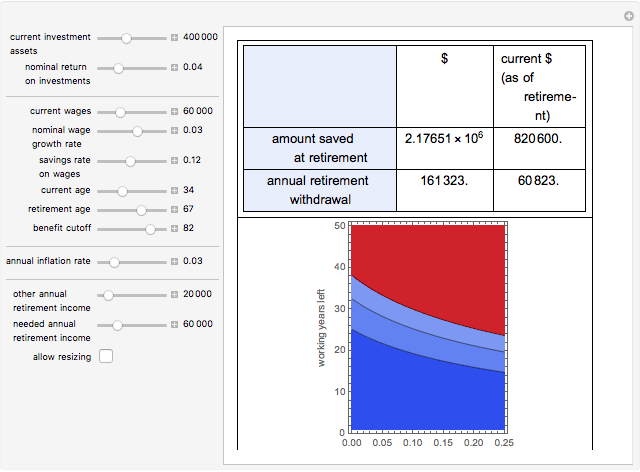

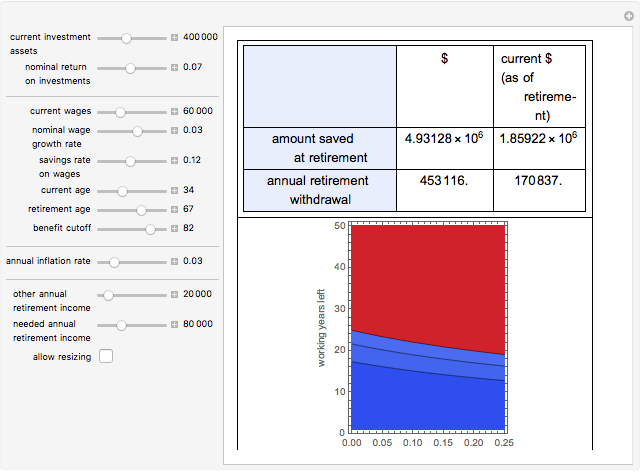

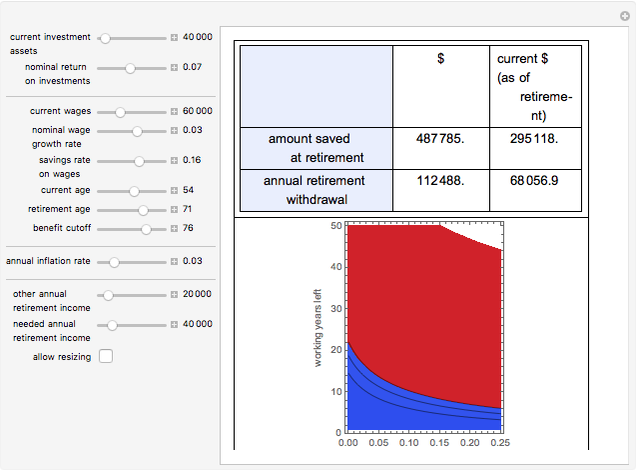

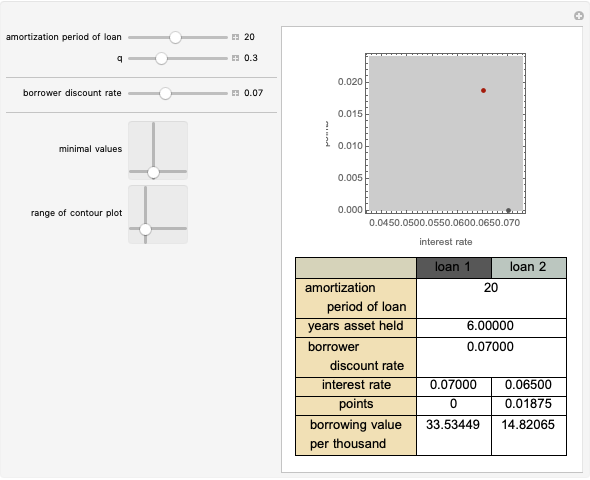

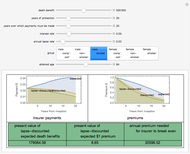

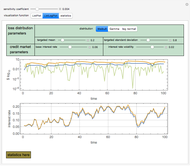

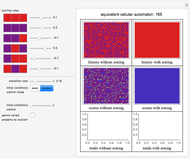

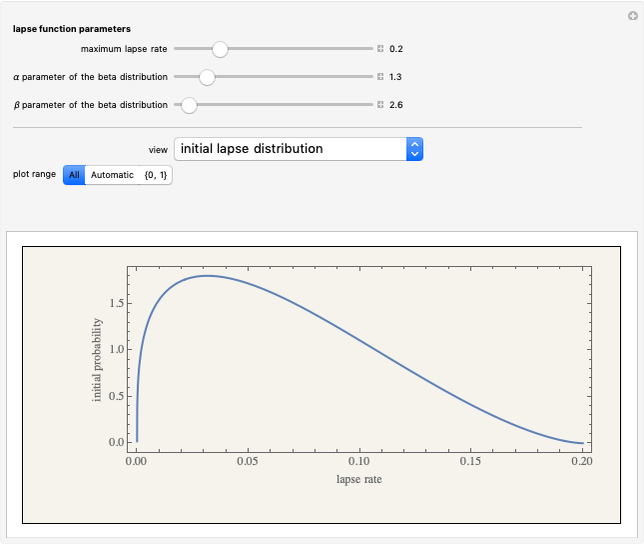

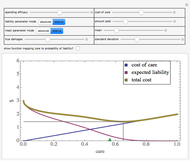

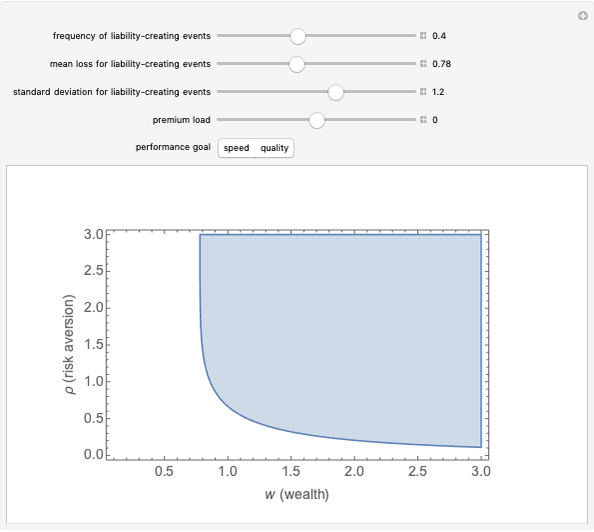

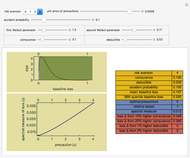

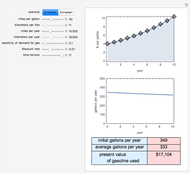

This Demonstration explores the tradeoff between the savings rate during periods of employment and the length of time people need to work in order to achieve desired levels of retirement income. First, set your current investment assets and the rate of return you anticipate making on investments over your lifetime. Next, set your current wages, your expected level of wage growth over your working lifetime, and the fraction of wage income you expect to be able to invest each year. Specify your current age, the age at which you wish to retire, and the age at which you are likely no longer to need retirement benefits. You also need to make a guess as to the rate of future inflation. Then, identify any non-investment income you expect to have during your retirement, such as Social Security benefits in the United States or, perhaps, part-time labor income. Finally, specify the needed or desired level of income you want during your retirement. The Demonstration shows how much money you will have available at retirement and the amount of money you can annually withdraw from that accumulation such that nothing is left at the end of the benefit period you specified. The graphic shows how you might achieve the same level of retirement income by either saving more during your working years or by working for a longer period of time.

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

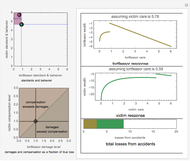

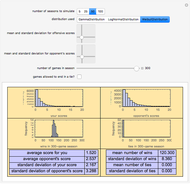

Snapshot 1: A low rate of return on investments significantly limits realistic retirement income.

Snapshot 2: A high rate of return on investments creates better choices among savings rates and retirement age.

Snapshot 3: The person who defers saving until later in life has a very difficult time creating desired levels of retirement income.

This Demonstration does not take taxation into account.

The amount of money accumulated at retirement can generally be annuitized by transferring the risk of longevity to an insurer. The precise amount paid on the annuity depends on a number of factors, including the health of the annuitant. You can obtain a decent approximation to the amount paid by an annuity by setting the benefit cutoff age to your expected age of death or, to decrease risk, to a slightly higher value.

Permanent Citation

"Saving for Retirement"

http://demonstrations.wolfram.com/SavingForRetirement/

Wolfram Demonstrations Project

Published: March 7 2011